If you’ve heard about major crypto blockchains such as BNB Smart Chain, Solana, and Avalanche, or decentralized trading protocols like Aave and Uniswap, you’ve probably come across the term “staking.” In this article, we are going to examine different applications of staking, describe its main pros and cons, and analyze various features Binance offers to users that are looking to stake their digital assets to earn a profit.

What is Staking?

Staking is a process of allocating crypto assets with the intention of securing the underlying blockchain networks and participating in the validation of on-chain transactions. In addition, staking also refers to the practice of leveraging the power of decentralized finance (DeFi) trading protocols to earn a yield on deposited crypto assets.

For a general overview of crypto staking, take a look at the What is Staking? article published on Binance Academy.

Staking Types available on Binance

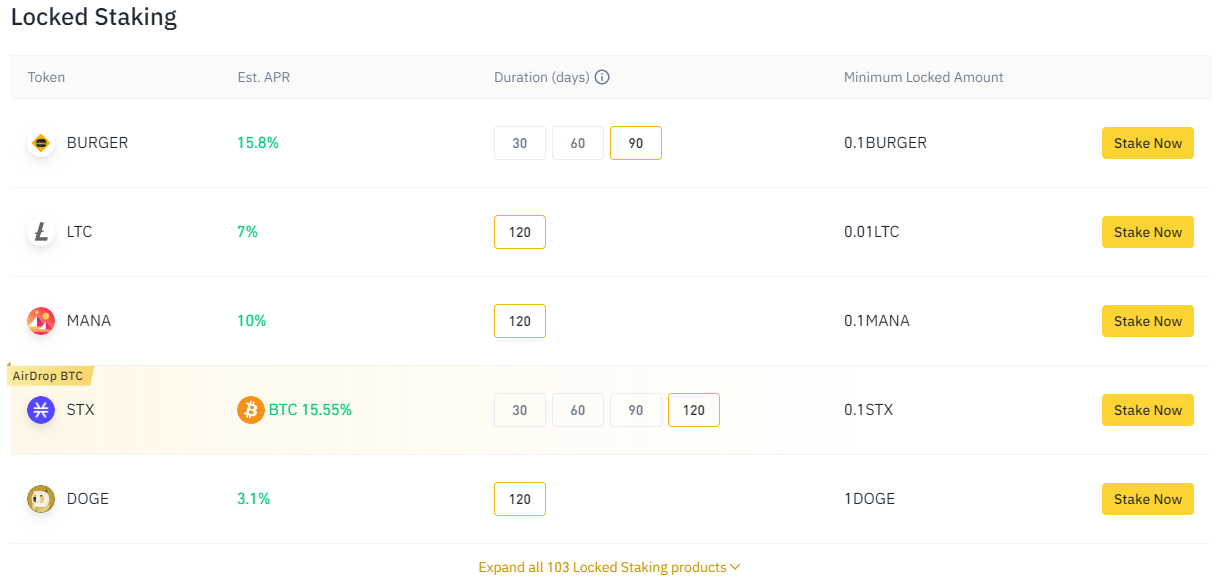

Binance allows users to pursue staking investments in two broad categories, which the company calls Locked Staking and DeFi Staking. Each service features numerous cryptocurrencies with various yield-earning opportunities and lock-up periods.

Read along to find out more about the two staking options available to Binance users.

Locked Staking

Binance allows users to stake their coins to participate in the Proof-of-Stake (PoS) consensus mechanism of various crypto projects. In a PoS consensus algorithm, users who want to become validators need to stake a certain amount of digital currency. Validators are responsible for verifying transactions and for producing new blockchain blocks. In exchange for their service, users who stake their crypto earn a share of staking rewards.

Proof-of-Stake is the most widely used consensus mechanism in the industry, thanks to its low energy consumption and high efficiency. Contrary to Proof-of-Work (PoW) networks – like Bitcoin, for instance – which require cryptocurrency miners to put vast amounts of computing power towards complex problem solving to earn mining rewards and secure the network, PoS relies on the total amount of coins that are placed in a smart contract as collateral to promote valid transactions.

Binance lets users stake over 100 different cryptocurrencies, including Cardano, The Sandbox, Avalanche, TRON, and BNB, to name a few. The lock-up period varies between each digital currency, ranging from 15 to 120 days.

Since Binance pools all coins deposited in locked staking, users have a higher chance of validating blocks and receiving rewards. It is worth noting that staking rewards vary between each chain. However, the following factors can serve as a general guideline that determines how staking rewards are calculated, as explained by Binance:

- how many coins the validator is staking

- how long the validator has been actively staking

- how many coins are staked on the network in total

- the inflation rate

In addition to the factors mentioned above, certain networks employ their own set of parameters when distributing staking rewards. Also, some platforms distribute staking rewards using a fixed percentage.

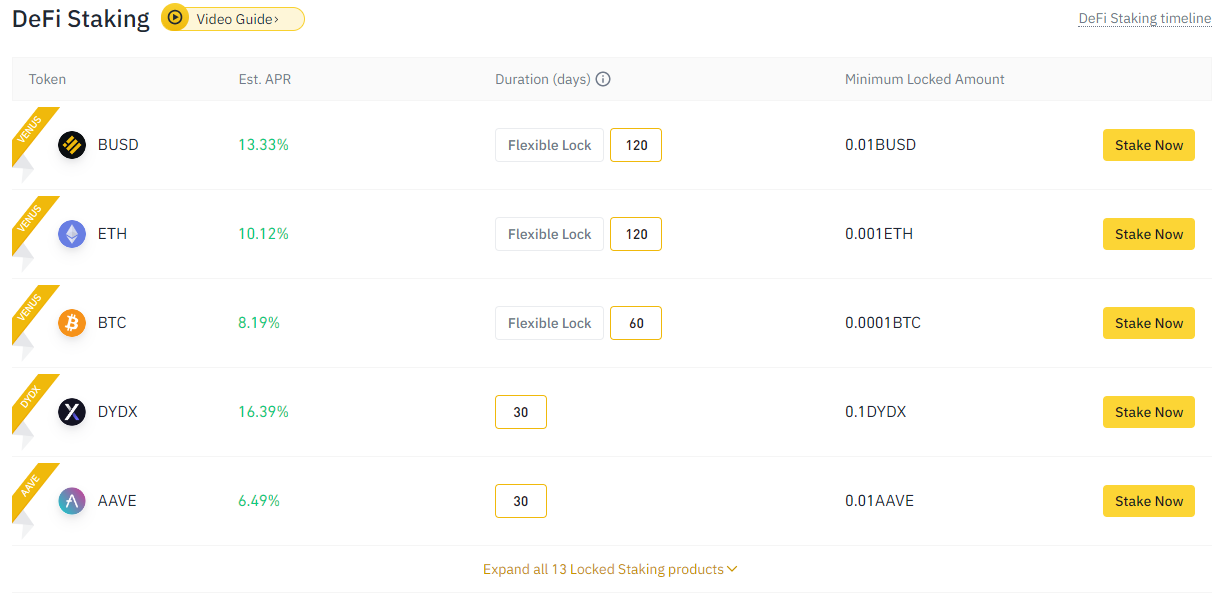

DeFi Staking

Staking in the world of decentralized finance (DeFi) refers to the practice of depositing digital assets into various yield-generating decentralized applications (dApps). For example, decentralized trading services like PancakeSwap and Aave allow users to use their crypto to provide liquidity via liquidity pools and earn a share of the total amount of trading fees generated by a particular pool.

In addition, DeFi stakers can choose to loan their assets and earn interest generated by the borrowing party, who might use the borrowed funds for spot and derivative trading purposes, or for other investment methods. There are drastic differences in terms of attainable returns and the degree of risk associated with various DeFi services.

Binance uses various decentralized trading protocols to generate returns on behalf of users that use DeFi Staking, including Venus, dYdX, Aave, and Maker. As of July 21, 2022, Binance users can choose between 13 supported cryptocurrencies – such as Ethereum, Bitcoin, and Tether – when using DeFi Staking.

Binance provides access to flexible lock staking products, which allow users to withdraw their crypto at any time, and products that feature up to a 120-day long lock-up period. It is worth noting that after depositing crypto in DeFi Staking products, earnings start to accumulate at 00:00 (UTC) the following day.

The estimated APR (annual percentage rate) varies a great deal between each crypto, ranging from just 1.19% for Dai to as much as 16.39% for DYDX. Keep in mind that the APR figures on Binance are an estimate and subject to change.

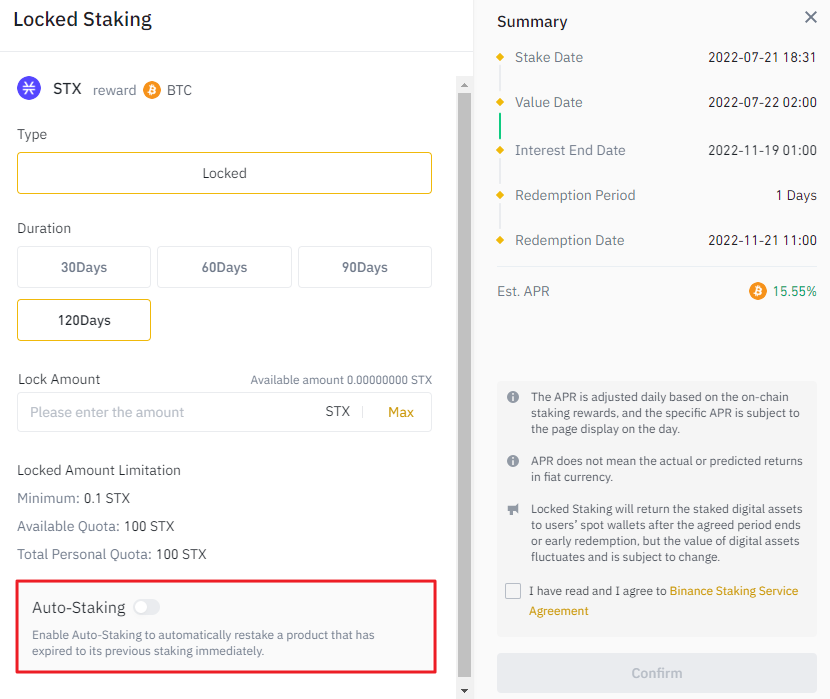

Enable Auto Staking to stake supported digital assets automatically

Auto staking is a feature that lets users automatically restake their digital assets once the initial staking period ends, making it possible for users to not miss out on any potential staking rewards by forgetting to stake their crypto manually.

The feature can be accessed in each crypto’s locked staking window, by toggling the “Auto Staking” button (highlighted in red in the image above). It is worth noting that the feature is available on a per-cryptocurrency basis, meaning that the automatic staking is not accessible across the whole selection of stackable cryptocurrencies on Binance.

The Bottom Line

The Binance Staking platform lets users take advantage of an additional way of generating income with their crypto assets. In some sense, staking can be thought of as a middle ground between holding and trading crypto – it enables users to put their crypto to work and earn a share of fees generated by decentralized trading protocols, or by earning a share of staking rewards distributed by Proof-of-Stake systems.

For more information about the service, you can take a look at Binance’s helpful articles on DeFi Staking and Locked Staking.