Key takeaways:

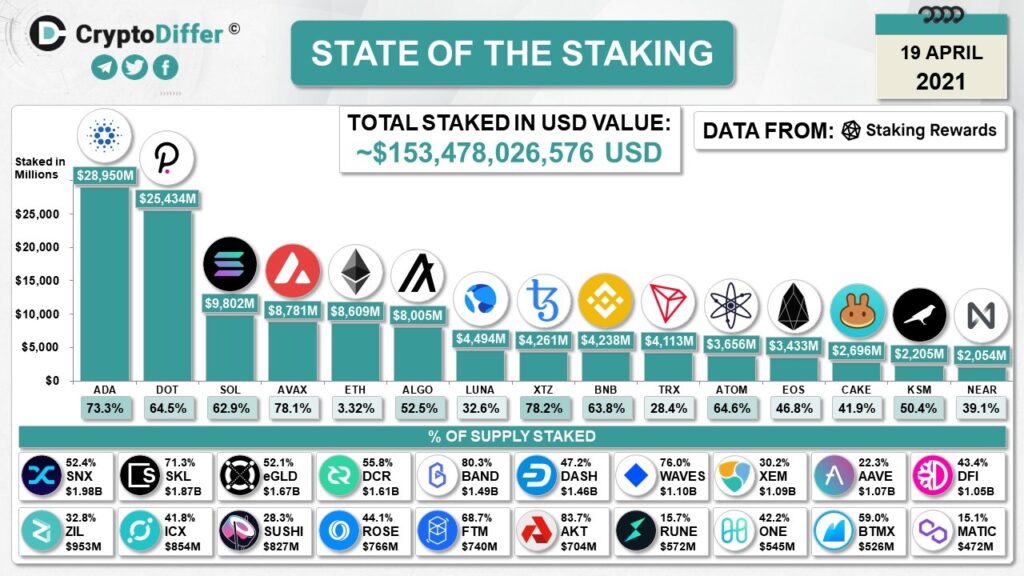

- Cardano is the most staked chain in the industry, with $29.73 billion in staked value, thanks to its active community and price resistance to the negative market trend.

- Since April, Ethereum has risen from 5th to 2nd place among the most staked crypto assets by value, despite ETH staking having severe drawbacks

- As of today, there is more than $146 billion worth of crypto assets locked in staking across different platforms

Cardano, a decentralized network that focuses on building a smart contract-powered decentralized application ecosystem is by far the most staked chain in the crypto sector, establishing a multi-month trend. Being one of the most actively developed cryptocurrency projects, we’ve decided to highlight ADA in our latest Top 3 Coins to Watch weekly section.

ADA has remained resilient despite the market downturn

Comparing today’s figures to that of April, which was a marquee month for the industry as the overall market capitalization was quickly approaching an all-time high and already surpassed $2 trillion, ADA managed to keep its spot as the most staked chain. In fact, since then, ADA added almost a billion USD in staked value on top of $28.95 billion recorded on April 19, according to data from Staking Rewards.

Image source: Staking Rewards

Since April the situation has in some ways been reversed. Polkadot (DOT) has fallen to 4th place, while Ethereum (ETH) has risen all the way to 2nd, despite having severe staking-related limitations, which we will discuss in the next section.

Image source: Staking Rewards

When assessing the total staked value of an asset it is important to keep in mind how big of a factor the price of the token plays in the overall equation. For example, DOT price has fallen from approximately $35 on April 19, to $12.27 at the time of this writing. Consequently, the Polkadot’s staked value took a corresponding hit. ADA, on the flip side, is priced very similarly today, at $1.17, as it was in April, at $1.20.

Ethereum is quickly rising through the ranks and closing the gap with ADA

While Cardano kept its top place among the most staked crypto assets by staked value for several months in a row, Ethereum has been slowly but surely closing the gap.

The biggest barrier of entry to those who wish to participate in Ethereum staking is the very steep 32 ETH minimum requirement. Another very considerable limitation is the undefined staking time period, as users will be able to withdraw ETH only after Phase 2 of the Ethereum 2.0 platform launches.

Various options have emerged, since the introduction of staking to avoid the said limitations, in a form of staking pools and derivative products. This enables users to participate in ETH staking with a much lower amount. In the case of Binance, users can buy specially designed derivative token BETH. Thanks to various solutions, Ethereum’s staked value grows higher by the month and could lead to ETH overtaking ADA in the not-so-distant future.