Key takeaways:

- In the letter to its shareholders, Square disclosed its encouraging earning figures for Q2, which showed a 91% increase in total gross profit year-over-year (YoY)

- Bitcoin gross profit increased to $55 million from $17 million last year

- Square had to pay an impairment loss on its Bitcoin position due to the decrease in net carrying value of Bitcoin in Q2

Shared in the letter to shareholders yesterday, Square disclosed its earnings figures for the second quarter of 2021. Compared to last year, the company’s total gross profit rose by an impressive 91%, to $1.1 billion. Bitcoin revenue increased more than 200% year-over-year (YoY).

Bitcoin is among the reasons for the Cash App’s success

Gross Bitcoin revenue for the first quarter of 2021 was a staggering $3.5 billion. In the second quarter, the revenue decreased by more than 20% and has fallen to $2.7 billion, which was mostly attributed to the weaker crypto market performance during May and June, when Bitcoin price fell by 50% since its all-time high.

While the gross revenue of Bitcoin services was indeed very high, the Bitcoin gross profit was $55 million, or approximately 2% of the total Bitcoin revenue.

Square considers Bitcoin an integral part of its ecosystem. In the letter, the company has linked the growth in user activity on the platform to the constant improvement of its services

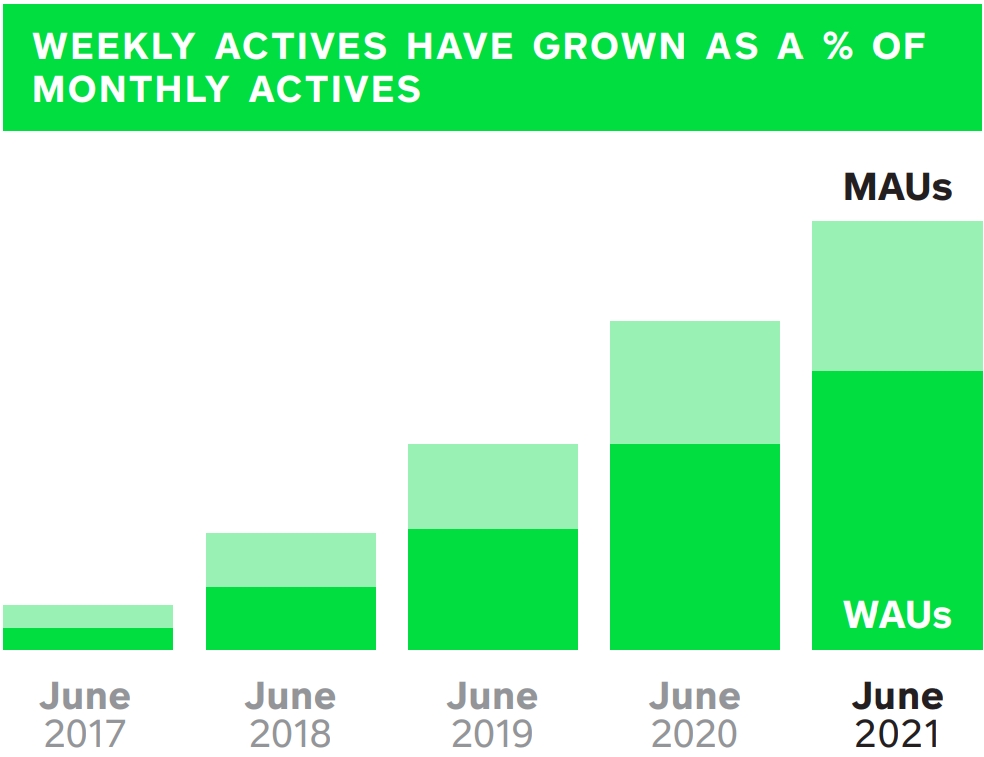

Square’s percentage of monthly active users (MAUs) and weekly active users (WAUs) has grown steadily since 2017, as can be seen in the image below, showing statistics for June 2017 to June 2021.

Square recognized a $45 million Bitcoin impairment loss

According to data from Bitcoin Treasuries, Square is in possession of 8,027 BTC. Out of the company’s total Bitcoin position, 4,709 BTC were bought in October 2020. An additional purchase of 3,318 BTC was made in February of this year. Bitcoin that Square holds puts it at the fifth place out of all the companies that currently hold the world’s largest cryptocurrency.

Due to Bitcoin’s price drop earlier in the year, Square was required to report the difference in the BTC’s value as an impairment loss. Per accounting rules, a report of an impairment loss is necessary when the asset’s price falls below its carrying value (initial purchase price). On the other hand, the report on increases in value is not required until the profits are realized in an eventual sale of the asset.

Due to the change in Bitcoin price, Square reported a $45 million loss. In Q1 Square also reported a loss, albeit considerably smaller, of $20 million. Square paid $220 million for its Bitcoin altogether, however, the current value of BTC holdings at the time of this writing is $320 million.

Jack Dorsey, founder and CEO of Square and Twitter, recently appeared at the B World Conference, where he and Tesla CEO Elon Musk expressed their support for Bitcoin and shared their thoughts on the cryptocurrency industry