We’re constantly seeking ways to stay ahead in the decentralized finance world. One key to success lies in leveraging top-notch DEX screener tools. Platforms like DEX Screener, DexTools, and DexGuru are indispensable for traders and investors, as they offer real-time data and in-depth market insights across multiple decentralized exchanges.

They feature (relatively) user-friendly interfaces and extensive coverage of various blockchain networks. Thankfully, there are plenty of tools available that make it easy to understand what’s happening in DeFi and quickly identify what’s worth paying attention to. This article will take a look at the top 11 DEX screener tools as of 2024.

List of Top 11 DEX Screener Tools in 2024

- DEX Screener: One of the best tools for analyzing decentralized exchanges

- DexTools: A DEX analytics platform similar to DEX Screener

- DexGuru: A comprehensive DEX aggregator and analytics platform

- DeFiLlama: A comprehensive overview of the DeFi ecosystem

- DexCheck: A rock-solid DEX Screener alternative

- Uniswap Info: Analytics for the Uniswap protocol

- Parsec.finance: Professional-grade DeFi data platform

- Defined.fi: Find trending tokens and NFTs

- CoinBrain: Price action “alarm” platform

- Poocoin.app: Follow token price on Binance Chain DEXes

- DappRadar: Support for over 1,500 dApps

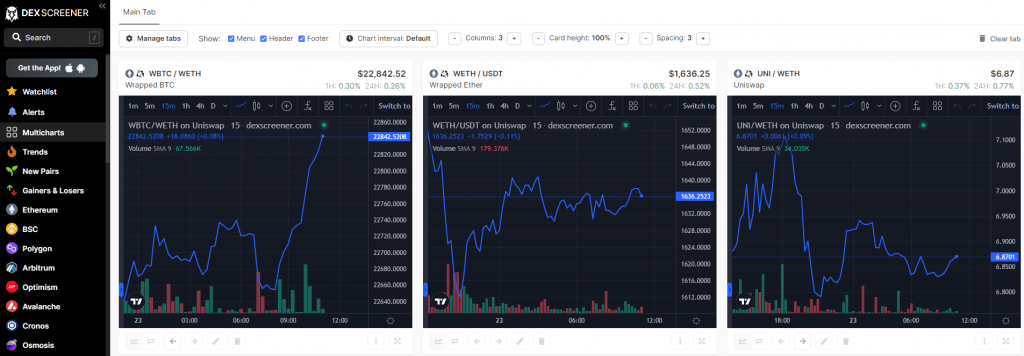

1. DEX Screener: One of the best tools for analyzing decentralized exchanges

Our exploration of decentralized exchange analysis begins with the foundational tool known as DEX Screener. This comprehensive platform empowers users to track and analyze real-time data from multiple decentralized exchanges (DEXs) and chains, providing a broad overview of the cryptocurrency market.

DEX Screener tools offer essential features such as real-time market data on token prices, trading volumes, and liquidity across various assets.

With advanced filtering options, users can analyze price changes, trading volume, and market volatility. This allows you to set alerts for specific price levels or significant volume changes, facilitating proactive trading strategies.

By consolidating data from multiple sources, DEX Screener saves time and increases accessibility for traders and investors. It also serves as a valuable educational resource for beginner investors, as it helps them understand market dynamics and develop effective investment strategies.

You can filter the data to specific blockchains and decentralized exchanges. Then, you can get even more specific and sort DEX trading pairs by the number of transactions, 24-hour trading volume, liquidity and more.

For example, if we want to know what’s currently the most active trading pair on the Uniswap protocol’s deployment on the Polygon blockchain, we can easily do so with DEX Screener.

Utilizing DEX Screener tools, we can gain a deeper understanding of market trends and dynamics, which ultimately leads to more effective trading.

DEX Screener’s comprehensive coverage and user-friendly interface make it a valuable tool for both experienced and novice traders.

The main downside of DEX Screener is that it’s limited to decentralized exchanges, and doesn’t show information about other kinds of DeFi protocols like Maker or Compound.

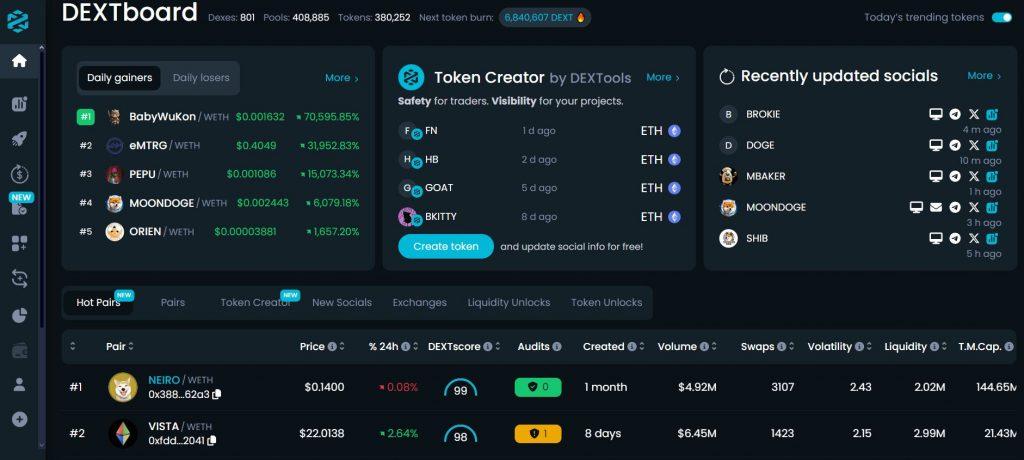

2. DexTools: A DEX analytics platform similar to DEX Screener

DexTools is a powerhouse analytics platform. By providing real-time insights into multiple decentralized exchanges across various blockchain networks, DexTools equips traders with the ability to quickly know what’s going on in the DeFi world.

Key features of DexTools include:

- Multi-Blockchain Support: DexTools supports over 90 blockchain networks, allowing users to track asset performance across different ecosystems seamlessly.

- Advanced Charting Tools: The platform offers advanced charting tools powered by TradingView, including indicators, multiple charting styles, and timeframes, to enhance technical analysis.

- Real-Time Data: DexTools provides real-time information on tokens, including trading volumes, liquidity, and price movements, to inform trading decisions.

- Comprehensive Token Insights: The platform offers detailed smart contract information, market trends, and popular trading pairs to enhance market understanding.

Dextools.io can also be used to find the newest tokens listed on decentralized exchanges, allowing users to potentially identify new opportunities. A good feature of Dextools.io is that it also provides information about smart contracts, including warnings about potentially suspicious smart contracts.

The functionality of Dextools.io has quite a bit of overlap with DEX Screener. The choice of which to use will simply come down to which platform you find the most comfortable to use.

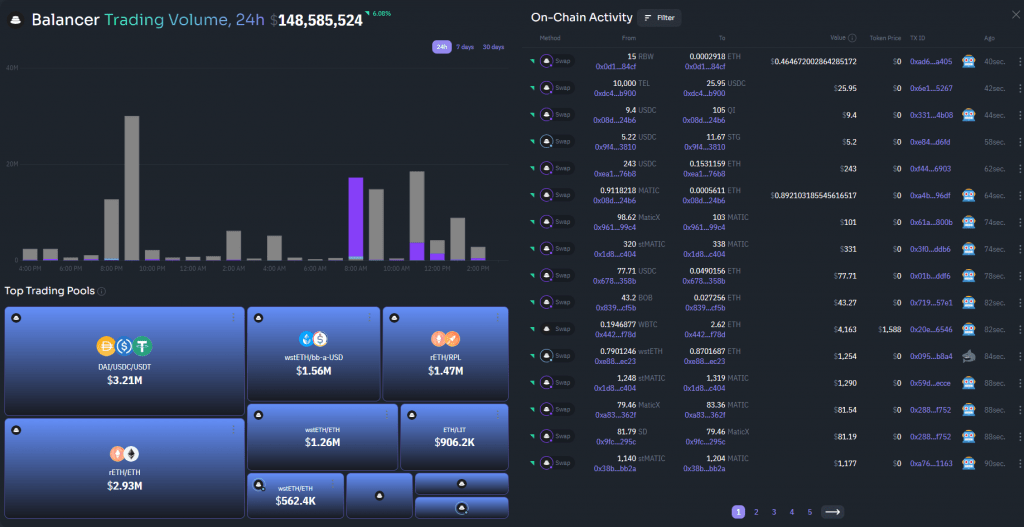

3. DexGuru: A comprehensive DEX aggregator and analytics platform

DexGuru is a powerful platform that combines DEX aggregation and analytics capabilities. It gives us deep insights into trading volumes and market trends across various decentralized exchanges.

It provides real-time data on trading pairs and market activity. Its advanced filtering options allow us to analyze tokens based on criteria such as liquidity, trading volume, and market cap. This makes it a lot easier to quickly spot new and potentially lucrative opportunities.

With DexGuru, we can access detailed information on individual tokens, including price changes, historical performance, and liquidity metrics.

The user interface of Dex.guru is filled to the brim with information, so the platform might not be the best choice for DeFi beginners. However, if you’re already well-versed in the world of decentralized finance, you’ll likely be able to get a lot of value from Dex.guru.

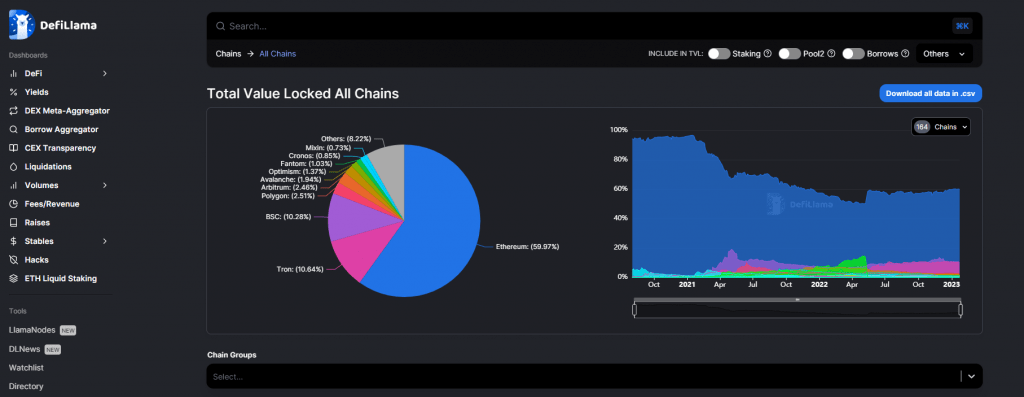

4. DeFiLlama: A comprehensive overview of the DeFi ecosystem

DeFiLlama is one of the best services if you need a comprehensive overview of the decentralized finance landscape. It’s a leading data aggregator and analytics platform in the DeFi ecosystem, providing unparalleled insights into the total value locked (TVL) across multiple blockchain networks and DeFi protocols.

This comprehensive platform aggregates data from numerous decentralized exchanges and protocols, making it a valuable resource for investors and analysts looking to evaluate market trends and investment opportunities.

Key features of DeFiLlama include:

- Multi-chain support: Aggregating data from over 242 layer 1 and layer 2 chains.

- Real-time updates: Providing historical and current data on TVL changes over time.

- Detailed analytics: Offering project-specific dashboards with information on liquidity pools, yield farming activities, and other financial instruments.

- Transparent methodology: Ensuring the accuracy and reliability of the data presented.

As a decentralized exchange aggregator, DeFiLlama’s analytics provides critical insights into the health and growth of the DeFi ecosystem. Its intuitive interface allows you to filter and sort data based on specific criteria.

With that said, the platform doesn’t provide detailed info about specific trading pairs on decentralized exchanges. If that’s what you need, consider using a tool like DEX Screener.

5. DexCheck: A rock-solid DEX Screener alternative

DexCheck is a platform designed to offer a comprehensive insight into DEXes and blockchain-based crypto transactions. It allows traders to monitor market activity effectively, and it gives real time data.

A key feature of the platform is its crypto whale tracker. This tool enables users to analyze transactions made by large crypto holders, often referred to as “whales” across various blockchains. It also provides data on the cryptocurrencies that these whales frequently purchase and sell.

DexCheck’s analytics on trading pairs enable users to identify popular tokens and assess market trends efficiently. Detailed analytical features, including transaction histories and price charts, are also accessible.

Also, DexCheck makes it possible to monitor the most successful traders active on decentralized exchanges. These traders are assessed based on their realized and unrealized profits. This functionality can be valuable for identifying addresses that are worth monitoring.

The platform’s user-friendly interface is helpful for beginners to navigate market data easily.

With its powerful analytics capabilities, DexCheck has a lot to offer.

While many of DexCheck’s services are accessible free of charge, certain advanced features are exclusively available to “Pro” members. Access to these features can be obtained by holding the platform’s native DCK token.

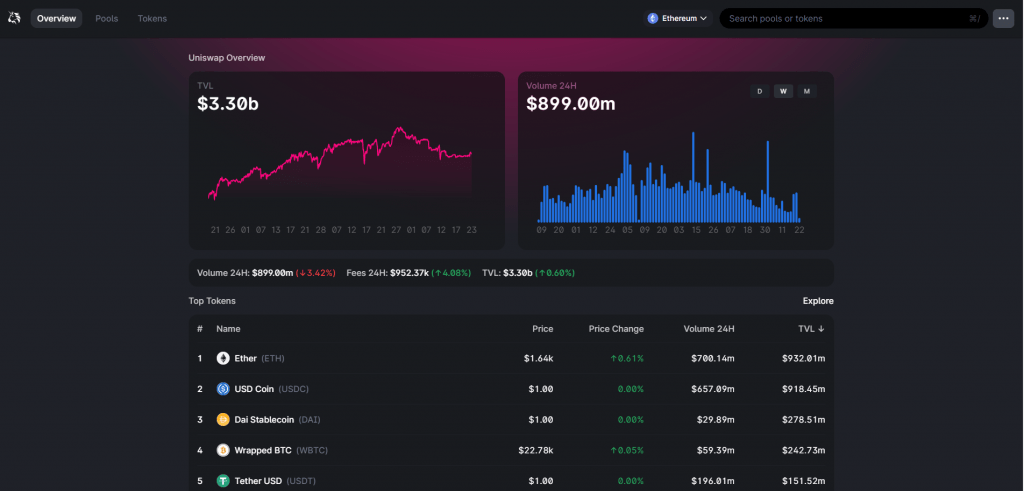

6. Uniswap Info: Analytics for the Uniswap protocol

For all people who have only ever used one DEX in their life, that DEX has most likely been Uniswap.

If that’s you, then you would probably benefit from using Uniswap Info (or Uniswap Explore), a specialized analytics platform designed to provide users with in-depth insights into the Uniswap protocol (which has a native token, UNI).

Uniswap Info offers a comprehensive suite of tools that help traders and investors monitor trading activities, track market trends, and make informed decisions.

Key features of Uniswap Info include:

- Detailed Trading Pair Analytics: Users can access real-time data on trading pairs, including trading volumes and liquidity metrics.

- Liquidity Pool Insights: The platform provides detailed statistics on liquidity pools, including total liquidity, fees generated, and historical performance.

- Token Performance Tracking: Users can monitor the performance of individual tokens on Uniswap, gaining insights into market dynamics and investor interest.

- Customizable Data Views: Uniswap Info features an intuitive interface that allows users to easily access and customize data views to meet their specific needs.

The main downside of Uniswap Info is that it is limited to only the Uniswap protocol, so you’re out of luck if you’re using any Uniswap alternatives. Also, its price charting functionality is very limited – it will suffice for a quick look at the price, but don’t expect any detailed technical analysis tools.

7. Parsec.finance: Professional-grade DeFi data platform

Parsec.finance offers professional-grade on-chain analytics tailored for DeFi enthusiasts. It provides users with deep insights into market dynamics and token performance.

One of the standout features of Parsec.finance is its customizable interface, which allows us to tailor our experience according to specific trading strategies and preferences.

We can access real-time data updates to facilitate informed trading decisions and enhance our responsiveness to market changes.

Advanced analytics tools are available for comprehensive data analysis, enhancing our ability to track market trends and historical performance. This includes on-chain lending positions, AMM liquidity depth, NFT price history, and token flows, among other important data points.

You can get quite a bit of value out of Parsec.finance’s free plan, but more advanced users might want to subscribe to one of the platform’s paid plans, which unlock access to advanced features. Parsec.finance’s paid plans start at $60 per month, and its most feature-packed “Team” plan costs $500 per month.

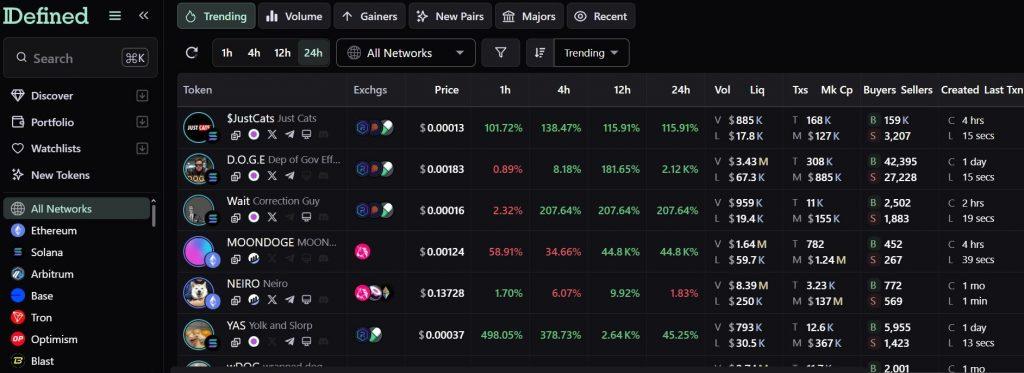

8. Defined.fi: Find trending tokens and NFTs

Defined.fi is an intuitive platform for tracking tokens on more than 40 different blockchain networks.

Defined.fi stands out as a comprehensive platform in the DeFi space, offering a wide array of tools for users to navigate the complex decentralized exchange landscape. By tracking tokens across 40+ blockchain networks, Defined.fi provides a rich source of data that helps in discovering trending and new tokens in the DeFi space.

Key features of Defined.fi include:

- Comprehensive Data: Provides detailed transaction histories and price charts, enabling users to analyze market movements effectively.

- Token Performance Insights: Offers insights into token performance, helping users make informed investment decisions based on historical data.

- User-Friendly Interface: Catering to both novice and experienced investors, Defined.fi enhances the overall user experience in DeFi exploration.

- Aggregated Data: Simplifies the process of monitoring diverse assets within the decentralized finance ecosystem by aggregating data from multiple networks.

- NFTs Coverage: The platform provides a ranking of trending NFTs across various blockchain networks. You can sort NFT collections by trading volume, number of trades, price floor appreciation and more.

These features make Defined.fi a great tool for anyone looking to dive deeper into decentralized exchanges and their associated assets.

9. CoinBrain: Price action “alarm” platform

We utilize CoinBrain to obtain real-time data and insights on various trading pairs across multiple decentralized exchanges. This tool allows us to filter and analyze tokens based on metrics such as liquidity, volume, and price changes, enhancing our trading strategies.

CoinBrain supports a wide range of blockchains, facilitating a comprehensive overview of the DeFi ecosystem. Its user-friendly interface caters to both novice and experienced traders, so it’s a very accessible platform to use.

Key features include customizable watchlists and price alerts, so you can track specific tokens and respond swiftly to market movements in decentralized trading.

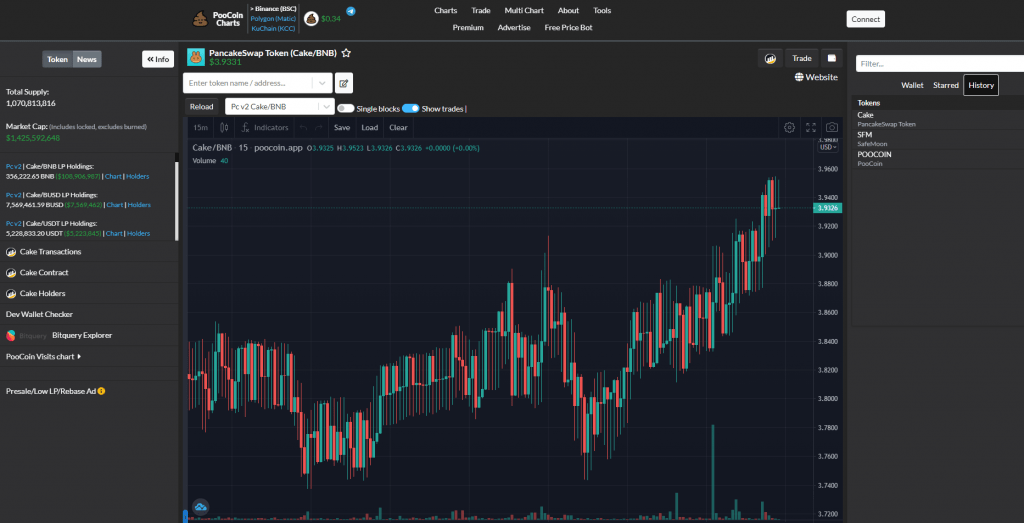

10. Poocoin.app: Follow token price on Binance Chain DEXes

Poocoin.app is a simple platform geared towards Binance Chain users. You can use it to view price charts for tokens sourced from various decentralized exchanges on the Binance Chain blockchain.

If you want more convenience, you can also connect your Binance Chain wallet to Poocoin, and the platform will automatically display price charts for the tokens you hold in your wallet.

The platform features price charts powered by TradingView, which gives you access to technical indicators such as moving averages and RSI.

Poocoin.app is not as feature-packed as the other tools we’ve highlighted in our list. However, if you’re a Binance Chain users and you’re just looking to quickly check the price movements of your tokens, the platform is worth having a look at.

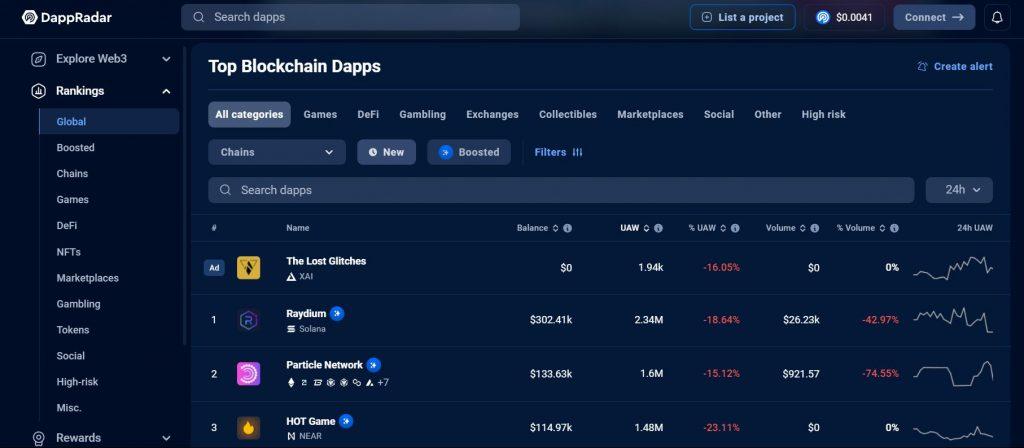

11. DappRadar: Support for over 1,500 dApps

DappRadar is a comprehensive platform that provides analytics and insights into decentralized applications (dApps) across multiple blockchains, which allows users to track performance, user activity, and transaction volumes.

This platform supports over 1,500 dApps and offers real-time data on various categories such as DeFi, NFT, and gaming. It’s a valuable resource for investors and developers alike.

Key features of DappRadar include:

- Extensive dApp Coverage: Supports over 1,500 dApps with real-time data.

- Customizable Dashboards: Enables users to filter data based on specific criteria and visualize trends effectively.

- Multi-Blockchain Data: Aggregates data from numerous blockchain networks for broad coverage.

- DeFi Insights: Provides insights into token sales, market capitalization, and liquidity metrics.

It’s a powerful tool for anyone looking to dive deeper into DeFi analytics and understand the dynamics of various decentralized exchanges.

The bottom line

We’ve explored the top DEX screener tools that provide real-time data and comprehensive market insights across multiple decentralized exchanges. These platforms feature advanced analytics and extensive coverage of blockchain networks.

Traders and investors can use these tools to stay ahead in the decentralized finance world.