Many cryptocurrency investors are quick to disregard the effects of short-term market volatility and are focused solely on the long-term. However, physical assets can only generate profit when the markets are moving in a positive direction, which can leave long-term holders at the mercy of constantly changing news cycles and macroeconomic conditions.

Trading futures on Binance Futures provides crypto investors with an opportunity to hedge their long-term positions to turn shorter-term market fluctuations into profit-generating opportunities. In other words, futures trading can help you profitably ride out temporarily unfavorable market conditions without affecting your spot funds.

What is futures trading?

Futures are a type of derivative financial contracts that bind investors into an agreement based on the future price of an underlying asset. Their inherent structure allows traders to gain exposure to physical markets without actually owning the assets themselves. This means that futures traders can go long on the price of Bitcoin, for instance, if they believe its value will increase, or go short if they think Bitcoin’s price will decrease in the future, without buying Bitcoin. The bottom line is that futures contracts allow traders to speculate on the future price of crypto assets and boost their earnings as long as the market moves in their favor.

The Binance Futures platform boasts more than 500 trading pairs and supports major coins like Bitcoin and Ethereum, as well as smaller altcoins such as Kava or Zilliqa. Users can utilize contracts with quarterly and by-quarterly expiration dates, or use perpetual contracts if they prefer trading with no expiration dates.

What are the main differences between futures and spot trading?

As described above, futures contracts don’t grant their owners direct ownership over the underlying digital currency. Instead, they represent a financial obligation to buy or sell a specific cryptocurrency at some time in the future.

Spot trading, on the other hand, refers to the practice of buying and selling crypto assets in the spot market. The ownership of coins is transferred between spot market participants on the basis of supply and demand dynamics; as a rule of thumb, the higher the amount of buyers, the higher the price of the cryptocurrency. Moreover, owning physical crypto assets grants its holders additional utility, such as the ability to participate in on-chain governance, staking, and more.

5 benefits of trading futures on Binance Futures

Binance’s Futures offering is arguably the best of its kind in the industry in terms of the number of supported assets, high liquidity, and wide range of features. In the following sections, we are going to list some of the main reasons why cryptocurrency holders should consider giving Binance Futures a try. If you are looking for a more general overview of the benefits of trading futures on Binance, check the article linked below.

1. Futures as a hedge against short-term market volatility

Utilizing shorting methods, especially for a shorter period of time, can be an excellent venue for risk mitigation for long-term crypto holders. Futures trading can act as a hedge against unexpected economic events or political news that can often lead to a broader sell-off in the spot market. Case in point, over the last couple of years, we’ve witnessed many events that have scared investors in crypto and traditional markets into selling their expansionary holdings. Instead of selling your crypto out of fear of suffering losses in such instances, you can use futures contracts to go short on the future price of the underlying crypto and make a profit when the markets swing into the red zone. By doing so, you can weather the storm of short-term volatility and incur smaller losses than if your entire exposure consisted of physical holdings.

Binance also supports a dedicated Hedge Mode, a futures trading feature that allows users to enter long and short positions on the same trading pair. The feature makes it possible, for instance, to go long on a particular cryptocurrency while simultaneously taking advantage of minute market fluctuations to generate extra profit.

2. Market-neutral trading strategies: make a profit regardless of which way the market moves

Binance Futures are a great choice for investors that seek to profit from both appreciating and depreciating crypto prices. As a rule of thumb, market-neutral trading strategies perform at their best in times of high market volatility and are for this reason considered a risk mitigation tool. Also, market-neutral strategies allow investors to focus on perceived market inefficiencies, largely ignoring the broader market trend. As an example of a market-neutral strategy, imagine the following scenario.

Suppose you think that a particular cryptocurrency, for example, BNB, is undervalued in relation to Ethereum. In this case, you could go long on BNB and short ETH. If your prediction turns out correct, returns made by your long BNB position would surpass losses generated by ETH shorts. The advantage of this strategy is that allows traders to turn a profit regardless of whether the overall market experiences positive or negative movements. If you would have not entered a short position on ETH, and only gone long on BNB, you would end up losing your investment in the event of BNB’s downturn. However, using the market-neutral approach, you are able to generate a profit as long as BNB outperforms ETH, regardless of whether BNB’s value actually ends up decreasing in the process.

3. Amplify your trading results with up to 125x leverage

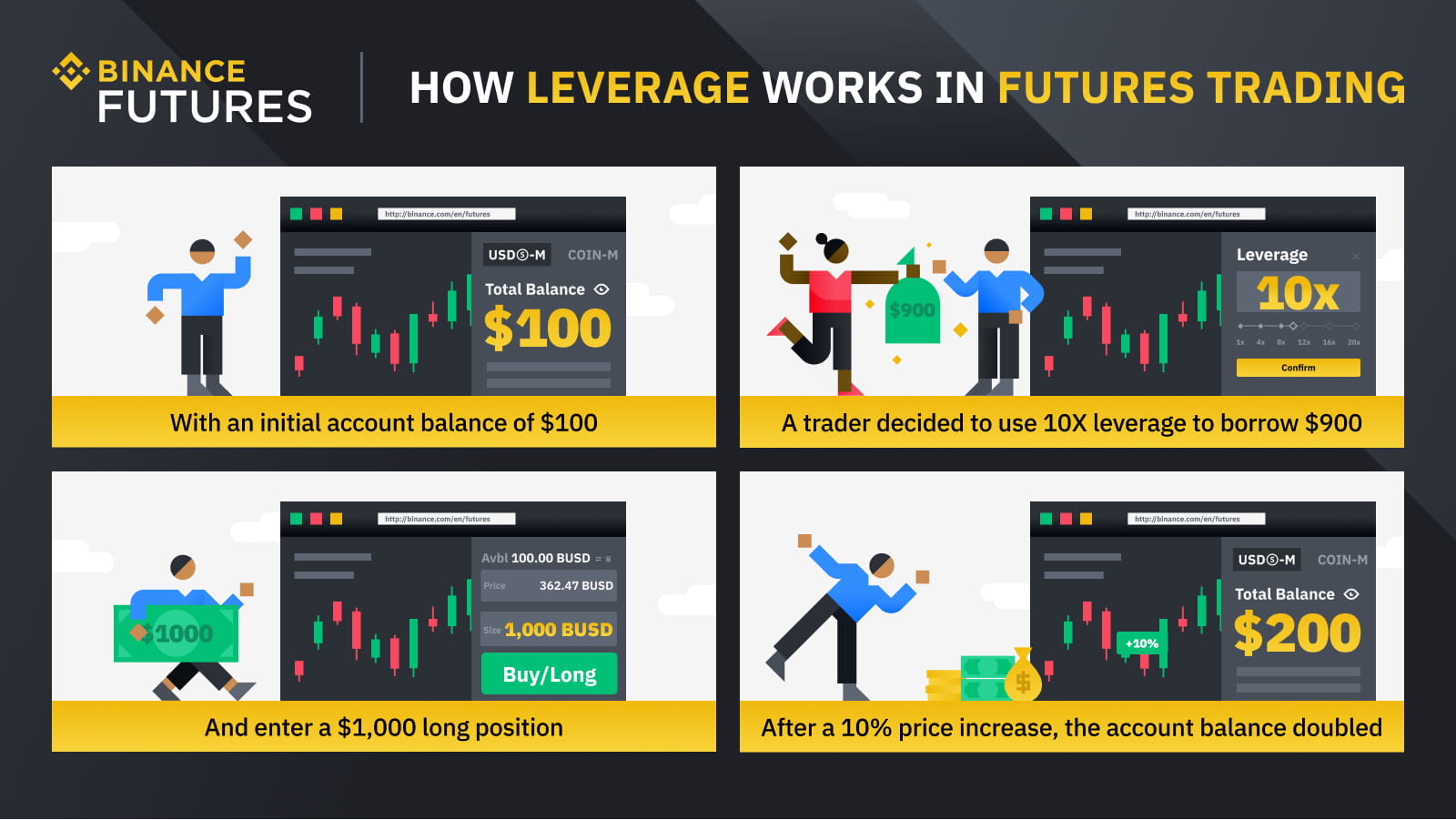

Another benefit of using Binance Futures is the ability to amplify returns with borrowed funds. This means that you can invest in a futures contract by providing only 0.8% of its total value as an initial margin. In practice, this means that you can control a capital position worth 1 BTC by investing only 0.008 BTC. However, the higher the leverage, the higher the maintenance margin and susceptibility to price movements of the underlying asset. Check Binance’s helpful graphic below for a brief description of how leverage works in Futures trading.

4. Robust liquidity and high trading volume

Binance Futures is the largest cryptocurrency derivatives trading platform in the world, both in terms of users numbers and the total trading volume. For context, Binance processed a whopping $7.7 trillion in futures trading volume in 2021. Moreover, the platform is home to over 28 million active users. In practice, these figures convey the fact that Binance Futures traders can trade contracts with virtually zero slippage across a wide range of trading pairs.

5. Strong safety measures

Binance employs a number of safety measures to ensure that its Futures trading platform remains sufficiently liquid regardless of the broader market trends. For starters, Insurance Funds act as the first line of defense against sudden drops in liquidity and ensure that winning traders are fully compensated. In essence, Binance collects liquidation fees from users to cover negative balances of bankrupt traders. If the number of bankrupt users rises too quickly for Insurance Funds to cover the losses, Binance’s Auto-Deleveraging mechanism kicks in and reduces open positions of the most profitable and the highest leveraged traders to minimize the platform’s risk exposure.

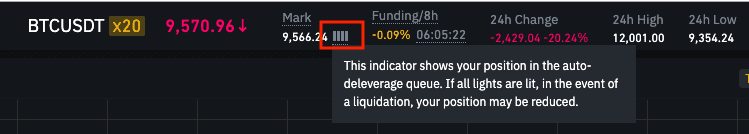

Binance displays an indicator that shows your position in the queue of futures traders that would have their position reduced if Auto-Deleveraging would trigger. For a full breakdown of the ADL mechanism and the formula Binance uses for its queue ordering system, click here.

Final thoughts

All too often, crypto holders focused on the long-term disregard futures trading as a practice that is only worthwhile for experienced traders or think that speculating on the future price of digital currencies provides no value to their overarching trading strategy. Hopefully, we’ve managed to successfully convey the main reasons why this is not the case. Futures trading can be used as a companion investment approach to physical investing and can help you not only withstand short stints of market turmoil but potentially make a profit when markets turn red.