Can you solo mine crypto and be profitable? The simple answer to this question is that it depends on a couple of factors. One on hand, it is possible to yield significant profits from mining Proof-of-Work (PoW) coins such as BTC and MTR through a personalized setup while at the same time, you could be running a loss-making operation before you even start.

Back when Bitcoin’s blockchain was launched in 2009, miners were able to introduce new blocks (solve complex mathematical equations) using CPUs and GPUs, which meant anyone could mine BTC at the comfort of the workstation computers. However, as more and more miners joined the network over the years, it is no longer as simple to mine BTC.

The reward for mining one Bitcoin block has also halved four times since the debut of the network. Initially, miners were rewarded 50 BTC for every Bitcoin block added to the blockchain; this halved to 25 BTC in 2012, 12.5 BTC in 2016, 6.25 BTC in 2020, and following the most recent halving of April 2024, the reward per block stands at 3.125 BTC.

The Nuances of Bitcoin Mining

At the core, Bitcoin’s blockchain is a decentralized network. Unlike traditional payment rails, it does not require third-party entities for transaction verification. Instead, this work is done by miners who take up the role of verifying transactions and ensuring network security.

The miners are in turn rewarded for their contribution to keeping the Bitcoin network efficient and secure. But at what cost? As mentioned in the introduction, Bitcoin mining requires some form of computational energy, otherwise referred to as hashing power. This determines how fast a given mining device can complete the complex mathematical puzzle for a new Bitcoin block to be added.

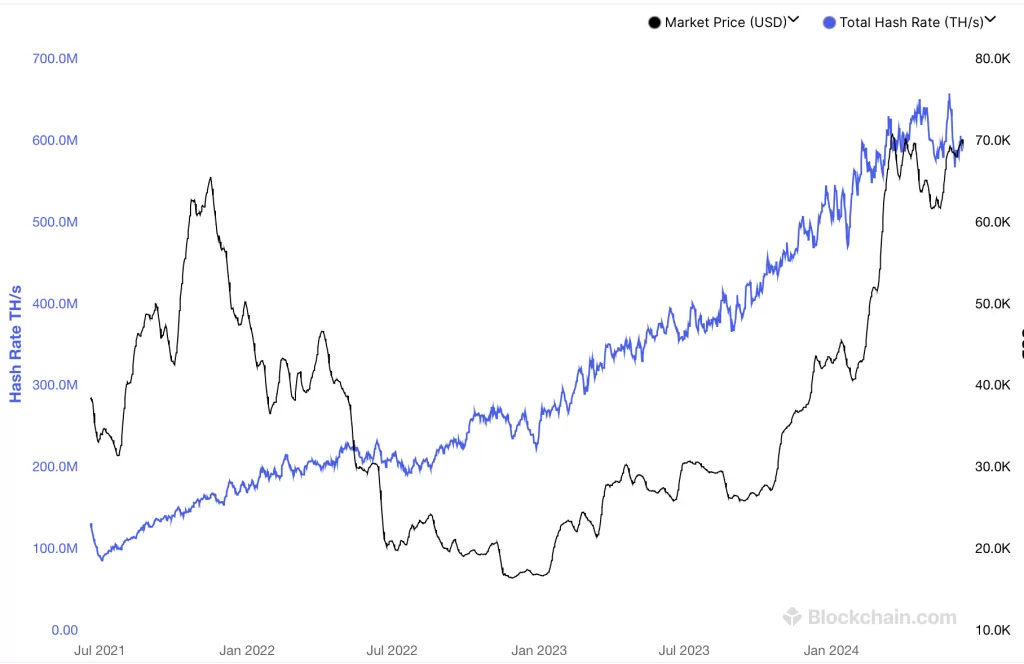

The more hashing power you have, the more likely you are to solve the puzzle before other miners. Simple, yes? The caveat, however, is that Bitcoin’s mining difficulty (hashrate) has been on a steady rise, which means that mining equipment is constantly getting outdated. As of writing, the hashrate is well over 602 million TH/s, a significant jump from a mere 130 million TH/s just three years ago.

Source: Blockchain.com

So, how much exactly would it cost to solo mine Bitcoin and what are the potential returns? While there is no exact estimate that would be constant, the cost of solo mining Bitcoin at the moment would first involve purchasing the latest and most energy-efficient application-specific integrated circuit (ASIC) mining rigs.

Some of the options in the market include Bitmain’s Antminer S19j Pro+ ($1895), MicroBT WhatsMiner M50S ($2055), Bitmain Antminer S19 XP ($3589), among others. This is just a glimpse of the initial cost, and even so, purchasing one mining rig would not cut it given that your competitors would be well-established Bitcoin mining companies such as Marathon Digital Holdings and Core Scientific, which run factory-like mining rig operations.

Other costs that would potentially affect one’s profitability are electricity and tax implications, both of which happen to be jurisdiction-dependent. For context, the energy cost of BTC mining in China before the ban was more favorable than that of other countries such as the U.S. and European countries which don’t have as much access to hydroelectric power.

Simply looking at the overhead costs of setting up mining equipment, electricity, and the muscle of corporate competitors, it makes more sense why solo Bitcoin miners have over the years opted to join mining pools or tap into cloud mining service providers. This is because despite BTC’s price consistently surging, it becomes more expensive to set up solo mining rigs as the hashrate increases. To add to it, with every halving, the reward block keeps on reducing.

Tapping Beyond Bitcoin Mining

While crypto mining has often revolved around stacking up more satoshis, what most people are oblivious to are the opportunities to solo mine or contribute to other blockchain networks, especially with Bitcoin’s increasing hash rates continuing to edge out smaller players.

A good example, in this case, is the Meter Layer 1 network, which introduces a combination of a PoW and PoS infrastructure. The two tech stacks are powered by the MTR flatcoin and MTRG coin, respectively. Meter’s PoW MTR coin shares the same attributes as BTC, but more importantly, it is designed to be more stable. Each MTR is backed by 10 KWH of electricity and can be solo mined using the SHA256 Proof of Work.

Some of the utilities this token can provide within and outside the network includes paying for transaction and storage fees, as well as a store of value and everyday payments. On the other hand, the MTRG coin is designed to operate as the governance token; a recent proposal to enhance Meter’s ecosystem tokenomics suggests burning 30 million tokens that were initially reserved for ecosystem growth.

There are also other mineable PoW altcoins such as Dogecoin, whose core utility is the popular meme culture that has proven to be a driving factor in today’s market setup. In addition to this, solo miners have the option of exploring privacy-oriented PoW coins such as Monero and Dash, although the trading of this category of coins has over the years been limited, with authorities issuing warnings to exchanges that offer trading pairs.

In summary, solo mining profitability is relative; whether one intends to mine BTC or other altcoins, it comes down to core factors, including the cost of mining equipment, electricity, tax implications, and, of course, the growth in value of the coin being mined.