Key takeaways:

- Today’s market pullback pushed the price of Bitcoin to $20,000, Ethereum to $1,000

- New BTC and ETH price levels represent the coins’ respective 18-month lows

- Prominent crypto investors say the negative price movement could continue in the short term

The crypto market selloff continues – BTC tests support at $20,000, ETH at $1,000

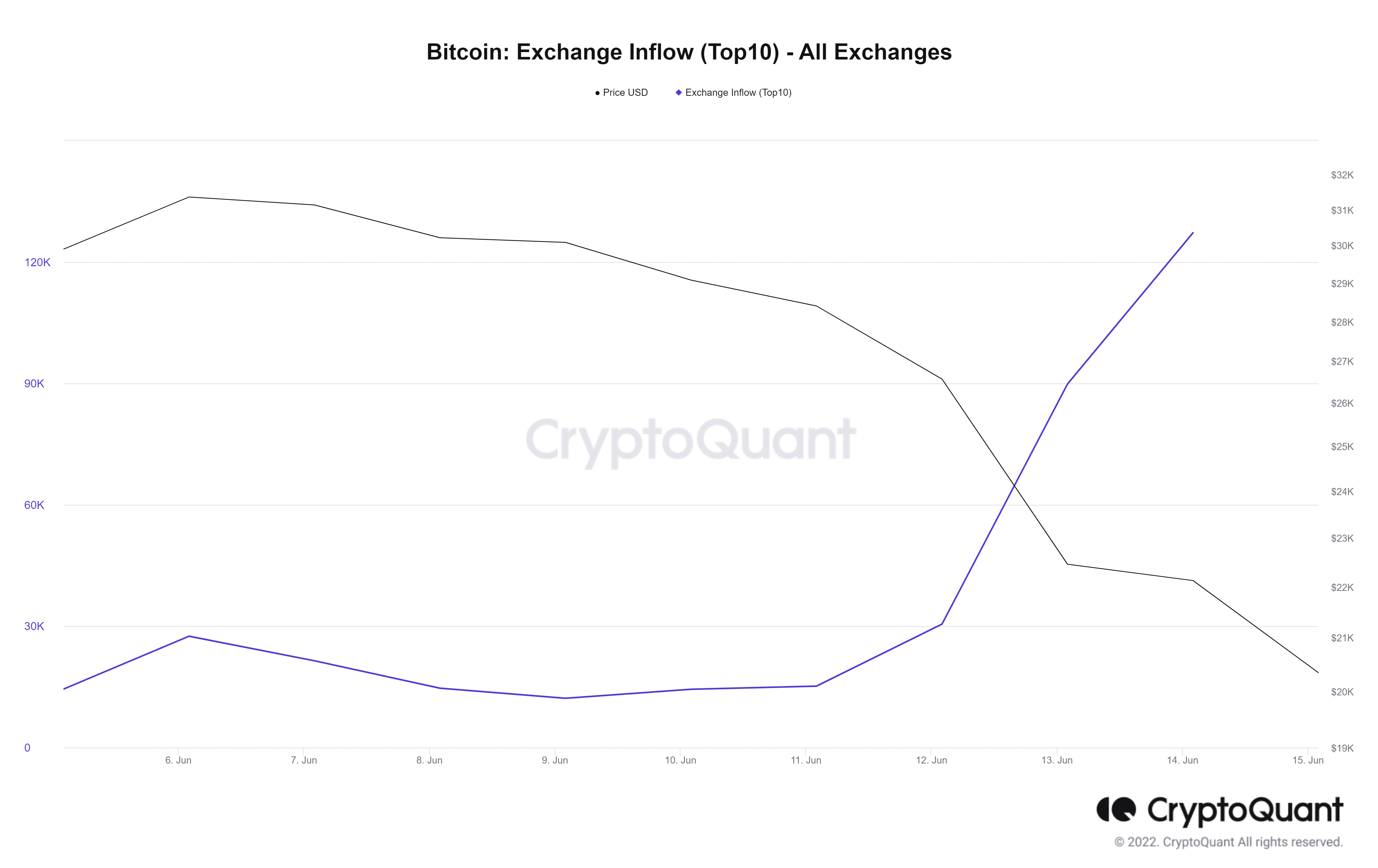

Yesterday’s cryptocurrency market bounce back was unfortunately short-lived as today a new bout of bearish activity sent the prices of digital assets deeper into a red zone. The roughly 10% drops in the value of Bitcoin and Ethereum come at a time when exchange inflows reached the highest levels since 2018, signaling that crypto investors are liquidating their holdings at an expedited pace.

In response, cryptocurrency exchanges have begun moving huge amounts of BTC to their hot wallets to provide the necessary liquidity for an ever-growing sell-side pressure. CryptoQuant data shows that BTC inflows across the top 10 crypto exchanges surpassed the 120,000 BTC mark on Tuesday. Coincidentally, this was the largest influx of BTC recorded since late 2018, when Bitcoin hit its multi-year low of just above $3,000.

More downward price movements on the horizon?

Although Bitcoin is trading at its lowest point since December 2020 and Ethereum at the lowest price since January 2021, we could see prices drop even lower in the short term. According to the crypto investor and Galaxy Digital CEO Mike Novogratz, the Terra collapse and Celsius crisis are primarily to blame for the notably bearish market activity in the past month. Novogratz told CNBC:

“We’ve gone to the level that should be close to a bottom. $21,000 bitcoin $1,000 ethereum. There’s been a tremendous amount of capitulation and fear. Usually not a good area to sell, but it doesn’t mean we can’t go lower. I think the macro environment is still pretty challenging out there.”

Co-founder and former BitMEX CEO Arthus Hayes holds a similar view as Novogratz. Hayes said that should $20K BTC and $1K ETH levels break, “we can expect massive sell pressure in the spot markets.”

With the market sentiment being notably negative and the Fear & Greed index showing extreme fear levels, it is safe to assume that it will take some time before the bulls retake the upper hand. For more information about a potential trend reversal, you can follow live Bitcoin price predictions and price forecasts of other digital assets listed on CoinCheckup in each coin’s respective Predictions tab.