Polymarket is a decentralized platform that allows users to wager on a wide variety of events, including sports, entertainment, cryptocurrency prices, and political election results.

In this article, we’ll break down how the platform operates, and how Polymarket makes money. We will also provide a step-by-step guide to placing bets on the platform and take a closer look at whether the platform is legitimate and trustworthy.

Key highlights:

- Polymarket is a decentralized platform that leverages blockchain technology for betting on a wide range of events.

- Users can trade shares of their predictions, with prices fluctuating according to market demand, enabling bettors to profit even before the event concludes.

- Currently, Polymarket doesn’t charge platform fees, but this is likely going to change in the near future.

- The platform is legitimate, but you should avoid events with poorly defined outcomes.

How does Polymarket work?

Polymarket users can browse numerous prediction markets and buy shares representing their predictions. If you think a particular outcome will happen, you buy shares for that outcome (named “Yes”).

If you think the event won’t happen, you buy shares for the opposing outcome (named “No”). Markets can be simple with a binary outcome (Yes/No, for example: “What price will Bitcoin hit in 2026?”) or more than just two possible outcomes (the classic example being “Who will win the 2028 U.S. Presidential Election?” as there are more than two possible outcomes).

Needless to say, you can buy as many shares (or a combination of shares) as you want, including portions of shares.

Currently, more than $730 million worth of bets have been placed on the winner of the 2024 U.S. presidential election. The outcomes are sorted based on the chance assigned to each outcome by the market.

After the event occurs, the outcome is verified by trusted oracles, which are services or entities that provide accurate information to the blockchain. Once the market is resolved, users holding shares of the correct outcome will receive payouts proportional to the number of shares they hold ($1 per share). Those who hold incorrect shares will lose their investment in that market as shares of the wrong outcome become worth $0.

It is worth noting that the prices of shares fluctuate based on the demand for each outcome. If more people believe an outcome is likely, the price of shares for that outcome will rise. This creates a dynamic market where users can trade shares, potentially making profits before the event is even resolved – similar to selling your betting position to the bookie before a sports event is finished.

Users can propose new markets on specific questions on their own, such as “Will [Team X] win the Superbowl 2025?” or “Will the price of Bitcoin exceed $70,000 by a certain date?” These markets are then created using smart contracts on the blockchain, which ensures transparency and fairness.

A step-by-step guide to using Polymarket

Now, let’s take a practical example at how you can place a bet on Polymarket.

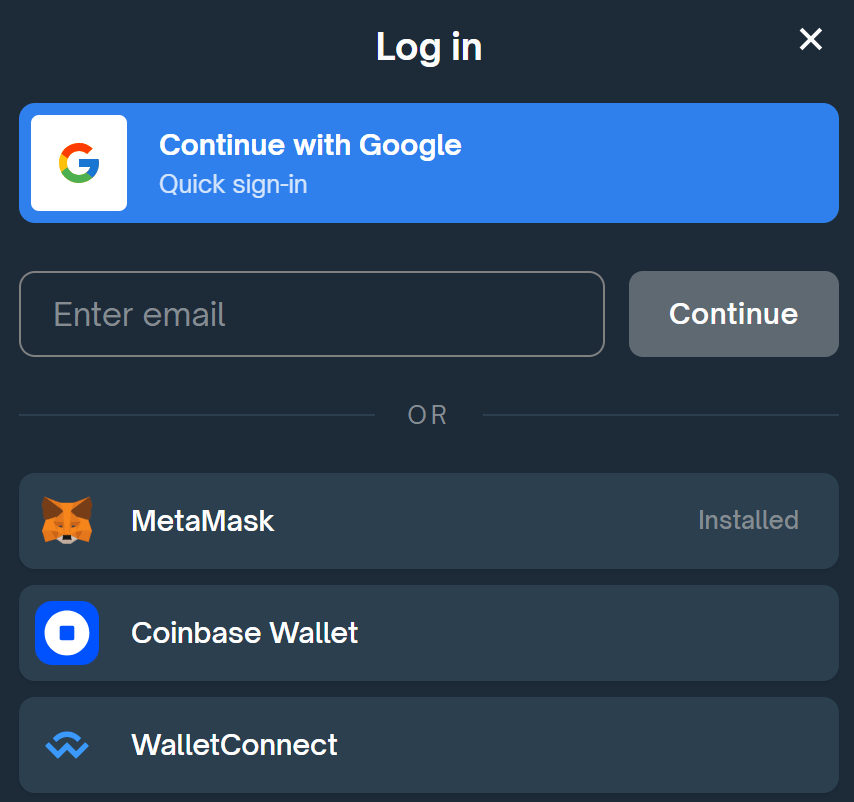

1. Sign-up to Polymarket

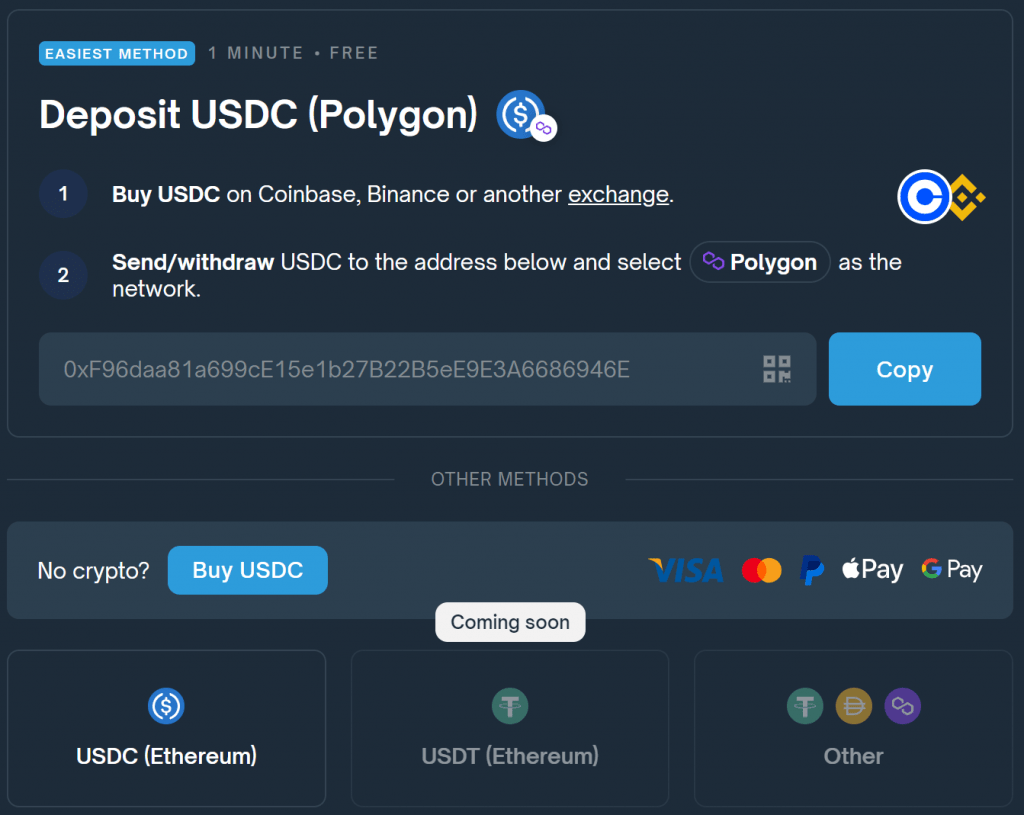

To place a bet, users need to have funds in the form of the USDC (USD Coin) stablecoin. Users can either register with an e-mail and then deposit crypto/buy the stablecoin using a credit card or interacting with Polymarket directly with the use of an already topped-up cryptocurrency wallet (currently supported wallets include Metamask, Coinbase, and WalletConnect).

2. Top-up your account

While buying USDC with a credit card directly on Polymarket is the simplest option, it is also the most expensive, because a fee will be charged by Moonpay, which operates the Polymarket’s integrated on-ramp. We therefore recommend depositing USDC from a cryptocurrency wallet (make sure you make the transaction through the Polygon network!) or even better, interact with Polymarket directly through a cryptocurrency wallet.

3. Pick a prediction market

Proceed to pick the event you want to bet on and decide on your prediction. Polymarket categorizes its events into “Politics”, “Crypto”, “Pop Culture”, “Sports”, “Business”, and “Science”. As you open and bet on events, Polymarket will also create a curated personalized category called “For You”.

Sell outcome shares and wait for the event to resolve

When you own the shares for an outcome, it is up to you whether you want to sell them before the event itself or wait for the event to resolve.

How does Polymarket make money?

As of now, Polymarket does not charge any platform fees. However, users will still incur a small transaction fee for each trade due to blockchain validators requiring payment for transaction processing. The company is currently supported by venture capital funding and potentially through liquidity provision and market-making services. It is likely that Polymarket will introduce fees in the future to generate revenue.

“We’re focused on growing the marketplace right now and providing the best user experience. Monetization will come later,” Polymarket Founder Shayne Coplan disclosed in a recent interview with Forbes.

Is Polymarket legit?

Yes, Polymarket is a legitimate business. The platform has been offering its services to bettors since 2020, and the team of developers stands behind their product with their real identity and reputation. Furthermore, Polymarket is built on a decentralized blockchain, and the entire process is governed by smart contracts. This ensures that the platform operates transparently and without the need for a central authority.

While Polymarket aims to comply with regulations, it does operate in the decentralized finance (DeFi) space, which is often subjected to regulatory crackdowns. Therefore, it is no surprise that Polymarket does not hold a spotless record either. The firm was involved in a massive controversy and was fined $1.4 million by the U.S. Commodity Futures Trading Commission (CFTC).

The CFTC alleged that Polymarket was offering event-based binary options contracts without proper registration as a designated contract market (DCM) or swap execution facility (SEF). As part of the settlement, Polymarket agreed to cease providing its services to customers in the U.S.

What to watch out for when using Polymarket?

While Polymarket is a credible platform, the quality of its markets can vary significantly. There have been several heated debates and fierce disputes over what is the truly correct outcome of an event. This usually happens with events, which have poorly defined outcomes.

To avoid disputes over the validity of outcomes, it is advised to only participate in markets with clearly outlined criteria for determining outcomes. It is also always advisable to practice good password hygiene and avoid holding large amounts of crypto in online custodial wallets.

The bottom line

Polymarket leverages the power of blockchain technology to create a transparent, user-driven prediction market where anyone can participate and potentially profit from their insights on real-world events. While the platform is legitimate, it has faced regulatory challenges like many other cryptocurrency platforms. To minimize issues, focus on markets with clearly defined outcomes and ensure good security practices.