During today’s massive sell-off event, the cryptocurrency market cap slid from $2.31T to $2.12T in the span of 5 minutes. Almost all major coins were showing double-digit losses. Most notably, Bitcoin fell to $43,000 before bouncing back to $47,087 at the time of this writing.

The second-largest cryptocurrency, Ethereum dropped to $3,179 as it lost 15%, before clawing back to $3,503 at press time. Other cryptocurrency projects followed in the footsteps of the big two as, at one point during the massive drop, almost all coins were showing losses in excess of 15%.

It is unfortunate that the day on which El Salvador started using Bitcoin and thus became the first country in which BTC is recognized as a national currency is marked by such a huge market downturn. Salvadoran president Nayib Bukele took to Twitter and tagged the International Money Fund (IMF), thanking the organization for the dip and the discounted price of BTC.

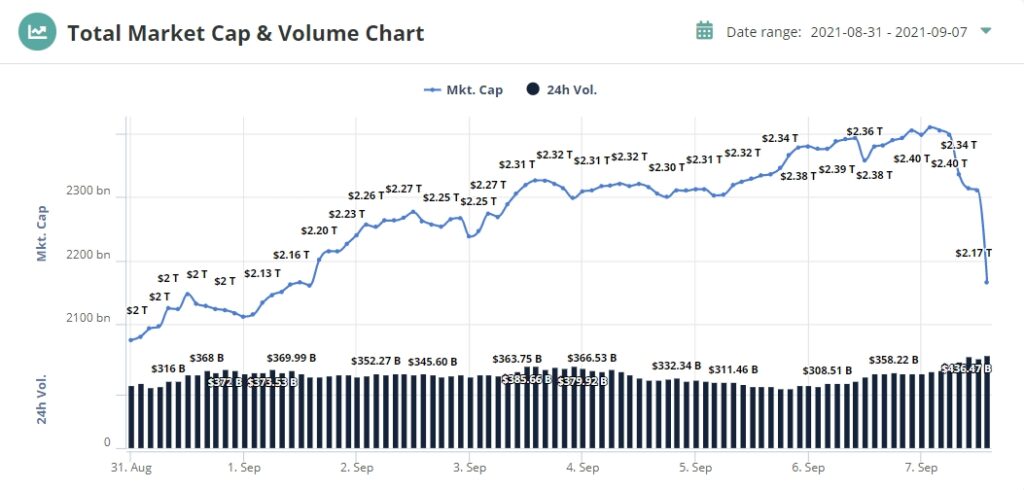

The extent to which the market has swung is most noticeable when looking at the total market cap chart. Since market capitalization’s peak value earlier in the day of $2.409T, the minutes-long drop pushed the value down to $2.165T.

What triggered the almost instantaneous drop is currently unclear. Some of the more notable voices in the community are putting blame on large-volume traders, also referred to as ‘whales’. Analyst and crypto trader Scott Melker, for instance, is certain that they were the ones responsible for the massive sell-off. He also tweeted that aggressive selling on the day that Bitcoin became legal tender in El Salvador when the World Bank and other similar entities “expressed discontent about the decision is not purely coincidental.”

The latest sell-off event resembles the one that took place earlier in the year on May 18, when the cryptocurrency market lost $200 billion in the span of a day and kickstarted a prolonged bearish trend, which saw Bitcoin drop all the way to $30,000, after reaching an all-time high of $64,829 in mid-April.