Key takeaways:

- Avalanche-native Tether (USDT) will give the DeFi platform’s users access to the largest and most liquid stablecoin in the industry

- The inclusion of the Avalance Layer-1 network marks the 9th platform USDT supports

- Users can head to Bitfinex cryptocurrency exchange to use AVAX-based USDT for fast and cheap transactions

Avalanche (AVAX) has become the ninth blockchain platform to support the world’s largest stablecoin. Users of the high-performing and easily scalable network can now use Avalanche-native Tether (USDT) to gain access to the most liquid stablecoin in the industry.

Alternatives to Ethereum-based USDT are gaining traction due to high gas fees

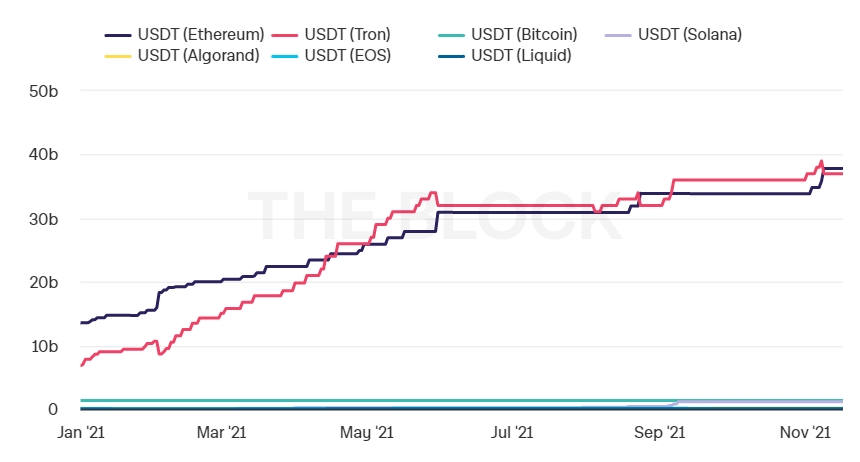

The first iteration of Tether’s USDT stablecoin was launched on the Omni protocol, built atop the Bitcoin blockchain, in October 2014. Since then, USDT has expanded to nine blockchain platforms, including Ethereum (ETH), TRON (TRX), and Solana (SOL), to name a few. It is worth noting that ETH and TRON-based versions of Tether account for over 95% of USDT’s total $74.4 billion market cap.

Recently, the TRON-native version of USDT gained popularity due to its cheap transaction fees and rising gas fees on the Ethereum network. According to data accumulated by The Block, TRON stablecoin transactions have surpassed ETH facilitated USDT for the first time in June 2021, and have continued to be neck and neck since then.

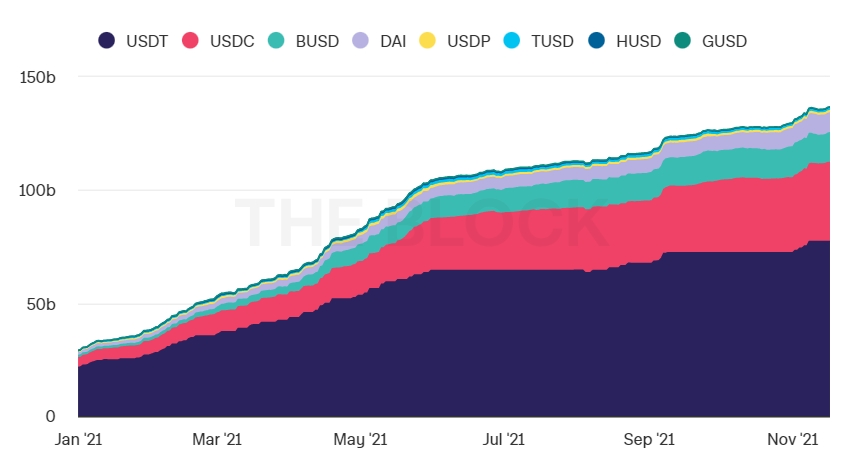

The main competitive advantage of USDT over other stablecoin solutions is its availability across numerous blockchain platforms. For instance, USD Coin (USDC), the second biggest stablecoin on the market with a market cap of $34.4 billion, can only be utilized by Algorand (ALGO), Ethereum, and Solana users.

Users of the Avalanche blockchain platform can now utilize USDT for transferring funds, staking purposes, and a variety of other use cases

It is not surprising that USDT keeps commanding such a large share of the total stablecoin market. Not only can Tether be used for transactions on nine different crypto networks, but the world’s largest stablecoin can be used for staking purposes, which can earn USDT holders considerable returns. Additionally, USDT can also be utilized for inter-exchange transactions, derivatives contracts, consumer loans, and more.

With $74.4 billion, USDT’s supply accounts for roughly half of the combined value of all stablecoins in the blockchain sector. Emin Gün Sirer, Director of the Avalanche Foundation, recognizes the addition of USDT as a milestone achievement for the platform:

“USDt on Avalanche is an essential building block for DeFi users. Tether has become a well-accepted, time-tested stablecoin with extensive support throughout exchanges. It will be even more powerful with Avalanche as its foundation.”

Avalanche, a prominent Ethereum Layer-1 competitor, has been one of crypto’s biggest success stories of the year. The highly scalable open-source smart contract-enabled blockchain ecosystem relies on its own Proof-of-Stake (PoS) consensus protocols called the Avalanche consensus protocol and the Snowman consensus protocol, which guarantee blockchain immutability while consuming minimal energy at the same time.

In the three months since the launch of a $180 million DeFi incentive fund, the price of AVAX tokens jumped by over 350% and hit an all-time high above $100 on Wednesday. The network currently boasts $13.18 billion in total value locked (TVL) across various DeFi services, a sharp increase from $312 million TVL on August 18.