Key takeaways:

- The strengthening of the US Dollar, which has just experienced a 16-month peak, has an inverse relationship with the price of BTC

- Twitter’s CFO stance that the company is not interested in adding crypto assets to its balance sheet might have been the main catalyst for the market selloff

- Rising electricity costs could wreak havoc on the remaining China-based crypto miners

After trading in a relatively tight range for the past week, Bitcoin (BTC) has been experiencing heavy selling pressure over the course of the last 24 hours. Other digital assets followed suit. Ethereum (ETH) dropped to a two-week low as did Cardano (ADA) and Polkadot (DOT), while 98 out of the top 100 cryptocurrencies are being traded in the red zone at the time of this writing.

What led to the massive selloff?

It is hard to pinpoint a single reason for the bearish momentum in a complex system of interconnected parts which the cryptocurrency market certainly is. However, there are some indications that point to three key drivers behind the sudden downward trading trend.

Speaking to the Wall Street Journal earlier today, Twitter chief financial officer (CFO) Ned Segal told the news outlet that adding crypto assets such as Bitcoin to the company’s balance sheet “doesn’t make sense right now.” Although Segal clarified his position by adding that Twitter simply isn’t in a position to take on the short-term volatility of crypto, the market responded to the news very negatively.

Another piece of news that could potentially harm the prospects of crypto assets’ profitability in the long term and could have led to investors taking some of the money off the table, is the rising electricity costs for China’s remaining crypto miners. As reported by Bloomberg, the country’s National Development and Reform Commission is contemplating imposing “punitive electricity prices,” which could be the final nail in the coffin of China’s crypto mining sector after the country issued a blanket ban on crypto in September.

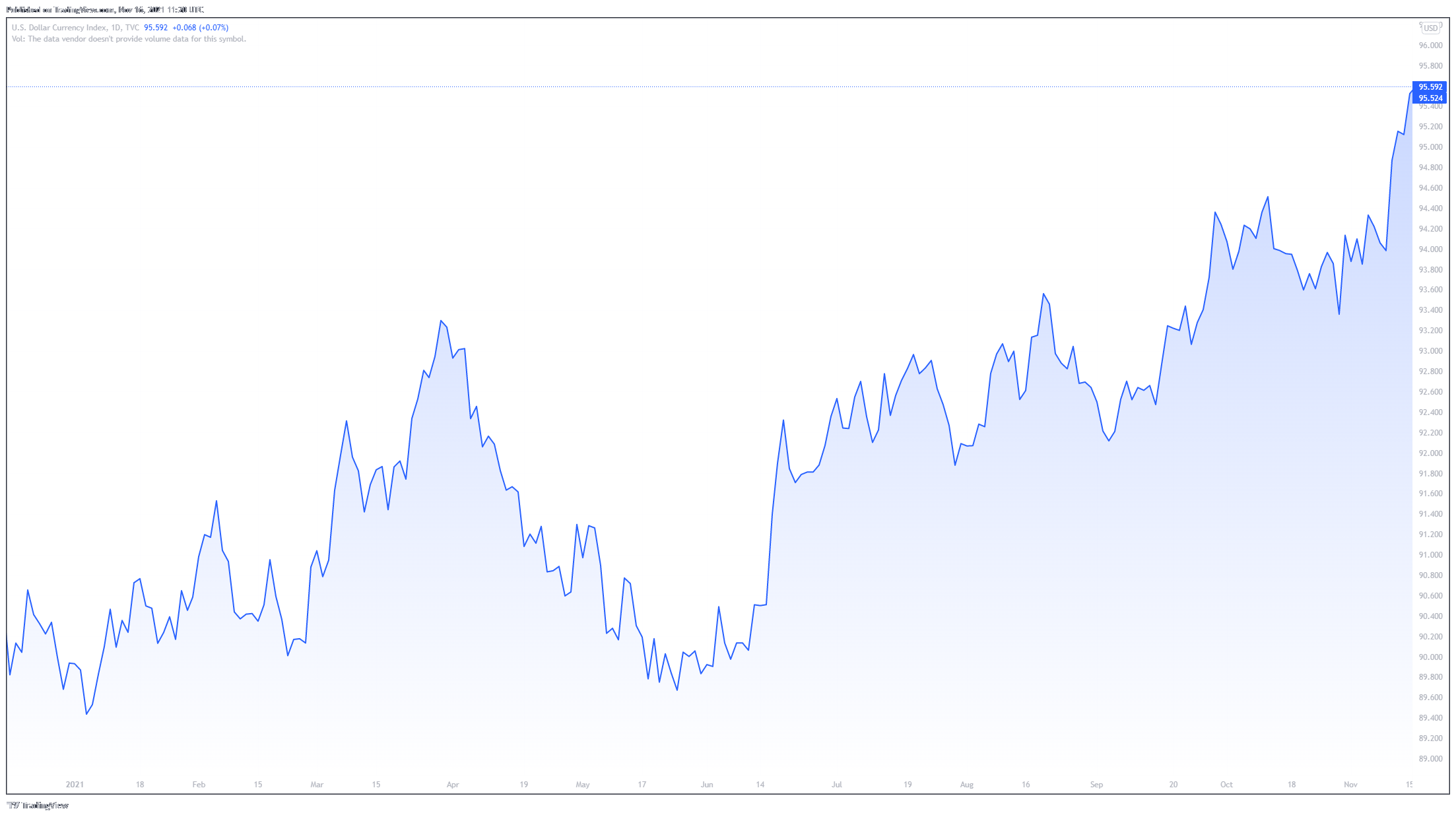

The recent virtual summit between China’s President Xi and the United States President Biden could have also played an indirect role in the ongoing selloff. The meeting between the leaders of the two superpowers has reportedly gone well, which has pulled the value of the US Dollar to a 16-month high.

The strength of USD in comparison to six other fiat currencies, measured by the U.S. Dollar Index (DXY), has historically had an inverse correlation with the value of BTC – the stronger the USD, the weaker is Bitcoin, and vice versa.

Over the past day, more than $840 million worth of long and short market positions have been liquidated due to abrupt downturn market swing, according to data from Coinglass. BTC liquidations accounted for the biggest share with $270 million, followed by Ethereum with $207 million, and Solana (SOL) with $26 million.