Key takeaways:

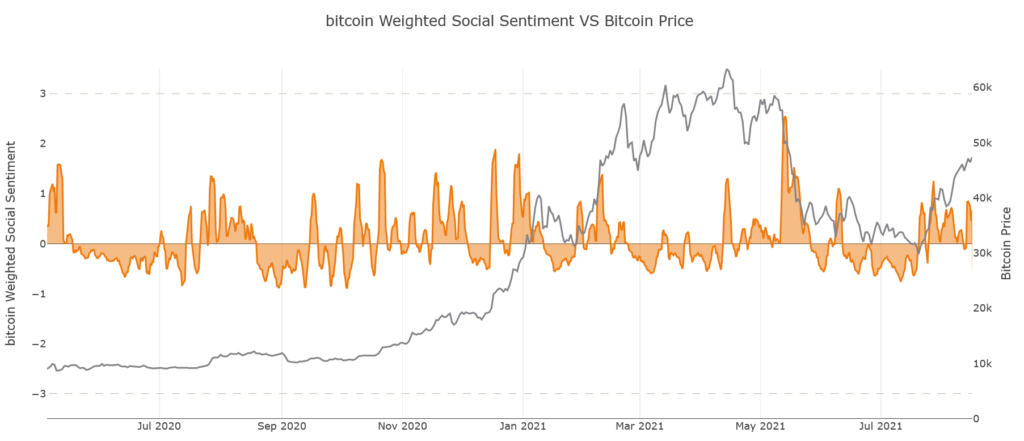

- Bitcoin has increased by 62% in the last 30 days, reaching a cycle high price tag of $50,394 and reaching a 3-month ATH

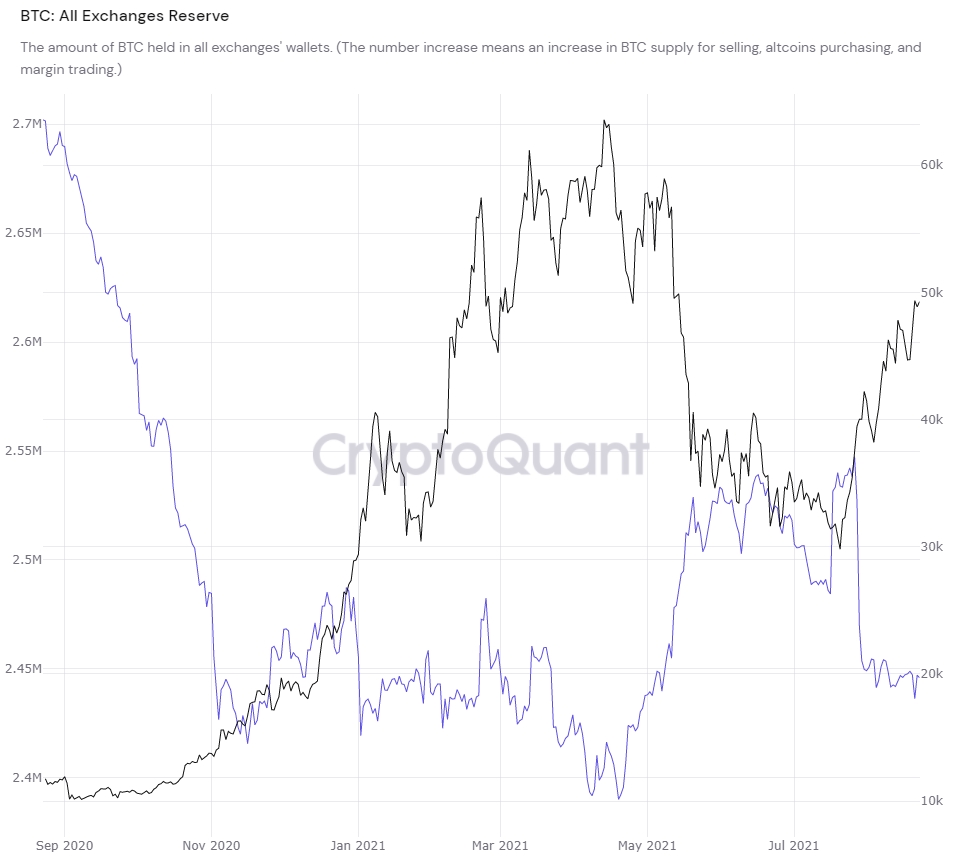

- Increased network activity and diminishing BTC exchange reserve point to an increased demand that will likely push the price even higher

- Total cryptocurrency market cap has increased by more than 60% since July low, which spurred massive growth among altcoins, most notably Cardano

Following the massive plunge the cryptocurrency market underwent back in May, which ultimately saw Bitcoin drop down to below $30,000, the world’s largest crypto is without a doubt again in bullish territory.

Bitcoin has been on a tear over the last month, reaches a 3-month ATH

The May crash heavily impacted crypto markets. On May 19 alone, more than $300 billion were wiped out in a single trading day. After hitting the low point of $29,753, Bitcoin has since been on a strong upwards trend. Today, the price finally breached the important psychological barrier of $50,000 to reach its cycle high of $50,394.

A big reason for the bullish action is the “demand/supply imbalance” that Bitcoin is currently experiencing, which was correctly identified by on-chain analyst Willy Woo in a Twitter post back in July. At the time, Woo also deduced that the price would need to move to $53K to address the market imbalance.

Looking at the chart of Bitcoin all exchanges reserves above, we can see a massive drop in the amount of Bitcoin reserves held by crypto exchanges since July, which historically speaking had a pretty strong correlation to Bitcoin price.

At the same time, the number of new entities on the Bitcoin network continues to grow. Since dropping to its lowest point of 505K in July, the number of active users has doubled to reach 1M users and a 1-month high. A combination of higher network activity and diminishing exchange reserves provides ample data to support the thesis that demand for Bitcoin will continue to grow in the near term.

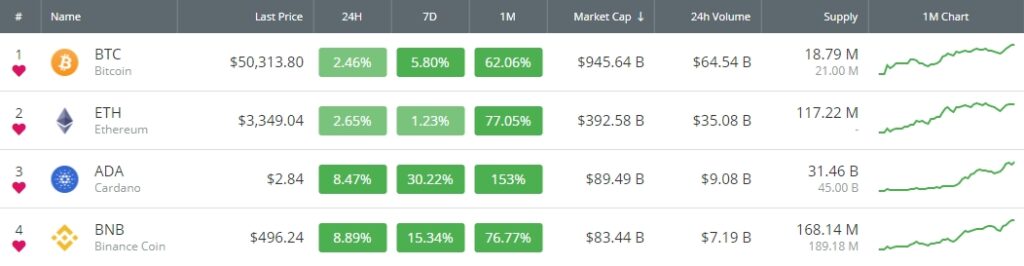

On the heels of Bitcoin growth, the total market cap has increased by $703B over the last month

Since July low, the total market capitalization has grown by more than 60% and increased by over $700B in the meantime. While Bitcoin was certainly the biggest contributor to the change, there were some notable cryptocurrency changes in the last month.

Ethereum has successfully launched the London upgrade and introduced Ether burning, which had a positive impact on the price as it introduced deflationary pressure on the world’s second-biggest crypto platform. Over the course of the last month, the ETH price is up by 77%.

Perhaps even more surprising was the journey Cardano was on over the last 30 days. In the time period, Cardano has gained more than 150% and surpassed BNB to become the third-largest coin by market cap. In the meantime, ADA has repeatedly pushed higher and ultimately reached its highest price today at $2.86, before making a small retracement to $2.84 at the time of this writing.