Binance Research is the analytical arm of the world’s leading cryptocurrency exchange Binance. They follow cryptocurrency trends and examine the potential futures of Bitcoin, altcoins, NFTs, DeFi, and blockchain in general. Their recent report, “Half-Year Report 2024,” dives deeply into the current state of the cryptocurrency market, showcasing the rapid growth of the crypt market.

Key takeaways

- The total cryptocurrency market capitalization saw substantial growth.

- Ethereum’s EIP-4844 update (restaking feature), Runes Protocol and Solana Blinks drive the technological advancement.

- DeFi platforms’ growth reflects the broader adoption and the integration of new “financial products”.

- The stablecoin market rebounded close to its peak, signaling that new money is coming into the cryptocurrency market.

Crypto market overview

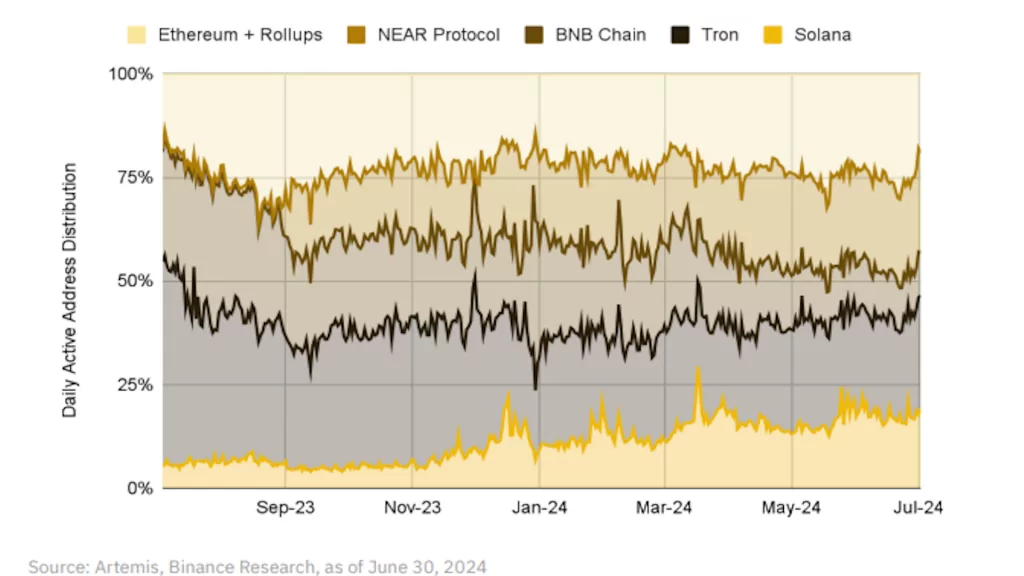

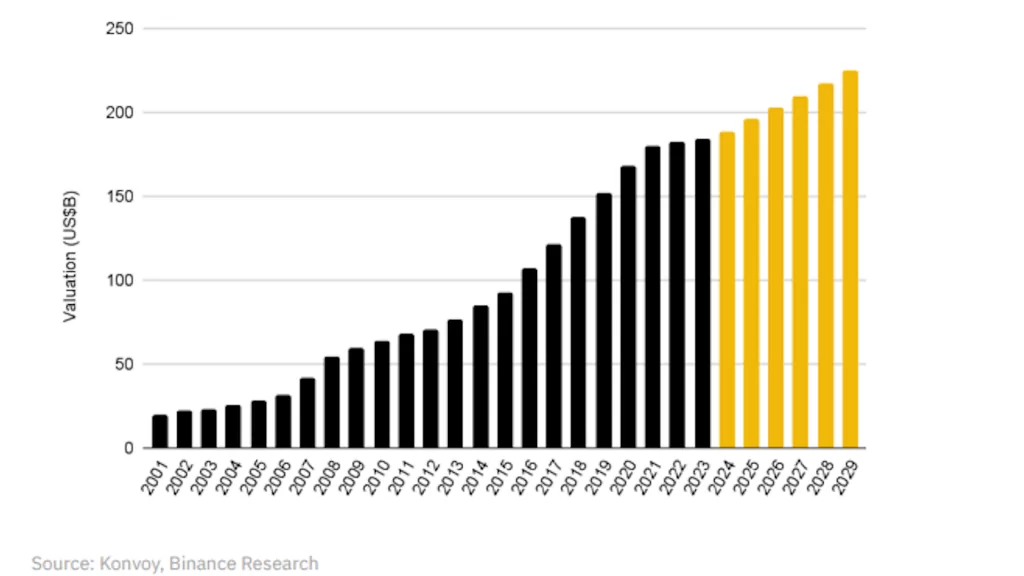

In the first half of 2024, the cryptocurrency market demonstrated significant growth, continuing the momentum from 2023. Total market capitalization rose by 37.3%, reaching $2.27 trillion. This growth was primarily driven by a 60.2% increase in Q1, followed by a 14.3% decline in Q2.

The launch of spot Bitcoin ETFs in the U.S. marked a significant milestone for the crypto industry. These ETFs have brought a new source of institutional demand, improving the market’s diversity and depth. Additionally, several narratives gained traction during this period, including restaking, memecoins, and airdrop seasons.

The layer-1 landscape

Bitcoin is growing

Bitcoin‘s performance shows substantial growth. The fourth Bitcoin Halving, which reduced the mining block reward to 3.125 BTC per block, combined with the approval of U.S. spot BTC ETFs, significantly boosted Bitcoin’s market dominance. Currently, Bitcoin commands over 53% of the crypto market.

Bitcoin’s market capitalization reached $1.22 trillion, reflecting a 102.5% increase year-over-year. The average daily transaction volume stood at $24.4 billion, a 53.5% rise compared to the previous year and the number of transactions surged by 38.7%. Additionally, the hashrate and mining difficulty increased by 55.2% and 60.7%.

The introduction of the Runes Protocol has added a new dimension to Bitcoin’s fungible token and NFT markets. Since the launch of Ordinals in late 2022, over 67 million Inscriptions have been minted. Bitcoin Ordinals have generated substantial transaction fees and have driven network activity since their launch.

Ethereum continues to lead in Layer-1

Ethereum has continued to lead the Layer-1 landscape. It introduced innovations such as restaking and the EIP-4844 upgrade. The approval of U.S. spot Ethereum ETFs in May should strengthen its position and drive ETH price near or even past all-time highs.

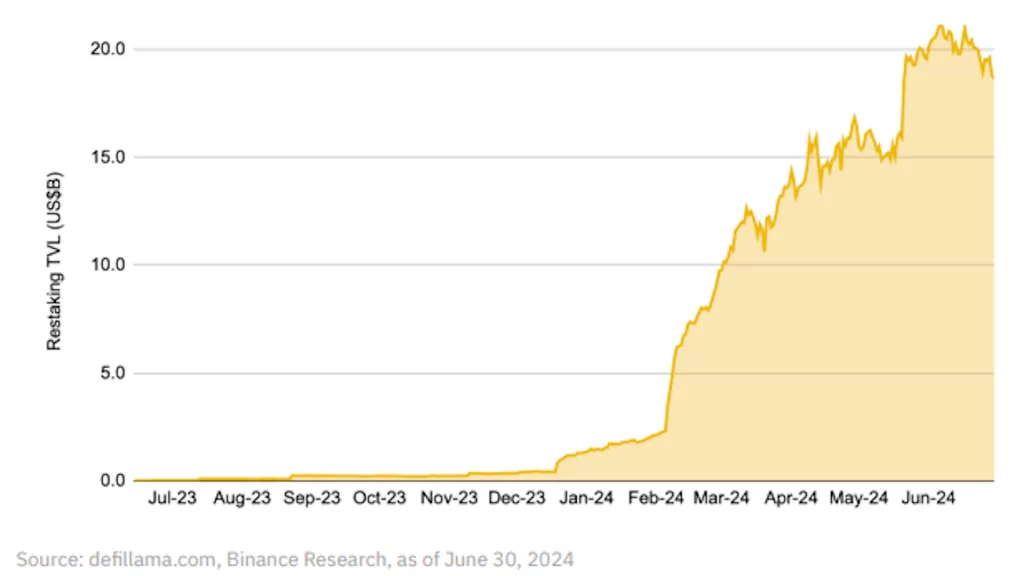

Restaking has become a dominant narrative for Ethereum, with EigenLayer commanding the majority of TVL in this market. As of June 2024, restaking TVL stood at over $14 billion. The Dencun upgrade significantly reduced transaction fees on Layer-2 networks.

Ethereum’s next major upgrade, Pectra, scheduled for Q1 2025, promises to introduce several improvements:

- increased flexibility for staking and restaking,

- improved account abstraction capabilities,

- optimized Layer-2 solutions.

BNB Chain continues its progress

BNB Chain has maintained its position as one of the leading Layer-1 blockchains.

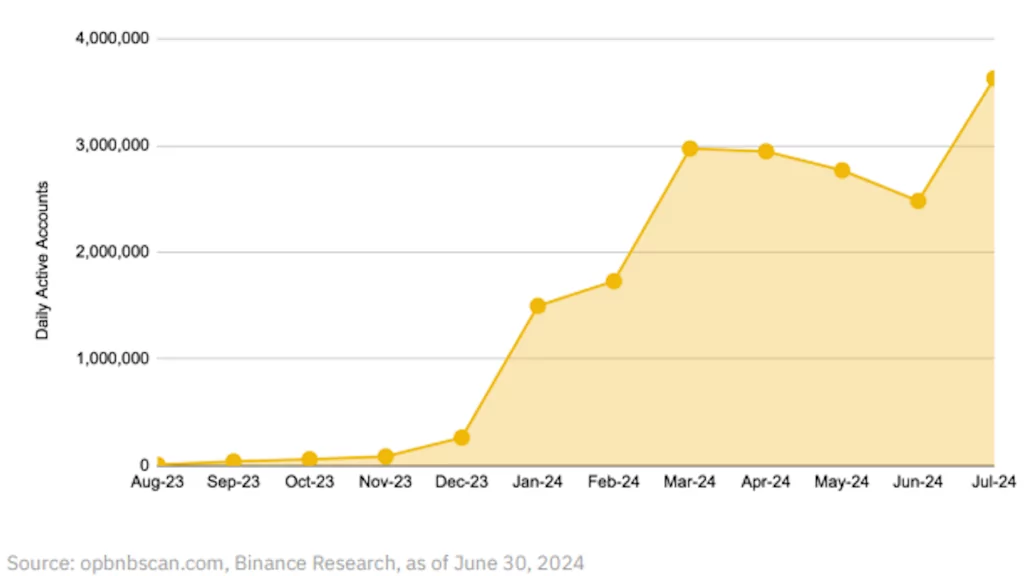

The opBNB optimistic rollup solution has grown, recording over 1.1 billion transactions across 3.5 million daily active accounts. The recent Haber hard fork also further reduced gas fees.

The BNB Greenfield decentralized data storage initiative allows users to create, store, and exchange data within the BNB ecosystem. Since its launch, BNB Greenfield has processed over 6.8 million transactions and stored 2.15 TB of data.

The BNB Chain has also launched several initiatives to encourage community engagement, including the Meme Innovation Battle which aims to accelerate memecoin innovation within the ecosystem, and the Airdrop Alliance with plans to introduce high-quality projects that are yet to release tokens and airdrop to retroactive BNB Chain and opBNB users.

Solana is seeing increased market attention

Solana has become a hub for memecoin trading, driven by its low transaction fees and cohesive product suite. The launch of the BONK memecoin, airdropped to Solana Saga Mobile owners, has been a notable success. Decentralized Physical Infrastructure Networks (DePIN) projects like Hivemapper and Helium have chosen Solana for their infrastructure needs, leveraging its high throughput and localized fee markets.

The introduction of Solana Blinks allows users to execute blockchain transactions from any platform that can host a link.

The layer-2 landscape

Layer-2 solutions have experienced dramatic growth in 2024, with total value locked (TVL) reaching $43 billion, a 90% increase from the start of the year. This growth has been driven by optimistic roll-ups like Arbitrum, Base, and the newly launched Blast.

Arbitrum remains the leading Layer-2 solution by TVL with its 33.7% market share. However, Base has surpassed Arbitrum in daily transaction volumes.

zkSync and other ZK-rollups have also seen substantial growth, although they currently lag behind optimistic roll-ups in terms of market share.

The promise of incentives has attracted significant capital inflows into Layer-2 chains, boosting overall TVL and driving user engagement.

Decentralized finance (DeFi)

DeFi has continued to expand in 2024, with total value locked (TVL) growing by 72.8% to $94.1 billion. This broad growth has benefited nearly every DeFi sector, including lending, decentralized exchanges (DEXs), yield farming, and derivatives.

The restaking market has emerged as the most discussed topic in DeFi for 2024. With explosive growth in the first half of the year, it now commands an impressive US$18.6B in capital, ranking as the fourth largest DeFi sub-sector. The derivatives market also has grown significantly, offering users more sophisticated financial instruments and hedging options.

Stablecoins

The stablecoin market has rebounded strongly and is near its peak market capitalization achieved in April 2022. As of June 2024, the market cap of stablecoins stood at $161 billion, a two-year high.

Tether continues to dominate the stablecoin market, maintaining its position as the most widely used stablecoin. Circle’s USDC and Ethena’s USDe have seen increases in market share.

Other stablecoins like MakerDAO’s DAI, First Digital’s FDUSD, and especially PayPal’s PYUSD have introduced unique features and use cases that further diversified the stablecoin ecosystem.

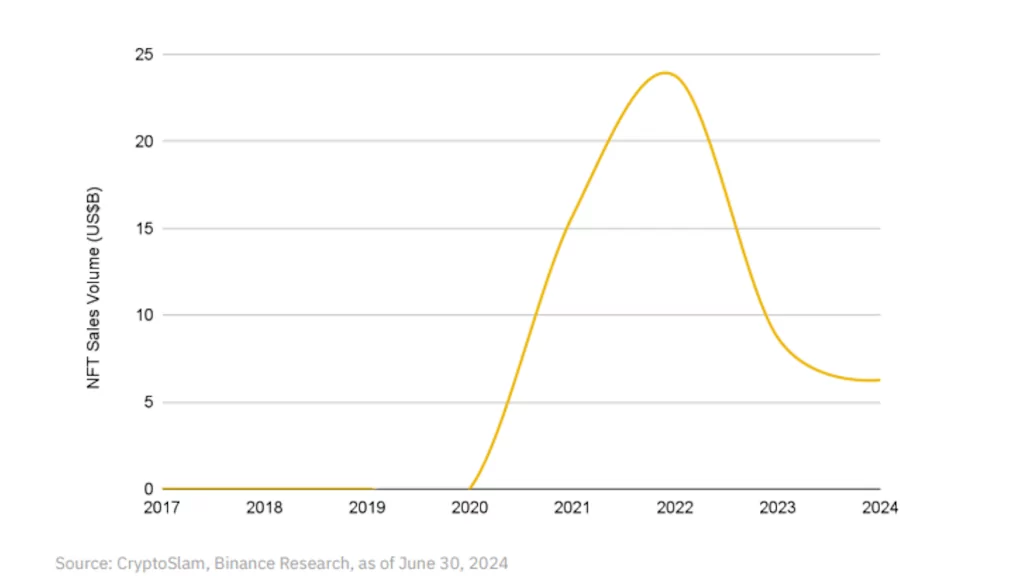

Non-Fungible Tokens (NFTs) and SocialFi

The NFT market has experienced turbulence in 2024, with sales volumes declining and major projects seeing significant drops in floor prices. However, platforms like Blur have maintained their dominance, driven by token airdrops and other incentives.

Bitcoin-based NFTs have continued to gain traction, leveraging the security and recognition of the Bitcoin network. Social finance platforms like Lens Protocol and Farcaster have also seen user growth, driven by new features and token releases. These platforms aim to integrate social interactions with financial incentives, creating new engagement models.

Web3 Gaming

The Web3 gaming sector had a strong Q1, but Q2 saw a decline in gaming project tokens alongside the broader altcoin market. Despite this, user growth metrics have remained positive, with projects like Pixels and Hamster Kombat attracting large numbers of players through token airdrops.

Projects focused on gaming infrastructure, such as Ronin and XAI, have continued to provide and develop robust platforms for Web3 gaming.

Massive multiplayer online role-playing games (MMORPGs) and metaverse projects have seen varying levels of success, with titles like Big Time (BIGTIME) and Illuvium (ILV) gaining traction.

Emerging Trends

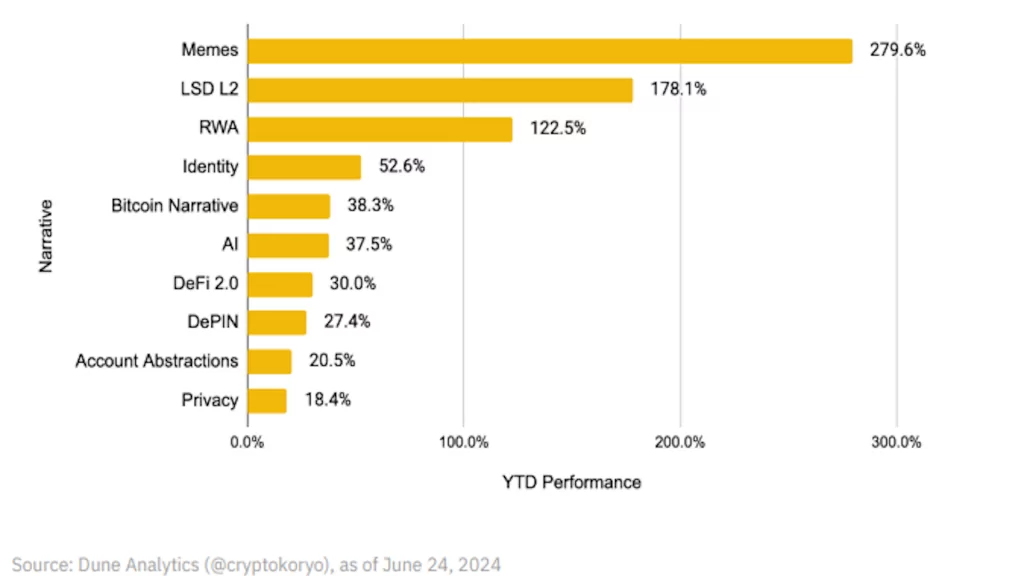

Several emerging trends have captured the attention of investors and the broader crypto community in the first half of 2024. These include memecoins, Artificial Intelligence (AI), and decentralized Physical Infrastructure Networks (DePIN).

Memecoins have been a significant driver of market activity, with many new projects launching especially on Solana, and gaining rapid popularity. AI-related projects have also seen increased interest, integrating machine learning and blockchain technology to create innovative solutions. DePIN projects have as well continued to grow. These projects aim to build transparent and verifiable networks for various applications, from mapping to 5G cellular coverage.

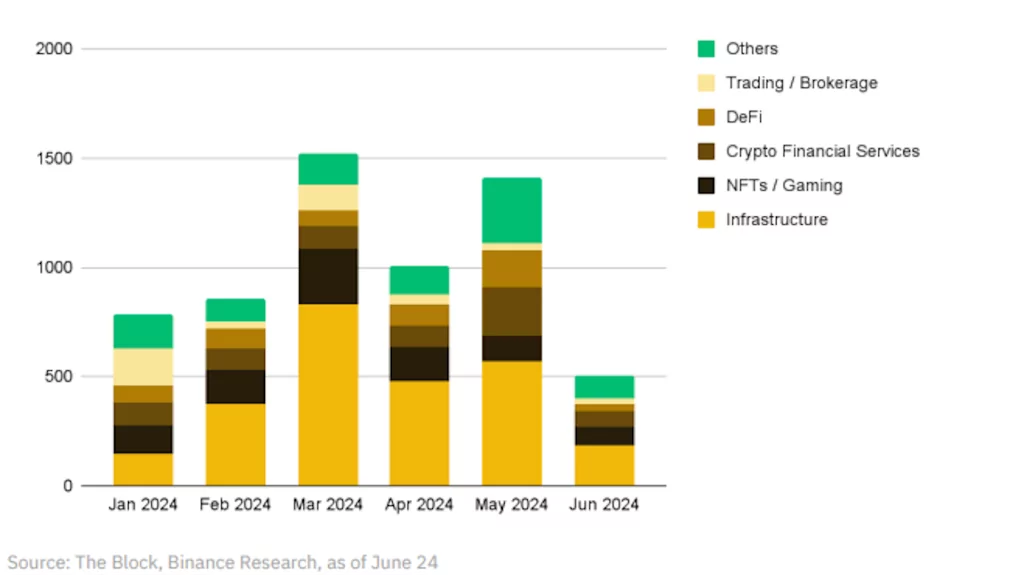

Fundraising and Institutional Adoption

The first half of 2024 has seen substantial fundraising activity and increased institutional adoption of cryptocurrencies. Numerous crypto projects have successfully raised capital, with significant investments flowing into DeFi, gaming, and infrastructure projects.

Institutional interest in cryptocurrencies has grown, driven by the approval of spot BTC and Ethereum ETFs and the increasing acceptance of crypto as a mainstream investment. Notable players like BlackRock, Grayscale, and Fidelity have been leading the charge, with substantial inflows into their ETF products.

Efforts to build robust crypto infrastructure have continued, with investments in security, scalability, and user experience improvements.

The bottom line

The first half of 2024 has been marked by significant advancements in DeFi and Layer-2 solutions, driving overall market growth. With continued institutional interest and technological innovations, the crypto market is ready for further growth. Key themes to watch are Bitcoin scalability, Ethereum’s ongoing upgrades, and the evolution of Layer-2 ecosystems. The market’s focus will likely shift towards improving user experience, security, and integration with traditional financial systems.