Key takeaways:

- Binance has just completed its BNB burn for the past quarter, which removed 1,684,387 tokens from circulation

- The latest, 18th quarterly burn, was the first to feature a significant overhaul to the process, in the form of Auto-Burn

- The Auto-Burn mechanic takes into account Binance quarterly profits, BNB’s price, and the number of blocks that were produced

Binance, the world’s largest digital asset trading platform, has just completed its 18th Binance Coin (BNB) quarterly burn, which forever removed 1,684,387 BNB (equivalent to $729 million) from circulation.

Binance introduces greater transparency and predictability to its quarterly BNB burns

The last BNB burn was the largest in terms of dollar value, surpassing the 17th quarterly burn by approximately $90 million. While all burns up to now employed a straightforward approach of Binance using a fifth of its quarterly profits to buy and destroy its native tokens, the latest burn is the first to feature a notable overhaul to the process, in the form of the recently announced Auto-Burn mechanic.

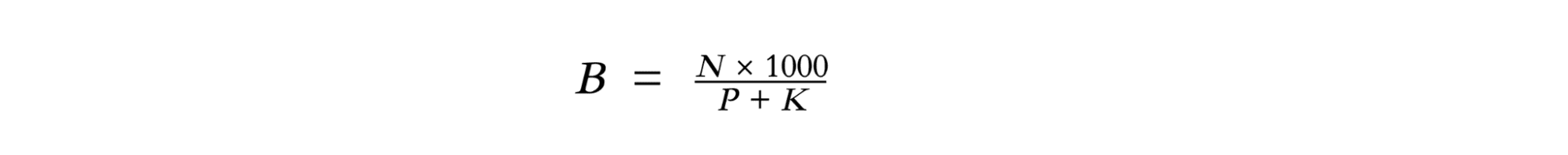

Auto-Burn formula as explained by Binance:

- B is the amount of BNB to burn. N is the total number of blocks produced on BSC during the calendar quarter.

- P is an average price of BNB against the US dollar.

- K is a constant value as a price anchor, initially set at 1000.

While the leading crypto exchange still follows its original goal of destroying 100 million coins that were allocated to the founding team when BNB launched through an initial coin offering (ICO) in July 2017, Binance has decided it is time to make the process more transparent and predictable. Auto-Burn has updated the old approach by not accounting only for Binance’s quarterly profits but also for BNB’s price and the number of blocks that were produced during any given quarter.

Binance CEO Changpeng Zhao (CZ) tweeted about the latest burn news earlier today, and stated: “BNB is deflationary.”

Binance is utilizing different methods to make BNB deflationary

Auto-Burn is not the only mechanism designed to have an impact on the supply and demand dynamics of BNB. In early December, the Bruno hard fork introduced real-time BNB burning to Binance Smart Chain (BSC) as part of the implementation of a much-anticipated Binance Evolution Protocol, BEP-95. BEP-95 brought similar burning mechanics to the Binance blockchain ecosystem, as did the London hard fork, namely EIP-1599, to Ethereum.

BEP-95 has fundamentally changed the way transaction fees are processed on the BSC network – gas fees are no longer distributed to validators in their entirety as 10% gets sent to the BNB burning pool. Binance introduced real-time burning mechanics in hopes of making BSC more decentralized and intends to let the program run even after BNB supply drops to 100 million coins.

Binance has recently made great strides in making BNB more deflationary, which should, in theory, provide significant upward price momentum. However, BNB, along with a number of other major coins, has been caught in a relatively tight trading range as of late. Despite the quarterly burn announcement, the price of BNB dropped by 3.85% in the last 24 hours and stands at $465, 0.41% removed from its 2022 low, at the time of this writing.