Key takeaways:

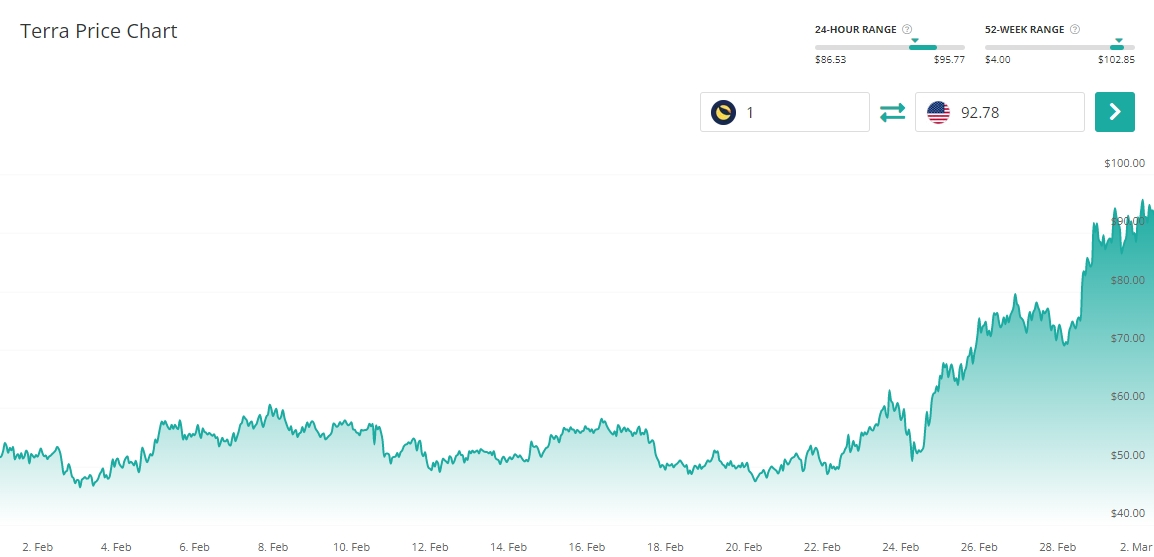

- Terra gained 79% in the last week of February and came within 10% of its previous ATH

- TerraUSD’s supply growth and stablecoin reserve fund as well as an increasing number of DeFi use cases are behind LUNA’s price ascension

- As of March 2, the Terra blockchain boasts the second-highest TVL ($23.7B) and staked value ($30.3B)

LUNA outperformed all major digital assets in February on the tailwind of nearly 80% gains

For the most part, Terra (LUNA) managed to ignore the high degree of volatility that permeated the markets throughout February. While Bitcoin and Ethereum experienced notable up and down movement, LUNA stringed together an impressive streak of price increases at the end of February that pulled its price close to its all-time high.

Terra’s price rally was kick-started by the Luna Foundation Guard (LFG) which announced it had raised $1 billion for a UST Forex Reserve through a private sale of LUNA tokens on February 22.

At the start of the month, LUNA was trading in the $50 range, after losing almost exactly half of its value since hitting ATH of $102.85 at the tail end of 2021. While LUNA was trading in a relatively tight range throughout the first three weeks of February, its price exploded in the final week. When all was said and done, LUNA finished the month up 79%, good for a $93 price tag.

Terra ecosystem continues to reach new milestones

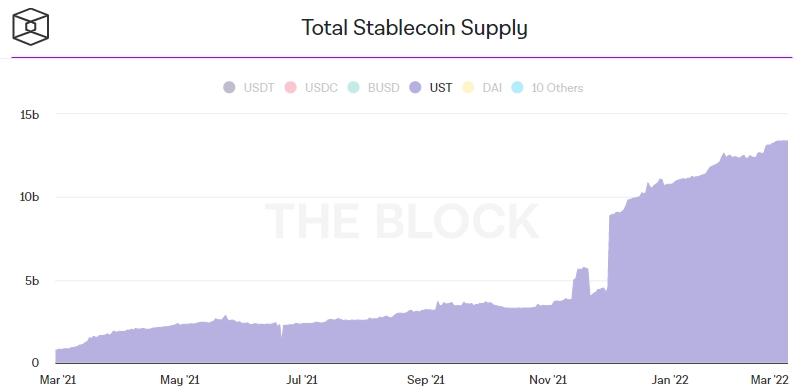

The main reasons behind LUNA’s price ascension are rooted in the growth of decentralized finance (DeFi), TerraUSD (UST) stablecoin supply, and various ecosystem developments.

For starters, the total value locked (TVL) on the Terra blockchain mirrored LUNA’s price and increased by more than 45% in February, increasing from $13.4 billion on February 1 to $19.6 billion on February 28. Terra-native savings protocol Anchor (ANC) accounted for the biggest share of TVL, followed by Lido (LDO) and Astroport (ASTRO), according to blockchain analytics firm DeFi Llama. Anchor Protocol provides LUNA holders with an opportunity to stake their tokens in return for nearly 20% APY.

According to data curated by Staking Rewards, Terra is currently the second largest network in terms of digital assets staked on its rails. For context, Terra’s staked value of $30.3B is ahead of Ethereum 2.0’s $28.4B, and trails only Solana which boasts a staked value of more than $40B.

One of the most significant developments pertaining to the Terra ecosystem in recent months has been the announcement of the $1 billion UST reserve fund. The fund will greatly reduce the risk of a “bank run” scenario, which could negatively impact the price of UST’s algorithmically-controlled price peg.

Users are able to mint UST by burning LUNA and, vice-versa, create new LUNA by burning UST. In light of LUNA’s impressive market performance, UST’s total supply increased to $13.3 billion by the end of February.

We’ve been keeping a close eye on Terra for the past couple of months and featured the project in our weekly Coins to Watch series multiple times. To read more about Terra and its short-term prospects, click here.