Key takeaways:

- Binance’s decentralized finance (DeFi) ecosystem had a short-lived success, as regulatory obstacles and Ethereum play a pivotal role in shrinking its market share.

- According to Messari’s Q2 DeFi report, Binance Smart Chain suffered from too many speculative investors and tokens that “have little use outside incentivizing user speculation.”

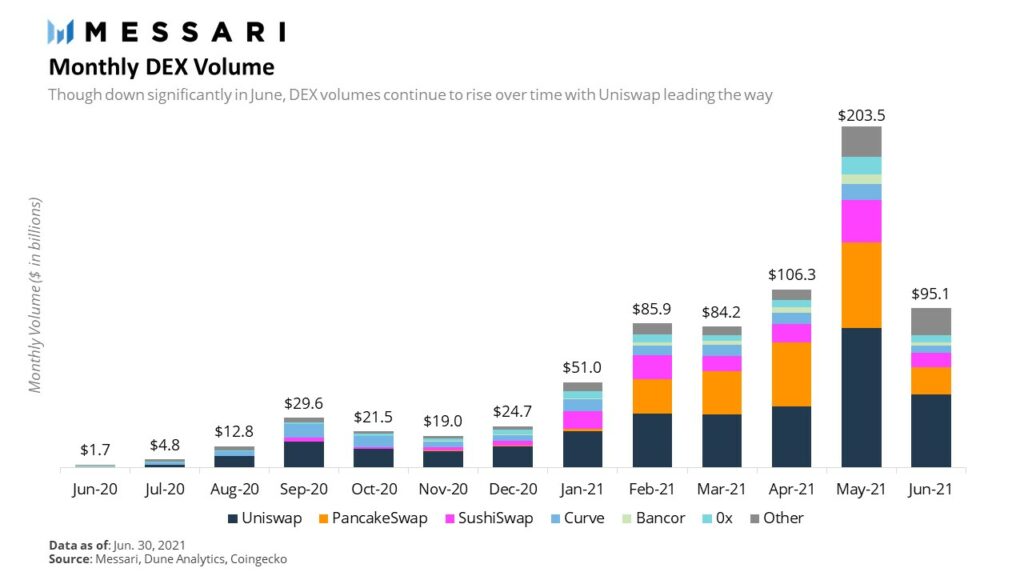

- Despite decentralized exchanges (DEXs) volume being in the negative trend to close out the quarter, June was still the 3rd most successful month in DEX history, showing a clear trend of a growing DEX userbase.

Binance has been having quite a hard time lately. Several national regulatory authorities have issued warnings or outright forbidden Binance from conducting its business in the affected countries. Additionally, a number of banks and payment processors have severed ties with the exchange and will no longer support transactions associated with Binance user accounts. Following the unfortunate turn of events, Binance Smart Chain (BCS) has lost almost half of its value in the second quarter of the year.

Binance’s race to surpass Ethereum takes a beating

According to a Q2 DeFi report by crypto analytics firm Messari, the whole decentralized finance (DeFi) sector has shrunk in value in the latter stages of the second quarter. After an explosive start to Q2, the big drop in the DeFi space becomes very apparent when looking at decentralized exchanges (DEXs) monthly volume metrics. DEXs volume had reached a high of $203.5 billion in May before falling down to $95.1 billion in June, more than a 50% drop.

During the market downturn, the Binance Smart Chain was among the hardest hit, with BNB, PancakeSwap and especially THORCHain being among the biggest losers in the ecosystem since June. Messari reports that many investors in the BCS space were using tokens with “little use outside of incentivizing user speculation.”

“Combined with a series of hacks and exploits on BSC leading to hundreds of millions of dollars in losses, BSC saw speculation dry up dramatically in June leading to PancakeSwap volumes diving 69% in June.”

– Excerpt from the Messari report

Ethereum-based Polygon was the biggest benefactor of BSC’s loss

Polygon (MATIC) is a protocol created for building and connecting Ethereum-compatible blockchain networks. Polygon aims to do away with Ethereum’s biggest drawbacks, such as slow and relatively expensive transactions. The success of Polygon in acquiring a higher DEX volume share was instrumental in squeezing BCS out of the picture. Due to this fact, PancakeSwap saw a 69% decrease in its volume from May to June.

Update to the most popular DEX on the market, UniSwap (UNI), has also played a pivotal role in eating away at BCS market share. On the heels of its latest v3 update, report adds, UniSwap now controls 40% of global DEX transactional volume and is quickly growing its relative market share in the space.