Having access to additional capital is essential to the way modern society works – realizing business ideas, buying a car or a house, or the realization of a myriad of other life goals hinges on the possibility of obtaining a loan.

Despite their importance, loans are typically difficult to get, requiring a substantial amount of paperwork and a good credit score. Also, financial institutions that deal with loans often give different repayment deals to different borrowers, depending on their employment situation and other criteria.

Cryptocurrency loans are different in that regard – they can be taken out by anybody under the same set of conditions, as long as they are able to supply a sufficient amount of digital assets as collateral. As such, cryptocurrency companies that offer crypto loans don’t abide by (sometimes) discriminative credit score practices or play favorites with their customers.

In addition to overseeing one of the more popular blockchain ecosystems and the largest digital asset exchange, Binance also allows its users to secure additional liquidity by taking advantage of crypto loans. In this article, we will be taking a closer look at the main benefits of Binance Loans and how the service might be beneficial to you.

How does Binance Loans work?

The premise behind the Binance Loans service is very straightforward – a user can supply its physical digital assets as collateral to take out a certain amount of crypto through a loan that has to be repaid in due time. In exchange for the service, Binance charges interest on borrowed funds on a daily basis.

How much crypto can I borrow?

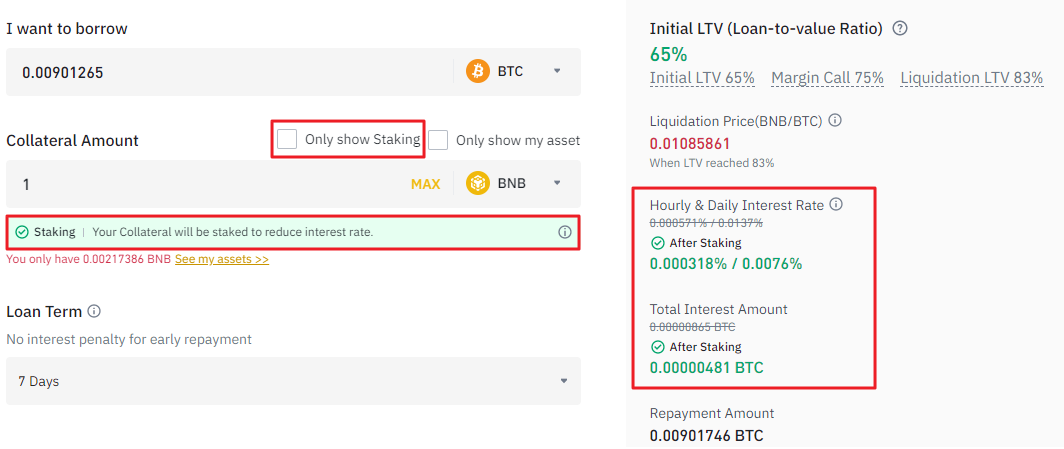

As a rule of thumb, Binance enables users to borrow crypto at an Initial Loan to Value (LTV) ratio of roughly 65%. This means that supplying $100 worth of crypto as collateral would allow you to take out a loan worth $65.

The maximum loan amount varies depending on the asset you wish to borrow and Binacne’s available loanable assets. For reference, at the time of writing the article, the maximum amount of Bitcoin that could be borrowed was 103 BTC (worth ~$2.2 million at current market rates). The maximum amount of Tether one could borrow was 800,000 USDT.

Which cryptocurrencies are supported?

With Binance Loans, users can borrow more than 60 different cryptocurrencies and supply more than 20 types of digital assets as collateral. The list of supported digital currencies includes:

What are the advantages of Binance Loans?

Now that we’ve briefly touched upon some of the basic mechanics of how Binance Loans works, let’s move on to examine the service’s main benefits.

Flexible terms

Binance’s loan service is mostly geared toward users that need short- to near-term loans. In total, there are five different loan terms users can choose from – 7, 14, 30, 90, and 180 days. However, users can choose to repay borrowed amount ahead of time. Keep in mind that missing the loan deadline can result in a loan liquidation and confiscation of collateral.

Early repayment without penalty

Binance has a very relaxed policy regarding early repayments. Whereas some lenders are adamant that loans are paid back according to the initial agreements (in pursuit of more interests), Binance allows users to pay off their debt before the loan term expires. This allows users to easily manage their open positions and potentially save on interest payments.

Use funds anywhere

One of the important benefits of borrowing crypto via Binance Loans is the ability to use borrowed crypto with no strings attached – apart from having to pay off the loan in due time, of course. Crypto that is loaned by Binance can be used on any of the exchange’s products, like staking via the Binance Staking service, trading on Futures and Spot marketplaces, or participating in Launchpad and Launchpool projects, among other things. Moreover, users are free to withdraw assets from the Binance platform to personal wallets or various decentralized finance (DeFi) protocols.

Loans staking

Binance uses the innovative approach called Loans Staking to offset the interest on borrowed funds. It manages to achieve that by using crypto supplied as collateral to support the operation of underlying blockchain networks. This means that BNB (supplied by borrowers as collateral), for instance, is used to secure the Proof-of-Stake (PoS) blockchain and generate rewards distributed to stakers. Said rewards are then used to cover some of the interest rate costs.

You can choose to filter coins and tokens that support the Loans Staking feature by ticking the box next to “Only show Staking”. Each asset that supports the feature has a green box explaining the feature. In the right-side panel, you can see how much can be saved by using BNB (or any of the supported collateral assets) as collateral with the Loans Staking feature activated.

Wrapping up

Thanks to a broad range of supported digital assets, repayment flexibility, and innovative features such as Loans Staking, Binance Loans has become one of the leading solutions for users looking to borrow crypto in the blockchain space. If you would like to give Binance Loans a try, please proceed by clicking on the button below.