During another week of bear market, the cryptocurrency market capitalization dipped below $1 trillion for the first time since the end of July. After a minuscule recovery, the combined market capitalization of all cryptocurrencies is slowly reaching back the $1.00 trillion milestone as we enter Week 35. Both BTC and ETH have incurred weekly losses of around 5%, causing two of the biggest cryptocurrencies to change hands at prices of $20,000 and $1,500 respectively – both of which are very near the coins’ two-year low valuation. Will we see trend reversal this week or will the market cap dive even deeper in the sub $1 trillion levels?

3. Polygon (MATIC)

Polygon, previously known as Matic Network, is a leading Ethereum Layer 2 scaling solution. The Polygon Layer 2 network consists of several simultaneously run proof-of-stake sidechains that regularly push the data to Ethereum to create network checkpoints. Currently, there two bridges that allow users to move assets between Ethereum and Polygon, the first one being the Plasma bridge and the second one the PoS Bridge. The Plasma bridge delivers supersonic speeds and throughput and allows for an easy and fast exit to Ethereum mainnet at the same time. Together with several other features and tweaks, Polygon provides a major scalability improvement to the biggest smart contract blockchain. By successfully overcoming Ethereum’s most limiting shortcomings Polygon has become attractive for DeFi projects and is establishing itself as one of the key DeFi networks.

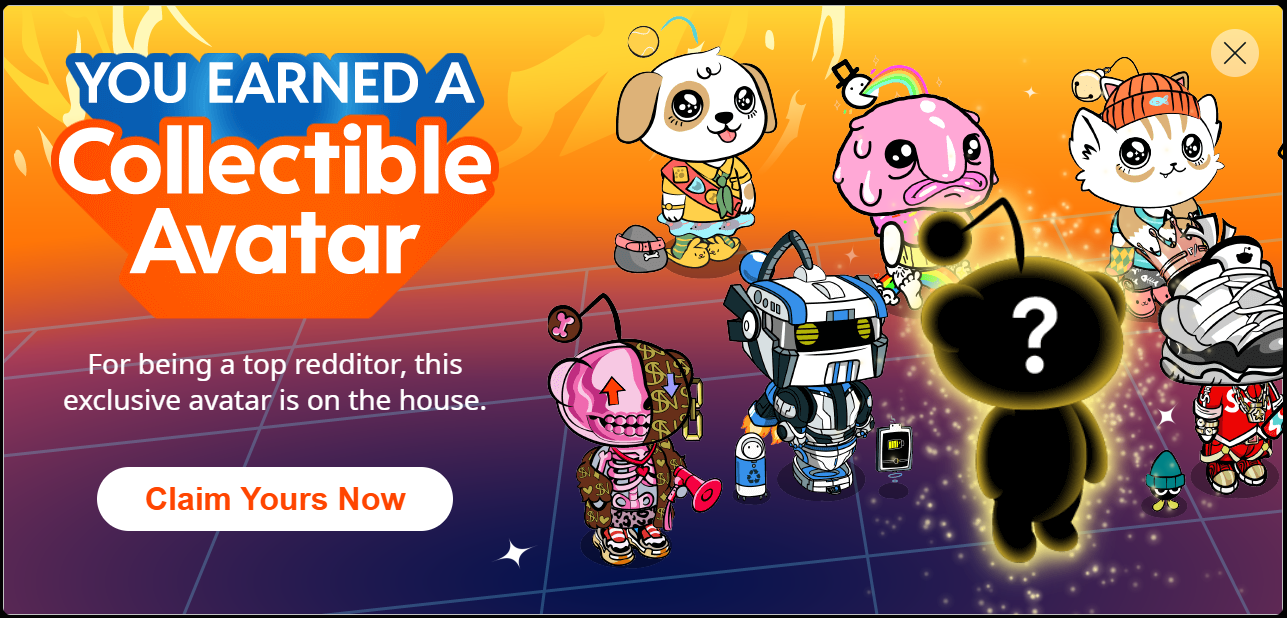

Reddit is airdropping free Collectible Avatars – Polygon-based NFTs – to its most active users

We have reported last month about Reddit’s launch of a new feature that lets users create and trade unique profile pictures called ‘Collectible Avatars’. Although the popular social platform completely avoided using the NFT terminology, the cartoon-inspired avatars are essentially exactly that – non-fungible tokens (NFTs) issued on the Polygon blockchain. Reddit sells Collectible Avatars through the site’s own marketplace at fixed prices ranging from $9.99 to $100. Recently a Reddit moderator announced that the platform will start air-dropping Collectible Avatars to its top community builders. Users who have collected enough karma will be able to choose between four avatar styles called ‘Aww Friends’, ‘Drip Squad’, ‘Meme Team’ and ‘The Singularity’.

Although Polygon blockchain works almost entirely in the background when it comes to Reddit’s Collectible Avatars such implementations still have the potential to introduce blockchain to the mainstream. In addition, Reddit revealed plans to implement more blockchain-based functionalities in the future, which could further benefit Polygon as they are apparently the platform’s blockchain of choice. Furthermore, Reddit is not the only big player that has partnered with Polygon. Other international companies that are involved with Polygon include Disney and Coca-Cola, making it likely for some interesting Polygon use cases to arise from these partnerships as well.

2. Chiliz (CHZ)

Chiliz is a blockchain based project aimed to cater the needs of sports and entertainment platforms. The goal of the project is to give sports fans a completely different experience of interaction with their favourite players, clubs, or leagues. The project’s own sports fan engagement platform called “Socios” for example monetizes the fans’ engagement with their favourite clubs through blockchain technology. CHZ is an ERC-20 token with utility within Chiliz and Socios platforms. In addition, the token has good liquidity and can be traded via some of the major exchanges. In addition, the project also operates its own Chiliz blockchain, where CHZ tokens are used as the currency. The project enjoys the support of several Italian Serie A teams, major football teams in Spain, and even the UFC.

The CHZ 2.0 announcement sparked activity among CHZ whales

Chiliz CEO has recently announced that the project plans launch of its own native chain (CHZ 2.0), which will see Chiliz transition from the Ethereum chain to the project’s own blockchain among other improvements. The announcement has apparently sparked considerable activity among CHZ whales as there were more than 100 CHZ transactions worth more than $100,000 conducted through the Ethereum network on August 23. Crypto analytics firm Santiment notes that this is the largest number of such transactions since March 29. At the same time market data showed increased trading activity, indicating that rich investors are accumulating CHZ. The extensive buy pressure sparked by the CHZ 2.0 announcement was identified as one of the key factors contributing to CHZ’s recent price action which defies the bearish sentiment that is currently engulfing almost all other crypto markets. To better illustrate the situation, while all other coins are in the red, CHZ is up by almost 20% in the past 7 days. In addition, Chiliz has been one of the biggest gainers in the past month as its token has almost doubled its price in that time. In addition to fundamental developments around CHZ 2.0, the technical analysis also favours CHZ appreciation. Looking at a daily price chart for CHZ/USD for the past 6 months we can see a formation of a nice cup and handle pattern. Recently, CHZ has been closing above the pattern’s neckline range, which is considered a potential bullish reversal setup.

1. Uniswap (UNI)

UNI is the governance token of the automated market maker (AMM) protocol Uniswap. UNI tokens are ERC-20 tokens that allow holders to decide on the future of Uniswap by voting on proposals. Uniswap – the platform, which facilitates quick swaps between various Ethereum-based tokens, has recently been struggling to keep its users and market share because of high fees on Ethereum. In March this year the project released Uniswap V3, a new and improved version of the AMM protocol on Ethereum mainnet. In July 2021 Uniswap tried to reduce the costs of trades by launching on two Ethereum Layer 2 networks: Optimistic Ethereum and Arbitrum. In its 3 years of existence, Uniswap has pioneered several DeFi functionalities and supported more than $1T in cumulative volume.

Uniswap governance community founds the Uniswap Foundation

Uniswap, the largest decentralized exchange (DEX) in terms of trading volume, will be governed by a new Uniswap Foundation, which will enhance governance and optimize how grants are distributed.

The creation of Uniswap Foundation follows the competition of a Uniswap governance vote that ended on August 24. The proposal to create a new organization that will overssee the decentralized growth and sustainability of the Uniswap Protocol was met with almost unanimous support from the community, as only 770 UNI signalled to oppose the proposal. The proposal also predicts $74 million in UNI to be allocated to newly created Uniswap Foundation. While this sounds like big money, it should be noted that $60 million will be used to fund the Uniswap Grants Program, which leaves the team with only $14 million of operating budget. In addition, Uniswap is also preparing to expand its presence in the digital collectibles market by becoming an “interface for all NFT liquidity”. According to Uniswap’s NFT product lead liquidity fragmentation and information asymmetry are big and yet unaddressed problems in the NFT sphere. Luckily, Uniswap has been holding talks with 7 top NFT lending protocols to solve these issues, he wrote on Twitter.