Binance Swap Farming enables users to exchange cryptocurrencies via a streamlined user interface that makes crypto trading accessible to even the most inexperienced users. In addition, users can earn BNB (BNB) rewards when exchanging tokens through Swap Farming, which can effectively reduce trading fees by up to 50%.

Swap Farming is a part of the overarching Binance Liquid Swap platform, which uses the automated market maker (AMM) system, similar in principle to the one used by popular decentralized exchanges (DEXs) like Ethereum-based Uniswap and BNB Smart Chain-based PancakeSwap.

Swap Farming taps into liquidity pools on Binance Liquid Swap to achieve low transaction costs and lower slippage for large orders than when using decentralized AMMs.

What are the main benefits of using Swap Farming?

As briefly mentioned above, Swap Farming is a streamlined cryptocurrency trading platform that allows users to earn a BNB-denominated rebate based on the trading fees accrued by each physical digital asset trade. We will discuss the main pros of the Swap Farming service in more detail in the following sections.

1. Easy to use

Swap Farming is arguably the most accessible way for traders to exchange digital assets on Binance. Contrary to using the dedicated Spot trading platform, Swap Farming features a very simplistic interface, which is especially beneficial for newcomers who might feel overwhelmed by the abundance of options and order types available when trading via the Spot market option.

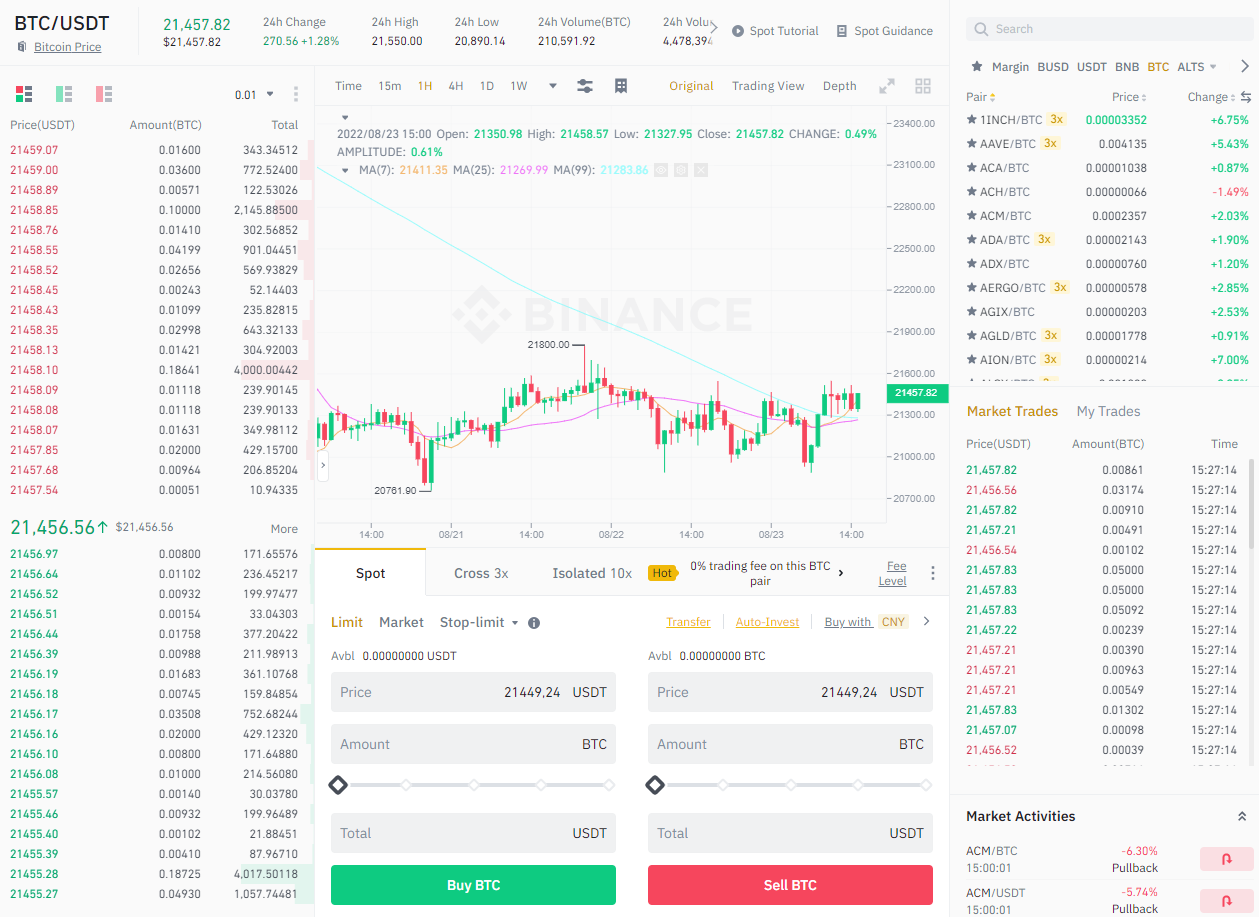

Here’s an image of the Spot market trading menu:

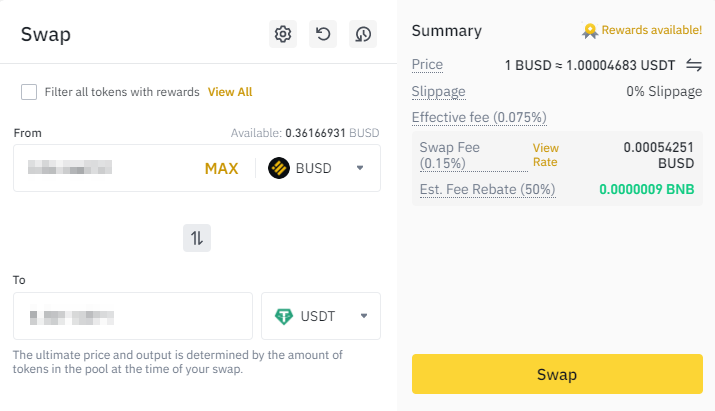

And the Swap Farming dashboard:

As you can see, the two services differ greatly in their respective designs and the number of features available. Obviously, investors who might want to use different order types, trading tools, and set detailed transaction parameters would prefer the first option. However, Swap Farming is a great choice for users who just want to exchange coins and don’t need all the bells and whistles.

2. Arbitrage opportunities

Another advantage of using Swap Farming is the ability to pursue potential arbitrage opportunities that arise between spot and swap markets. In arbitrage, investors simultaneously buy and sell crypto (or other assets) in different markets to generate a profit due to minute price discrepancies between different markets.

Taking advantage of arbitrage opportunities is mostly reserved for experienced traders, who are not afraid to make large investments in order to generate a small amount of profit. Swap Farming is especially attractive to such investors because it offers low trading fees and features low slippage thanks to high liquidity facilitated by liquidity pools.

3. Capital efficient trades with low slippage

High capital efficiency ties directly to the above point about arbitrage opportunities. Whereas low liquidity on DEXes, and even in centralized spot markets, can oftentimes result in high slippage, most crypto pairs that can be traded via Swap Farming don’t suffer from the same predicament.

Slippage refers to the difference between the expected price of an order and the price when the order actually executes. Negative slippage is mostly a problem for large orders and can result in a part of an order being sold at a lower price than initially planned.

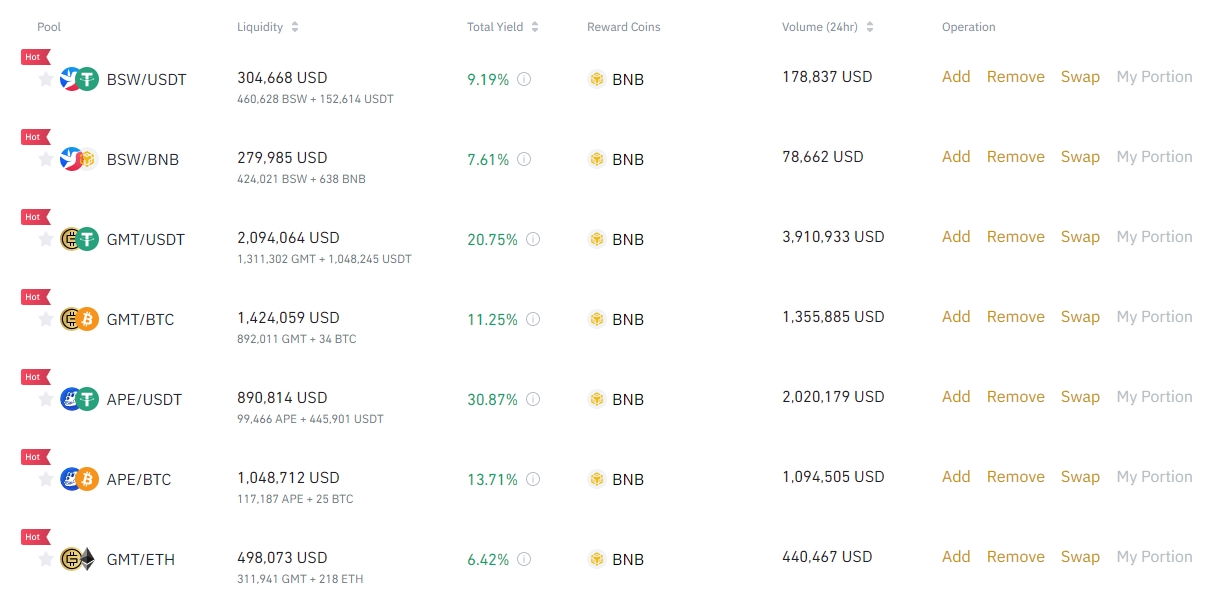

Since trading via Swap Farming is facilitated by pools consisting of two digital assets, for example, Bitcoin (BTC) and Ethereum (ETH), or Binance USD (BUSD) and Tether (USDT), and incentivized by distributing farming rewards (a share of trading fees accrued by a liquidity pool) to liquidity providers, it suffers from very low slippage.

4. Earn BNB rewards and save up to 50% on trading fees

One of the more attractive propositions when using Swap Farming is the ability to earn BNB rewards simply by exchanging digital currencies. Binance distributes up to 50% of the total value of the trading fee to users in the form of BNB rewards.

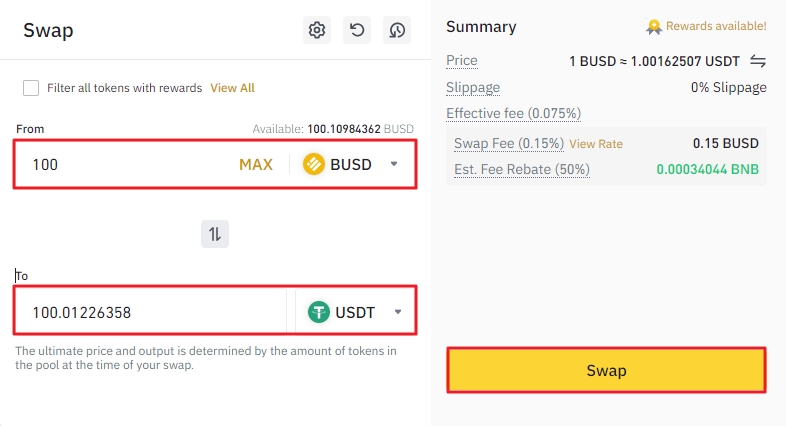

To earn BNB rewards, you first need to swap crypto tokens. In our example, we’re swapping 100 BUSD for USDT. The right panel in the image below displays the total slippage rate and the amount of BNB rewards we stand to earn by making the swap.

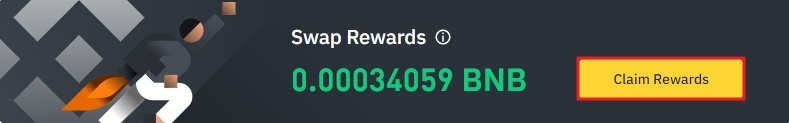

After making the swap, you can claim BNB rewards at any time by clicking the “Claim Rewards” button at the top of the Swap Farming homepage.

Our 100 BUSD/USDT swap generated roughly 0.0003 BNB in rewards, effectively reducing the trading fee by 50%. This brings us to the last item on our list.

5. VIP tier requirements

In addition to arbitrage opportunities, high capital efficiency, low trading fees, and a streamlined user experience, Swap Farming features another bonus for Binance users – trading volume facilitated via Swap Farming counts towards VIP requirements.

This allows users to climb the VIP ladder to get a better deal when using Binance products and services. Binance has a 9-tier VIP program, with each subsequent tier sporting gradually more beneficial trading fees and other perks. For context, non-VIP users have to pay 0.10% on maker and taker fees when trading on Binance. However, users belonging to the most exclusive, VIP 9 tier, pay just 0.02% and 0.04% on maker and takers fees, respectively. It is worth noting that having BNB deposited in your Binance Spot account further slashes fees by an additional 25%.

In addition, VIP perks include higher withdrawal limits, better borrowing interest when trading on margin, better Futures trading rates, and more.

Closing thoughts

Swap Farming is a cryptocurrency swap platform that enables traders to exchange crypto coins and tokens with high capital efficiency and low trading fees. The service is primarily targeted at users who might be seeking a streamlined platform to swap their crypto, and for investors who might benefit from slippage levels that lower than on most DEXes and spot markets.