Margin trading gives investors the opportunity to amplify trading results and increase exposure to markets with borrowed funds. Next to identifying good buying and selling opportunities, the interest rate on margin funds plays a pivotal role in determining how lucrative each individual trade can potentially be.

Earlier this year, Binance launched an exclusive promotion in order to slash interest rates on borrowed crypto capital and provide its users with more profit-making opportunities. The recently launched interest rate reduction promotion introduces lower rates for Bitcoin (BTC), Ethereum (ETH), Binance USD (BUSD), and Tether (USDT) loans. In some cases, the savings can reach up to 80%!

An overview of Binance Margin’s Interest Rate Reduction Promotion

“Up to 80% savings? How is that even possible?” you might ask. To put it simply, Binance has basically revamped its interest rates structure for BTC, ETH, BUSD and USDT assets for the duration of the promotion, and thus allowed its users to gain access to additional crypto capital at heavily discounted rates.

Read more: Binance Margin Launches Interest Rate Reduction Promotion For BTC, ETH, BUSD & USDT

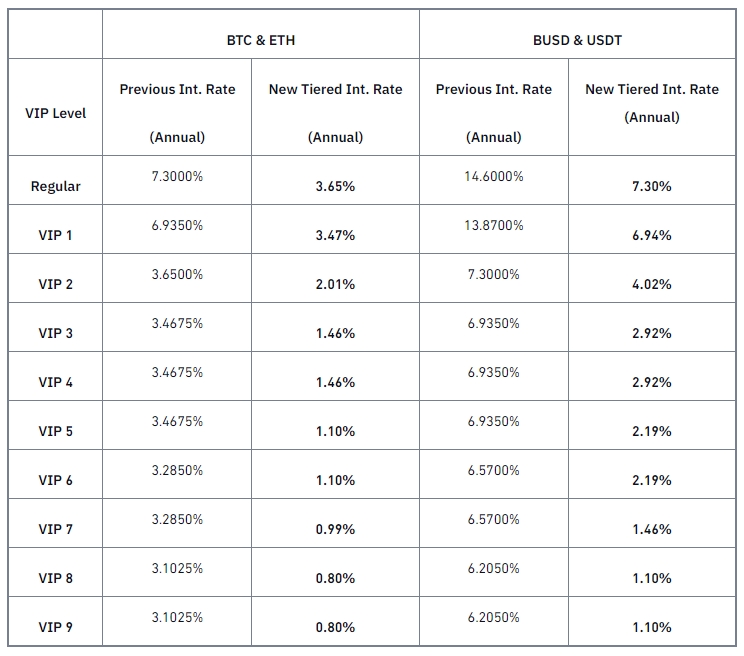

According to the company’s mid-March announcement, the promotional interest reduction period will continue “until further notice”. While the new rates are heavily correlated with each user’s VIP status, the promotion applies to non-VIP users as well. Let’s take a look at the updated interest rates chart before we proceed with a real-life type scenario.

In the table above, you can see the old interest rate structure in the columns to the left and the new one in the bold text next to it. As mentioned before, the interest rate slashing applies to all VIP tiers and “regular” users as well. Whereas previously, Binance charged 7.3% for BTC and ETH on margin for “regular” users, it now charges just 3.65%. That’s a 50% reduction right off the bat.

The interest rate reduction is present across all levels. As a rule of thumb, higher-tiered VIP users get to enjoy the most significant discounts. Case in point, users with the eighth and ninth VIP status, pay over 80% less interest when borrowing BUSD and USDT.

How much can I save with interest rate discounts?

Let’s examine how the interest rate reduction might fare in practice for a non-VIP Binance user that borrows 10,000 BUSD to trade on Margin.

Previously, such a user would have to pay 14.6% yearly interest for borrowing BUSD. This translates to a daily interest payment of exactly $4. Thanks to the new promotion, the daily interest payment is halved to just $2.

The table below showcases yearly and daily interest payments based on the old structure for a “regular” and a “VIP 9” user borrowing 10,000 BUSD to trade on Margin.

| VIP Level | Principal | Old int. structure | Yearly int. payment | Daily int. payment |

| Regular | 10,000 BUSD | 14.6% | 1460 BUSD | 4 BUSD |

| VIP 9 | 10,000 BUSD | 6.205% | 620.5 BUSD | 1.7 BUSD |

Now, let’s take a look at the same scenario as in the table above with the new interest rate structure applied.

| VIP Level | Principal | New int. structure | Yearly int. payment | Daily int. payment |

| Regular | 10,000 BUSD | 7.3% | 730 BUSD | 2 BUSD |

| VIP 9 | 10,000 BUSD | 1.1% | 110 BUSD | ~0.3 BUSD |

As you can see, the potential savings can be massive. A Binance user with the highest VIP status pays nearly six times less for interests payments on BUSD than before.

Obviously, the above calculations apply to USDT as well. You could, for instance, borrow USDT to trade BTC in cross margin mode and save up to 80% on interest rates.

Why should I give Binance Margin a try?

Besides the current interest rate promotion, Binance Margin is one of the premier platforms for crypto traders seeking to magnify their market exposure with leveraged trading orders with borrowed capital.

Let’s take a look at some of the features that make Binance Margin stand out as one of the best products in the sector.

Diverse trading pairs

There are more than 600 trading pairs available on Binance Margin, giving customers ample opportunity to pursue leveraged positions on crypto staples, such as Bitcoin and Ethereum, as well as a wide range of smaller altcoins, like Cosmos (ATOM), The Sandbox (SAND), VeChain (VET), and many more.

Multi-asset collateral

The multi-asset collateral feature allows users to trade USDⓈ-M Futures more effectively by sharing their margin across multiple margin assets. The so-called Multi-Assets Mode currently supports BTC, ETH, BNB, XRP, ADA, DOT, SOL, USDT, BUSD, and USDC at various collateral ratios. In simple terms, the feature gives users the ability to offset losses accrued when trading futures contracts in the same margin asset to increase capital efficiency and more easily diversify across various digital assets. For example, users can seamlessly share their margin across USDT- and BUSD-margined positions.

Cooling-off period

In order to promote responsible trading practices, Binance introduced the Cooling-off Period feature last year. It allows users who might feel pressured by losses or be otherwise incapable of rational decision-making to block themselves from using margin trading for a certain period of time. Margin traders can use 1 day, 3 days, or 1 week-long cooling-off period to protect their portfolio from potentially harmful decisions.

Insurance fund

The Margin Insurance Fund covers the losses of user margin accounts that go bankrupt and have insufficient collateral to repay the borrowed capital. As such, the Insurance Fund acts as a safety net that ensures seamless operation of the Margin platform and prevents liquidity problems that could occur if a large number of users were to go bankrupt in a short amount of time. You can follow the Fund’s balance in real-time on the Binance website.

For more information on Binance Margin and a step-by-step guide to the trading service, click the link below.

Binance Margin – Amplify Your Trading Results and Earn ‘Friday Funday’ Rewards

While there are plenty of benefits to using Binance Margin, please keep in mind that using any kind of leveraged financial instruments involves significant risk. Do your research and never invest more money than you are willing to lose.

Final thoughts

If you have previously been on the fence about giving Binance Margin a try, there will unlikely be a better time to try it out than now. The massive reduction in interest rates effectively makes each margin trading order less expensive and consequently, more lucrative. Hurry up and use your crypto holdings as collateral to borrow additional capital at an up to 80% discount for the duration of the promo.