In early 2023, the Ordinals protocol was introduced to the Bitcoin blockchain, leading to massive expectations across the community – the world’s leading blockchain had finally broken free of its “digital gold” status and was ready to offer users more utility and capabilities. However, the launch of the innovation has done little to impact the blockchain, only raising debates and arguments on whether it is the holy grail of utility Bitcoin was looking for.

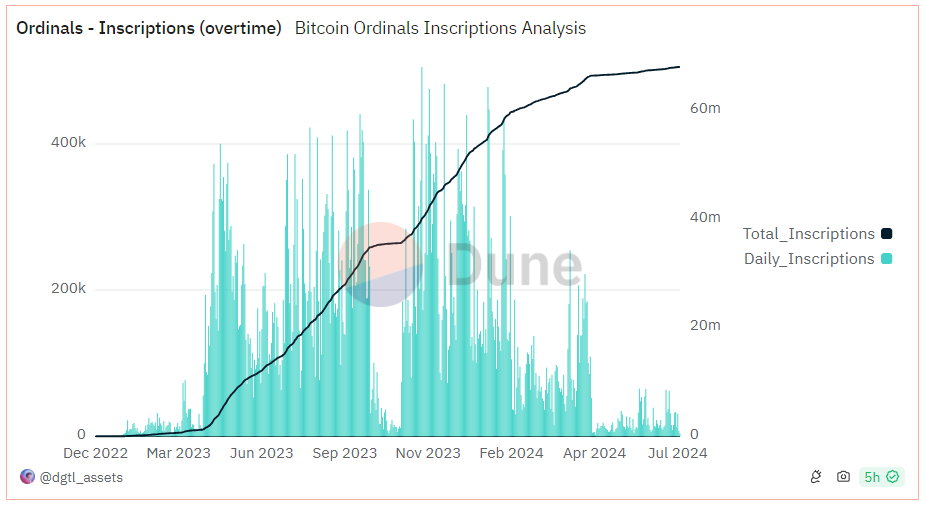

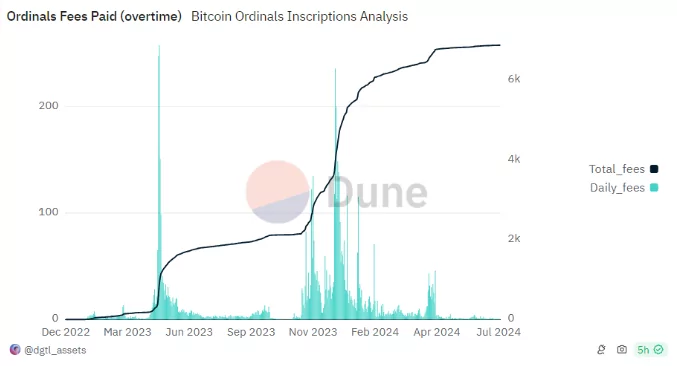

Ordinals were introduced when Bitcoin experienced almost two years of constant low fees due to the reluctance of users to send Bitcoin transactions in favour of other cryptocurrencies. Shortly after the introduction of the protocol, gas fees started skyrocketing as Ordinals drove up huge demand to send Bitcoin transactions.

Image: Dune Analytics

Fast forward to April 2024, in tandem with Bitcoin’s halving, a new product on the blockchain – Bitcoin Runes – was launched, introducing a new method for creating fungible tokens. Runes were expected to enhance the idea brought about by Ordinals, but after a hyped-up surge in user activity in the first few days, the innovation has witnessed dwindling attention and transaction activity.

The decline in user activity on both Ordinals and Runes, despite the initial excitement, was shocking for most in the Bitcoin community. Notwithstanding, the lack of any significant impact by both innovations on the Bitcoin ecosystem has further exacerbated the downfall of these technological ‘advancements’. New applications such as Zeus Network and SoftNote have risen to pick up the ruins, offering users superior capabilities, including ease of use, low transaction fees, security and interoperability – targeting to become the future of the blockchain.

In the sections below, we delve deeper into the challenges that could have caused the fading excitement of the Ordinals protocol and Bitcoin Runes and show applications that offer better utilities and solutions to the Bitcoin ecosystem.

The Inevitable Fall of Ordinals and Bitcoin Runes

Ordinals is a protocol built atop Bitcoin that allows users to embed data into the Bitcoin blockchain. The innovation includes Bitcoin Ordinals (a numbering mechanism for satoshis) that provides uniqueness to each sat and Inscriptions, which allows users to inscribe these numbered sats with arbitrary content. Simply, this would typically work like non-fungible tokens (NFTs), creating Bitcoin-native digital artifacts.

On the other hand, Runes enables the creation of fungible tokens on the Bitcoin blockchains. However, unlike BRC-20 and SRC-20 standard tokens, Runes are not reliant on the Ordinals protocol and are designed to be simpler and more efficient. They utilize established Bitcoin blockchain models, such as the UTXO model and the OP_RETURN opcode.

So where did it all go wrong for the Ordinals and Runes?

- Cost of inscription of data on Bitcoin blockchain

- Bitcoin’s scalability problems

- Lack of interoperability with other blockchains

- Lack of well-established L2 solutions for Bitcoin

Image: Dune Analytics

With the development of new technologies such as SoftNote, which provides users with affordable inscriptions and Zeus Network, offering cross-chain interoperability with Solana, more scalability and cheaper fees, the challenges faced by Ordinals and Runes could be easily solved. By integrating such innovations, Bitcoin can enhance its capabilities, and compete with DeFi-based blockchains in utility for the user.

Solutions to Bitcoin Ordinals’ and Runes’ Failures

As stated above, one of the biggest challenges to the growth and adoption of Ordinals and Runes is the high transaction fees and congestion issues on Bitcoin. This highlights its limitations in handling high liquidity and frequent transactions.

A Transfer To Solana Blockchain?

Luckily, the launch of Zeus Network, a cross-chain interoperable blockchain with Solana could be the solution that Bitcoin needs. The project, launched on Jupiter LFG launchpad, offers solutions that could integrate Runes and Ordinals to enhance scalability while minimizing transaction fees. The platform leverages Solana’s transaction speed and scalability, combined with Bitcoin’s security, trust, and liquidity foundation.

On Zeus Network, developers can build applications and services that connect Solana and Bitcoin. However, Zeus is not a bridge as assets on Bitcoin remain protected on the blockchain while those on Solana remain on Solana. The main advantage of the platform is providing a convergence of the two blockchains, paving the way for developers to build highly scalable, efficient, and reliable DApps.

The platform is composed of two major components – the on-chain Zeus Program Library (ZPL), a set of SVM programs and client SDK and the off-chain Zeus Layer, a peer-to-peer network composed of Zeus Nodes. By leveraging the ZPL platform, assets from Bitcoin can transition into a ZPL-Asset, unlocking access to the vibrant Solana ecosystem.

Amidst the dying hype of Runes, Zeus Network launched zRuneX, communicating the Runes assets to Solana, and offering new possibilities to users. zRuneX aims to reduce congestion on Bitcoin’s blockchain, enhancing user experiences, and reducing the transaction fees and time, enhancing the trading of Runes.

Secondly, the development of zOrdX, a replica of Ordinals but on Solana, leverages the ZPL network to bring Ordinals to Solana. This enables developers to easily trade and transfer Ordinals with the scalability, efficiency and speed that Solana offers.

Moving Large Transactions To Liquid Sidechain

One of the biggest solutions preferred to solve the block space and fee issues of Ordinals and Runes is the Liquid Network. The Liquid Network, Bitcoin’s premier sidechain, provides infrastructure that could prove to be a potential solution to these challenges.

First, the Liquid sidechain could help reduce congestion on the Bitcoin Layer 1 chain by migrating large data transactions from the main chain to the sidechain. This will lead to faster processing times for transactions on Bitcoin as well as reducing overall transaction fees. Secondly, Liquid sidechain offers quick transaction times (less than 1 minute) meaning it can process a large number of transactions at a go, hence reducing overall congestion caused by Runes and Ordinals. Additionally, the Bitcoin main chain could benefit greatly from reduced data payloads associated with Ordinals.

Finally, Liquid can offload a portion of the transactional load from the main Bitcoin blockchain. Huge data associated with Runes and Ordinals could be moved to the sidechain, reducing the mempool for Bitcoin, which could be used for more organic and traditional transactions.

Affordable Inscriptions on SoftNote

Our final solution is SoftNote, a platform that promises to offer affordable inscriptions on Bitcoin Ordinals. The platform offers less than $2 to inscribe data on 1 MB of SoftNode Ordinals, compared to Bitcoin Ordinals costing upwards of $8,000 for the same deal.

Additionally, the inscriptions on SoftNote Ordinals are immutable meaning you can own the inscribed Satoshi infinitely and no one else can overwrite your unique identifier. This makes the process more rewarding for anyone who chooses to invest.

Lastly, the transaction fees for minting a SoftNote Ordinal are almost negligible (~$0.02). This ensures the transactions are more efficient and many people can afford to mint their own Ordinal or Rune. The minting process also reduces the wait time from about 12-60 minutes on the main Bitcoin blockchain to less than a second.

Final Words

In conclusion, the rise and fall of Ordinals and Runes illustrate the challenges that the Bitcoin blockchain and the wider ecosystem face. To properly integrate these innovations on the Bitcoin blockchain, new scalable solutions are needed to solve the issues of scalability, high transaction fees, and interoperability.

New scalable solutions such as Zeus Network, Liquid Sidechain and SoftNote offer promising alternatives by enhancing capabilities, reducing costs, and improving efficiency. These advancements may pave the way for Bitcoin to compete with other blockchain platforms in providing versatile and user-friendly services, ensuring its continued relevance and utility in the evolving digital landscape.