There are various ways of approaching crypto investments. Some investors prefer to buy digital assets in hopes of their value increasing over time, which is commonly referred to as the Buy and Hold strategy. Others, engage in derivatives trading and are trying to make profitable traders both during positive and negative market movements.

Both spot and derivatives trading requires users to manually manage their digital assets. What’s more, the profits are not realized until the physical asset or contracts are sold.

What if we told you that there is another way to make money with crypto? One that allows you to earn passive income on your existing assets at that? If you are intrigued and want to learn more about how to earn interest by staking crypto assets and increasing your crypto savings, read our overview of Binance Simple Earn.

Binance Simple Earn: A crypto savings account

Binance Simple Earn is a one-stop investment solution that allows crypto investors to earn daily rewards generated by their existing crypto assets. The service aims to streamline the process of generating passive income with crypto, and provides users the ability to utilize both locked and flexible products.

The Simple Earn platform was launched in September 2022, unifying Flexible Savings, Locked Savings, and Locked Staking products, under a single umbrella. As a part of the Binance Earn platform, Simple Earn provides users with another venue to turn their idle crypto assets into profit-generating investment vehicles.

For existing Locked Savings users, the move means that their positions will be automatically transitioned to relevant Simple Earn Locked Products upon the expiration of their subscription. The rewards accrued and subscription management is still accessible through the Earn wallet.

How does Binance Simple Earn work?

Binance pays interest rates on crypto deposited in Simple Earn products. The deposited crypto is used for liquidity-providing services and for supporting the operation of underlying blockchain mechanisms, such as the Proof-of-Stake (PoS) consensus. In return, Simple Earn users earn profit distributed via Binance interests.

Binance Simple Earn products vary in terms of their duration periods, which cryptocurrency their support, and expected annual percentage rate (APR).

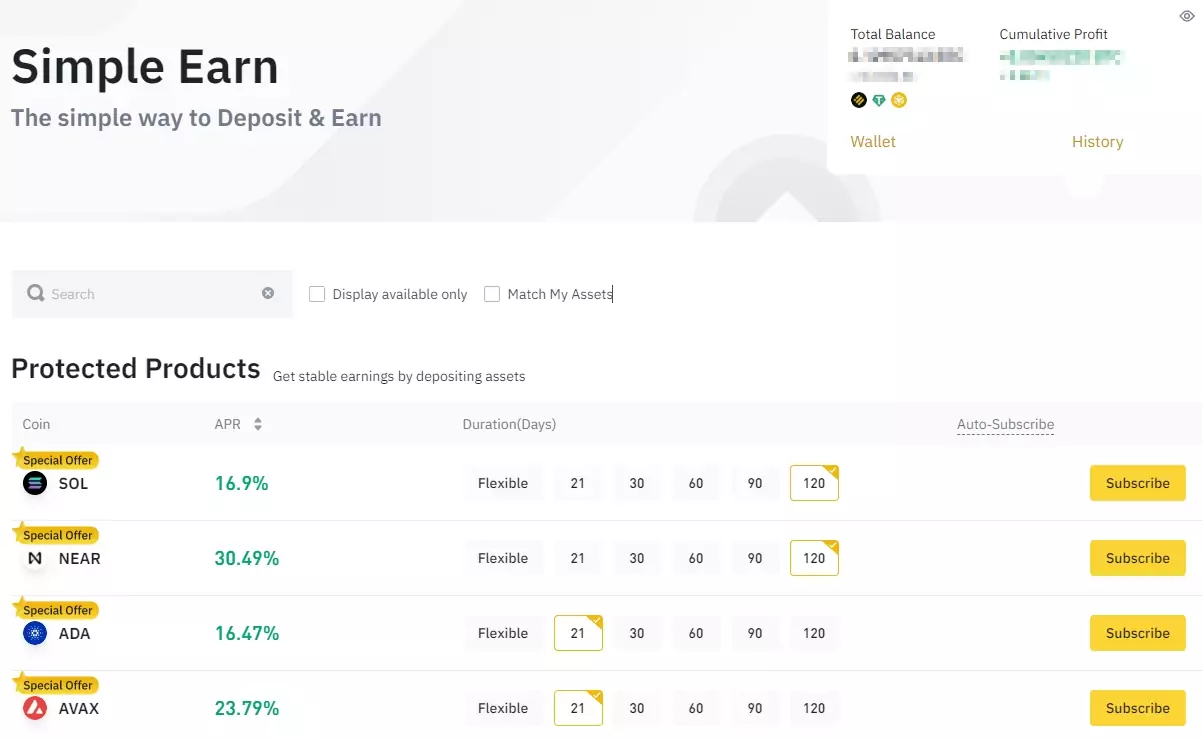

Here are some popular subscription plans currently available on Simple Earn, designed for Solana (SOL), NEAR Protocol (NEAR), and Cardano (ADA) users:

| Supported coin | APR | Duration options |

| SOL | up to 16.90% | Flexible, 21, 30, 60, 90, 120 |

| NEAR | up to 30.49% | Flexible, 21, 30, 60, 90, 120 |

| ADA | up to 16.29% | Flexible, 21, 30, 60, 90, 120 |

In total, there are more than 300 Simple Earn products Binance users can choose from as of October 17, 2022. The selection includes options for staking Bitcoin, Ethereum, BNB, and virtually every other well-known crypto asset.

How much can I expect to earn with Simple Earn?

The profitability of different Simple Earn plans depends on the cryptocurrency used and the subscription’s duration. As a rule of thumb, longer locked periods net bigger returns that shorter plans.

To illustrate this point further, let’s look at the following example.

Suppose you want to deposit Solana. If you were to choose the flexible duration product, which allows you to withdraw assets at any time without forfeiting daily rewards, you would earn 1.5% APR. In addition, the Solana product features a tiered APR, meaning that every coin above the 20 SOL limit would generate 0.2% APR.

On the other hand, if you would commit to a 120-day locked subscription, you can expect to earn 16.9% APR. Moreover, there is no tiered structure when using the locked option, making it that much more lucrative.

It is worth noting that in some cases, the APR doesn’t increase in a linear fashion, meaning that shorter locked terms can sometimes offer a higher APR than longer ones.

Binance uses the following formula to calculate daily rewards:

Rewards = Your Deposited Assets × APR/365

What is the difference between Flexible and Locked Simple Earn products?

The main difference between Simple Earn products is in their duration. Here’s a brief overview of the differences between flexible-term Simple Earn products and their locked-term counterparts:

| Flexible-term products | Locked-term products | |

| Rewards distribution | initial rewards are deposited in the Spot account on the third day; after that daily | initial rewards are deposited in the Spot account on the third day; after that daily |

| Asset redemption | at any time | after the locked period ends |

| Yield expectations | low to moderate | moderate to high |

How to subscribe to a Simple Earn product?

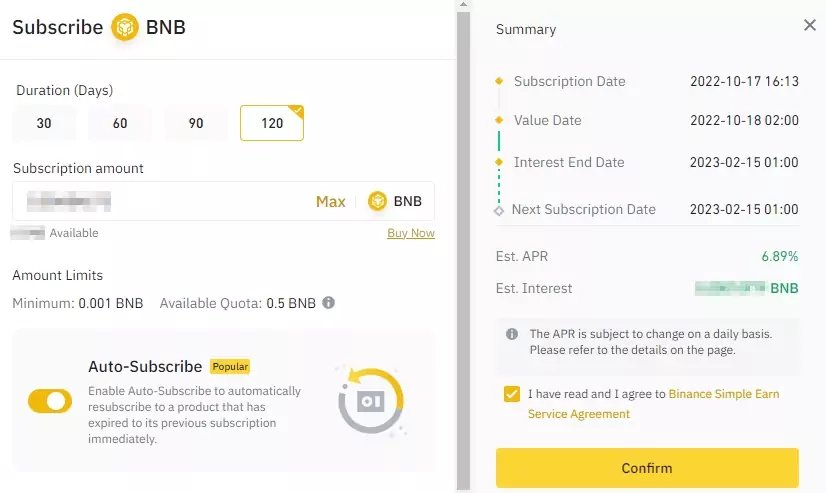

If you want to take advantage of the Simple Earn offering, simply search for the coin you wish to earn Binance interest rates on from the dashboard. After that, click on the [Subscribe] button, which is displayed next to every product.

From here, you can select the duration period of your order, choose the amount of cryptocurrency you would like to deposit, and see an estimated APR.

If you want to automatically resubscribe to the product after it expires, you can choose to turn on the Auto-Subscribe toggle. After you’ve entered all the parameters of your order, and agreed to Binance Simple Earn’s terms and conditions, you can initiate your plan by clicking [Confirm].

When are rewards distributed?

The first distribution of crypto rewards to a Spot wallet account occurs on the third day after you subscribe to a product, usually between 0:00 UTC to 08:00 UTC. Keep in mind that you’ll lose all rewards you have accrued if you choose to redeem deposited crypto before the locked period ends. The rewards will be deducted from the asset you deposited, when you withdraw them.

Closing thoughts

Binance’s Savings offering has been streamlined thanks to the newly-launched Simple Earn, which combines Flexible Savings, Locked Savings, and Locked Staking products into a single crypto savings solution. If you are looking to generate passive income with your idle crypto assets, then Binance Simple Earn could be the perfect choice for you.