Key takeaways:

- Bitcoin lost over 15% of its value in the past week and breached the $33,000 support earlier today

- The total cryptocurrency market has nearly halved (to $1.54 trillion) since last November’s market peak

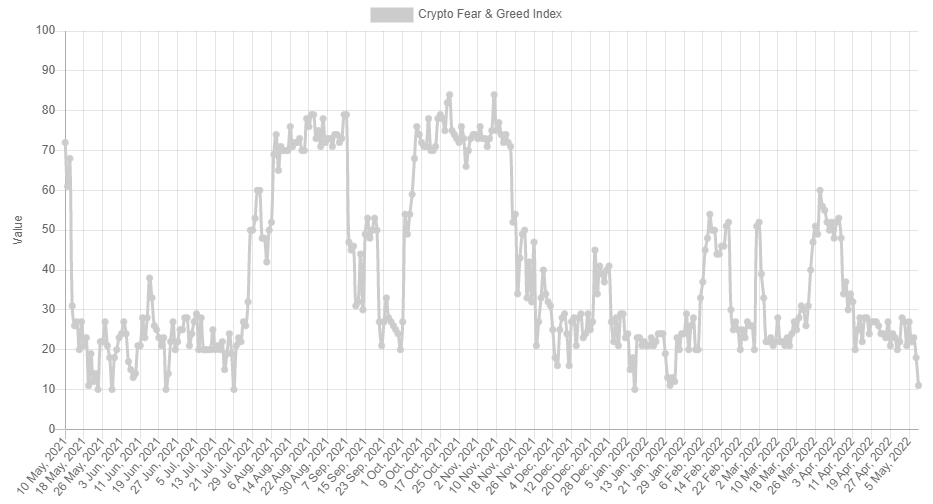

- The broader economic landscape sees crypto investors enter the stage of “extreme fear” as bearish sentiment takes hold

Bitcoin plunges sub $33,000 on a -15% weekly change

Bitcoin shed more than 15% of its value in the last seven days as the fear of a further economic slowdown grips the markets. The world’s largest cryptocurrency is now trading at its lowest year-to-date price level of $32,700 at press time. According to technical analysis from CoinCodex, the current investor sentiment is in the bearish zone, while the Fear & Greed Index shows “Extreme Fear” levels.

Bitcoin’s poor market performance over the past week wasn’t an isolated occurrence as it has had a negative impact on the price of other digital assets as well. Ethereum slid below $2,400 roughly a month after trading near its YTD high of $3,570 early in April. Likewise, other major Layer 1 tokens have also retraced to or near their 2022 lows.

BNB, Solana, Cardano, Avalanche, and Polkadot all show more than 15% seven-day price retractions. It is worth noting that Terra’s LUNA lost 26% of its value–the most out of all major cryptocurrencies–which led to TerraUST momentarily losing its USD peg.

As a result of negative price movements, the total cryptocurrency market cap shrank to $1.54 trillion, a near 50% swing compared to its last November peak.

Investor sentiment turns notably bearish

The reason for the massive drop in the valuation of most digital assets is likely the Fed’s decision to raise interest rates by 0.5%, the highest individual hike in over 20 years. With seven rate hikes expected this year, both cryptocurrency and traditional markets are hurting. Case in point, Nasdaq 100, a stock market index tracking 100 of the largest non-financial companies listed on the Nasdaq stock market, had its worst month since the 2008 financial crisis in April.

The expectation of additional rate hikes and adverse effects of economic sanctions put in place in light of the Russian invasion of Ukraine have contributed to the Crypto Fear & Greed Index dropping to the “Extreme Fear” territory, showcasing that most crypto investors share a bearish outlook for the near-term.

Bitcoin analyst sharing his market insight via the On-Chain College Twitter moniker noted on May 7 that 7.7 million BTC, or 41% of the total circulating supply, are “sitting in loss” at the current market rates. With the price of Bitcoin losing an additional $3,000 since the Tweet was posted, it is safe to assume that more of the BTC supply is currently in a loss than at the time of last April’s Covid-induced Market crash.

For the time being, it seems that the bears will continue to have the upper hand. Some analysts, like Worth Charting founder Carter Braxton Worth, for instance, predict we could see Bitcoin drop to $30,000 if the market sentiment doesn’t change soon. For context, the last time BTC traded below $30,000 was nearly a year ago, in June 2021.