How to choose among hundreds of IDOs and not get left behind when the sale starts? Learn the four most powerful tips and tricks for choosing good projects – and explore three promising upcoming IDOs.

Why participate in IDOs?

The IDO format has become the most popular way to launch new projects, especially in blockchain gaming and DeFi – and for a good reason.

1) High ROIs. The most successful IDOs of 2021 earned their investors over 150x, or 15,000%. These included Bloktopia, StarLaunch, PulsePad, Velhalla, and others. If you missed these projects, don’t get upset – 2022 will bring new opportunities to make 100x and more on an IDO.

2) Attractive price. IDO prices usually vary between $0.01 and $0.2 per token, and individual allocations are usually between $5 and $100, depending on the launchpad. This makes them accessible to just about anyone.

3) Participation in a DAO. Many IDO projects invite early supporters to participate in the governance. As a token or NFT holder, you’ll be able to vote on reward distribution, new features, and other matters that directly impact you.

4) Transparent access. As each IDOs us governed by a smart contract, you can be sure that your tokens will be unlocked and available for claiming exactly on schedule.

However, in spite of all these advantages, many investors still manage to lose money on IDOs. Why? Because a lot of these projects never get anywhere, failing to release a successful product. The price can pump shortly after a DEX listing and then go back to – and even blow – the IDO price.

With several IDOs starting on any given day, you’ll need to invest some time in research to pick the good ones. We’ve asked the team behind the popular Drunk Robots game to share their top four due diligence tips.

How to do IDO research: the 4 most important techniques

1) Follow the narratives. Vladimir Nikitin, Co-Founder Drunk Robots, comments:

‘Every couple of months, a new narrative emerges in crypto, followed by a bubble and a cool-off. Some narratives never come back into the spotlight, while others go through a second or even third wave of popularity. The key narratives of 2021 were the metaverse, GameFi, nodes, Tomb Finance and OHM forks, plus everything Solana.

In 2022, we expect a huge second wave on GameFi and the metaverse, even bigger than the first. Web 3.0 dApps and new layer-2 and layer-1 networks could attract a lot of capital, too.’

Start by making a list of 10-20 projects that fit the potential upcoming narratives and then continue with the due diligence to narrow it down.

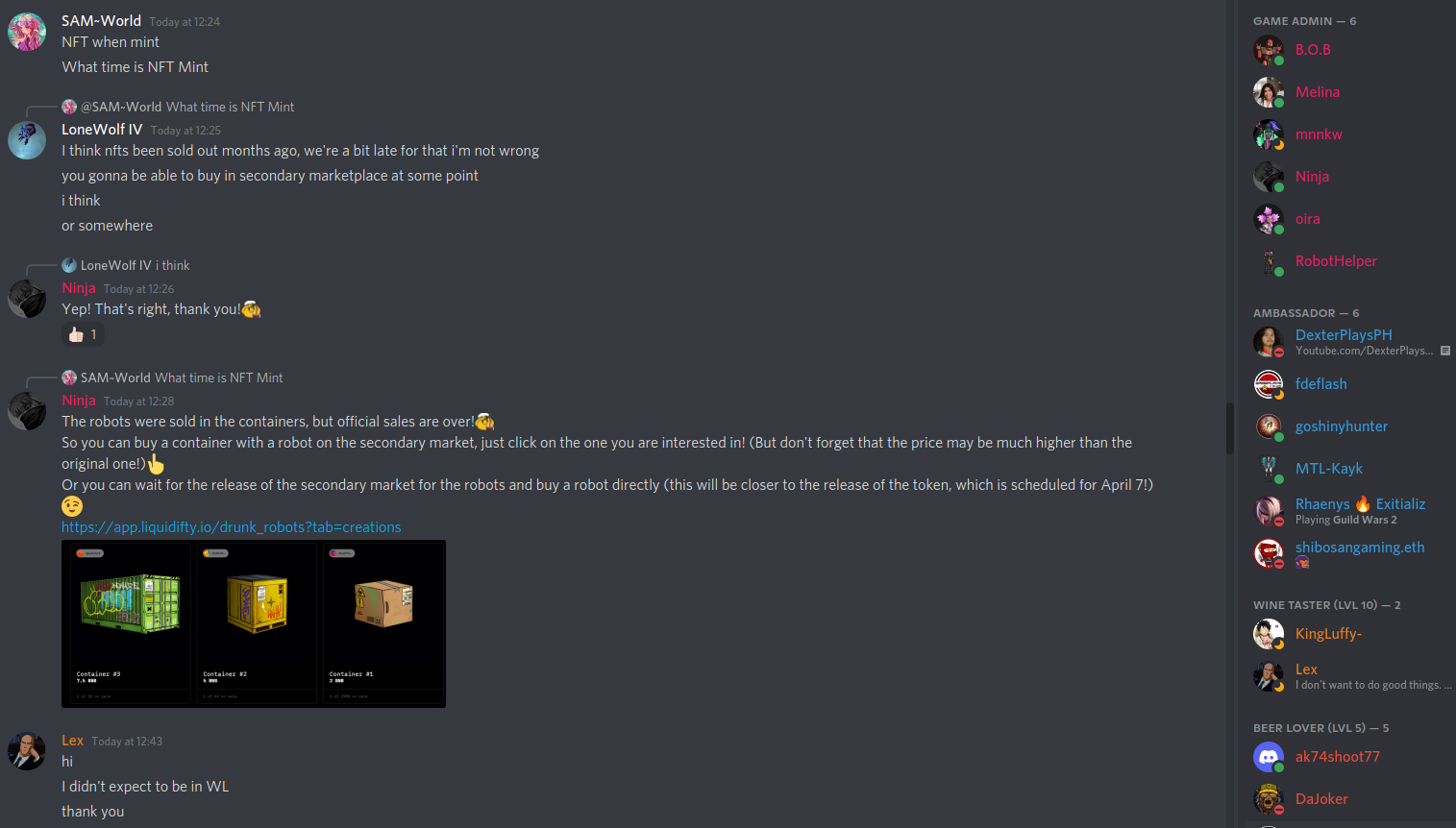

2) Check the community activity. Join each of the projects on the list on Twitter, Telegram, and Discord, and dedicate at least 15 minutes to analyze their posts and interactions. It’s better to write down your observations in a spreadsheet. Here’s what you should be looking for:

- a few thousand members on Twitter and/or Discord;

- at least one announcement or tweet every day;

- active discussion on Discord/Telegram, with new chat messages posted every few minutes;

- team presence: actual team members (not just hired moderators) answering questions.

A screenshot from Drunken Robots’ Discord, with 6 of the game admins present and active

3) Look for projects with a product and/or partnerships. By the time the IDO starts, a project should be beyond the idea stage. It doesn’t have to have a fully working DeFi protocol or game, but it should have something: a beta testnet, an NFT collection, etc.

Partnerships are also crucial, because they help bring publicity and credibility. Remember: you will only earn a good ROI on an IDO if a lot of other people learn about the project and believe in it – and having the backing of large blockchain funds and protocols is a major trust factor.

4) Prepare for the IDO in advance. Once you’ve gone through steps 1-3, you should have a few quality projects left on the list. Next, study their IDO terms:

– Whitelist: normally you’ll need to fill a form and pass a KYC to be whitelisted for an IDO – either on the project’s site or on the launchpad.

– Currency and wallet: you’ll need to use a non-custodial wallet like MetaMask to purchase IDO tokens, and to have the required currency on the correct chain. If a project launches on BSC, for example, you’ll need to send BNB, USDC, or USDT over to MetaMask using the BSC network.

– Staking: some launchpads require that you stake their tokens in order to get a guaranteed allocation.

Don’t leave it until the last minute: pass the KYC, connect the wallet to the launchpad, and load it with crypto at least one day before the IDO.

3 interesting IDOs to watch

We’ve picked a few fresh IDOs that illustrate all the points above in terms of community activity, product development, and partnerships. It should help you do your own research in the future.

Drunk Robots ($METAL, April 7, 2022)

This fun and quirky Play2Earn game takes place in Los Machines, a huge city populated by robots whose main hobbies are booze and violence. You can battle other users to win token prizes; scavenge for NFT goodies to customize your robot; and join quests to collect $METAL.

Drunk Robots runs on BSC and boasts partnerships with such major players as Merit Circle and Animoca Brands (the company behind The Sandbox), Liquidifty, Moonrock Capital, DEX Ventures, etc. You can already play several free mini-games that don’t require an NFT – or buy one of the 10,101 drunk robots and join a battle in the PvP arena.

The IDO will take place on three launchpads: Liquidifty, TrustPad, and GameFi. The IDO price is $0.01; $METAL will be listed on Gate.io and PancakeSwap soon after.

Aptos (IDO date TBA)

Meta (formerly Facebook) spent two years working on a massive blockchain project – first called Libra, then Diem. Finally it sold off all Diem assets, because the regulatory pressure was just too much. However, part of the Diem team decided to build their own L1 blockchain using the architecture developed for Diem: the Move programming language and the Move VM (virtual machine).

The new chain, Aptos, is positioned as the safest and most scalable in the blockchain space, and it’s one of the most anticipated L1 projects – definitely something to keep on your radar.

Hashflow ($HFT, April 2022)

Hashflow connects traders directly to market makers to enable more efficient decentralized trading. The protocol should ensure low spreads and solve the perennial problem of bots – algorithms that exploit the transparency of blockchain to front-run users’ trading orders. Hashflow starts with regular spot trading and plans to progress to futures and other derivatives – something that is still rare in the DEX market.

The protocol is already live on Avalanche and Arbitrum and enjoys the backing of Alameda Research, BlockTower Capital, Dragonfly Capital, and several more funds.

The sheer number of IDOs on the calendar can seem overwhelming. However, if you follow a clear due diligence and selection procedure, you can narrow them down to a small pool of projects that have a good chance to succeed. Remember that IDOs aren’t a get-rich-quick scheme – and, just like everywhere in crypto, patience and good research really pay off.