Key takeaways:

- The researchers at Ecoinometrics have taken a close look at historical market data and compared gold’s and Bitcoin’s store of value properties

- Bitcoin outperforms gold in almost every way, even when accounting for Bitcoin perceived high volatility

- Given the current economic climate, the price of gold should be way higher, which is a possible indicator that Bitcoin is already chipping away at gold’s store of value market position

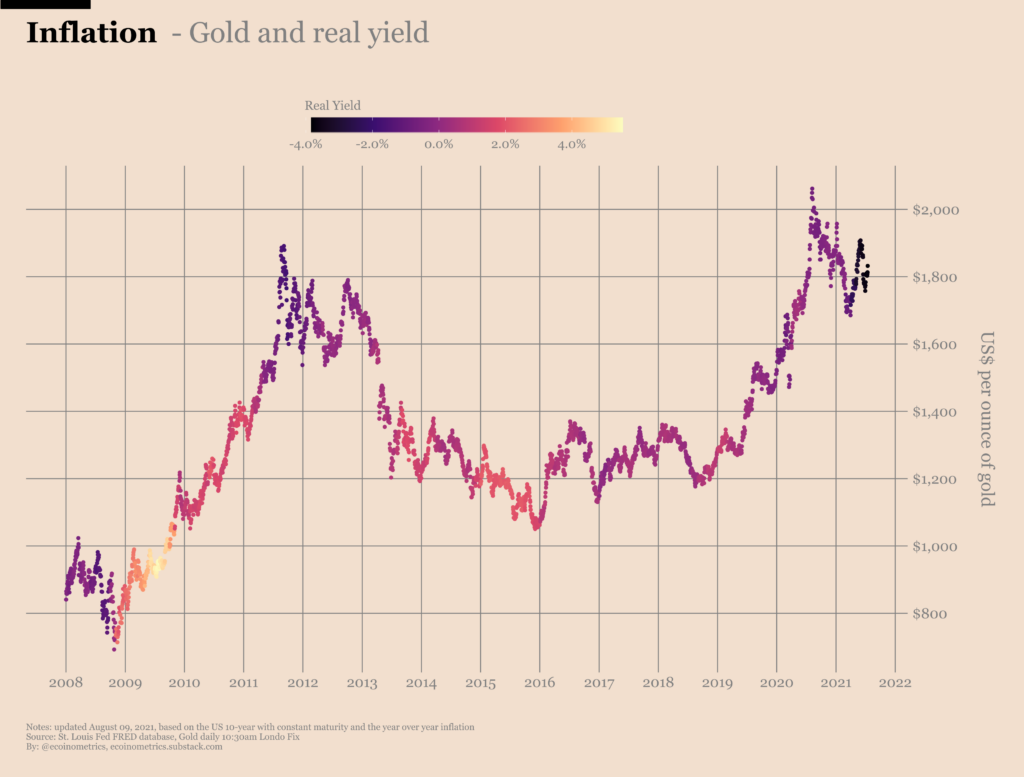

Judging by the market data analyzed by the Ecoinometrics research team, gold is severely underperforming, despite the negative real yields which should in theory push the value of the precious metal upwards considerably. While the inflation rates continue to increase on the tailwind of massive Covid-19 relief-related economic stimulus programs, the price of gold hasn’t increased by as much as one would expect.

Since the start of the year gold’s value continues to decrease when priced in BTC

Perhaps the most telling indicator for the gold’s disappointing performance this year is the direct comparison to Bitcoin. When charted in the value of BTC, gold continues to dip ever lower while the world’s biggest cryptocurrency continues to do well in the time of relative economic adversity.

The current trend was established despite no BTC ETF being available in the US, which severely limits the investing options for corporate investors choosing their store of value option. When the BTC ETF is finally approved by the SEC, the outflow of funds from Gold ETF to BTC ETF is very likely to commence and push the relative value of gold even lower.

We have recently covered how traditional financial institutions are lining up to provide in-house crypto services that would enable wealthy clients to invest in digital assets. Wells Fargo and JPMorgan were the latest examples of this trend. One can only imagine by how much the corporate funds’ flow to the crypto market would increase if there was a fully regulated ETF option readily available.

Gold hasn’t benefited from high inflation rates by as much as would be expected

Historically speaking, when the real yields turn negative the price of gold explodes. At its height, gold did momentarily cross over the $2,000 mark but hasn’t managed to hold the price for very long. At the moment, the market capitalization of gold controlled by ETFs and similar financial instruments represents a third of Bitcoin’s market cap.

There are different perspectives one could choose when looking at the current situation. You could say that the price of gold is bound to explode but it just hasn’t happened yet. Granted, this would be a somewhat realistic outlook. However, it is hard to imagine why gold’s massive increase in value would be just around the corner when it hasn’t made a move up to now when the economic situation with negative real yields and rising inflation rates was perfect for gold to thrive.

The second option, as proposed by Ecoinometrics, is that gold has plateaued and we won’t see a big move in the near future. This can only happen if the Fed manages to balance real yields and prevent inflation from increasing. If that happens, buying gold as a hedge against inflation and its value as a safe haven asset wouldn’t be appealing to investors.

The third option is that gold was going to exponentially grow, but it hasn’t due to Bitcoin siphoning away some of the funds that would historically find its way to the gold market. The last option does seem very likely. If you are choosing a store of value, wouldn’t you rather choose one that hasn’t even become widely adopted yet but has still managed to outperform most traditional assets over the last decade?

Over the long-term gold’s low risk prevails, they say…

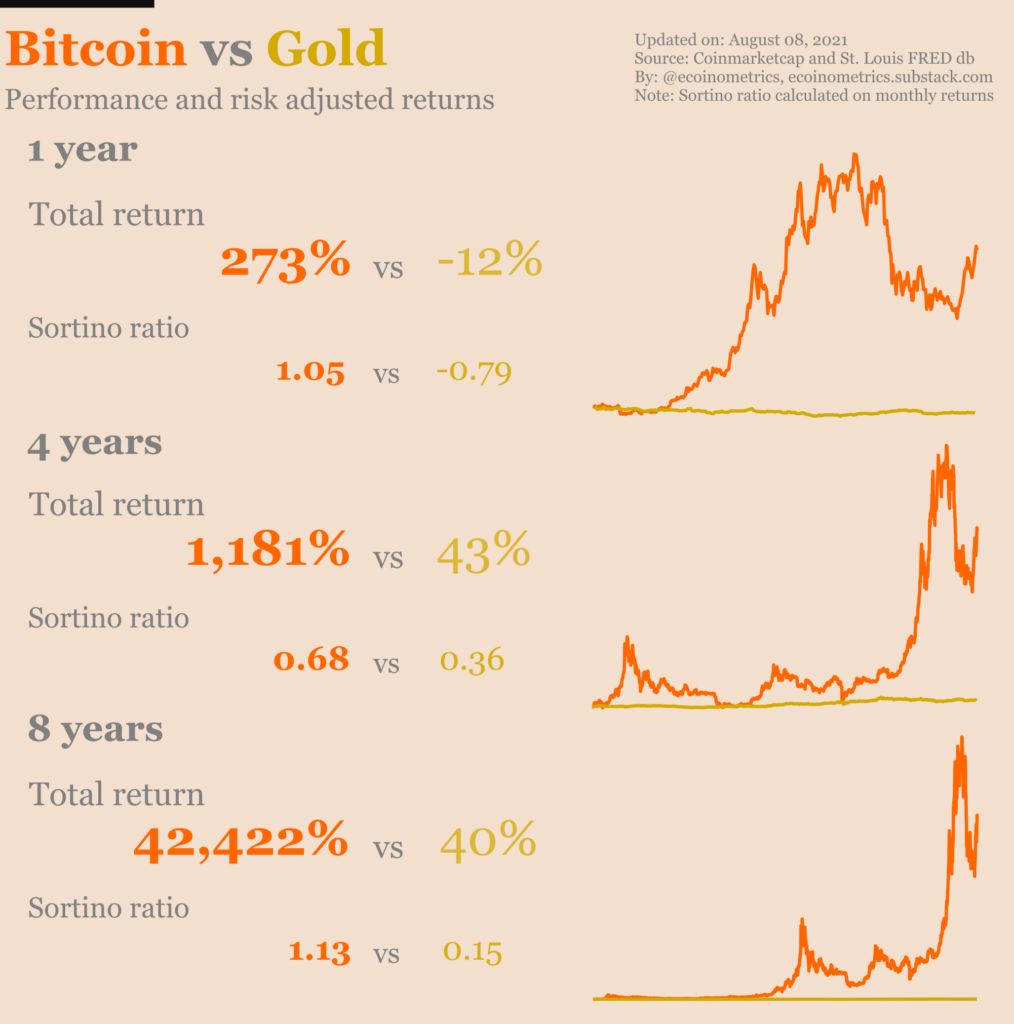

The most common argument when investors are choosing gold over Bitcoin is that gold’s low returns are justified due to the low inherent risk it introduces to a traditional portfolio consisting of stocks, bonds and precious metals.

When taking a step back and neglecting the short-term volatility of Bitcoin, we can quickly deduce that the equation is not as simple as that. While Bitcoin certainly carries a higher risk, which is most prominently felt in the short-tern, the risk-adjusted returns over longer periods of time are painting a different picture.

The risk/reward proposition for gold is far worse than for Bitcoin when calculated as a Sortino ratio, which is a helpful way of estimating the investment’s return while taking a given level of bad risk into account. In short, the ratio differentiates harmful volatility from total overall volatility.

On this basis, an investment in gold doesn’t seem at all enticing, not on a one-year scale and not over an eight-year period. We haven’t even mentioned Bitcoin total returns over the same amounts of time, which completely obliterate whatever gold manages to produce. Keep in mind though that as Bitcoin matures, the total returns will continue to slowly normalize.

At the moment, choosing Bitcoin over gold as a method to store value seems quite obvious. Currently, gold’s low volatility and associated risk levels are not enough to outweigh the benefit of high risk-adjusted returns of Bitcoin.