Although Bitcoin is now a part of mainstream consciousness, some investors are uncomfortable with putting their money into something that exists in a purely digital form.

We have seen several attempts over the years to make physical Bitcoin and attach the digital currency BTC to a tangible object, with varying success. We’ll highlight some of the most notable physical Bitcoin variants and also explain the different meanings of the term “physical Bitcoin”.

Key highlights:

- There are two main types of physical Bitcoins – coins with actual BTC value and decorative replicas.

- Coins with embedded BTC were popular in Bitcoin’s early years but are now mostly discontinued.

- Collectible physical Bitcoins can be worth more than their BTC content.

- Physical Bitcoins are less secure than hardware wallets and mainly serve as novelties.

Physical Bitcoin – Real-life coins with BTC value

There are certain types of physical Bitcoin that you can buy which actually have a BTC value associated with them. Most commonly, these are gold-colored metal coins that have a code attached to them that allows you to access digital BTC coins on the Bitcoin blockchain.

These coins usually employ some kind of tamper-proof mechanism to give prospective buyers the reassurance that the BTC coins associated with the physical coin have not been touched yet.

The idea of a physical Bitcoin was most popular in the earlier days of Bitcoin, when the idea of a fully digital currency with no representation in the “real world” was perhaps a bit tougher to grasp. In addition, the name “Bitcoin” itself made representing BTC with physical coins a fairly straightforward idea.

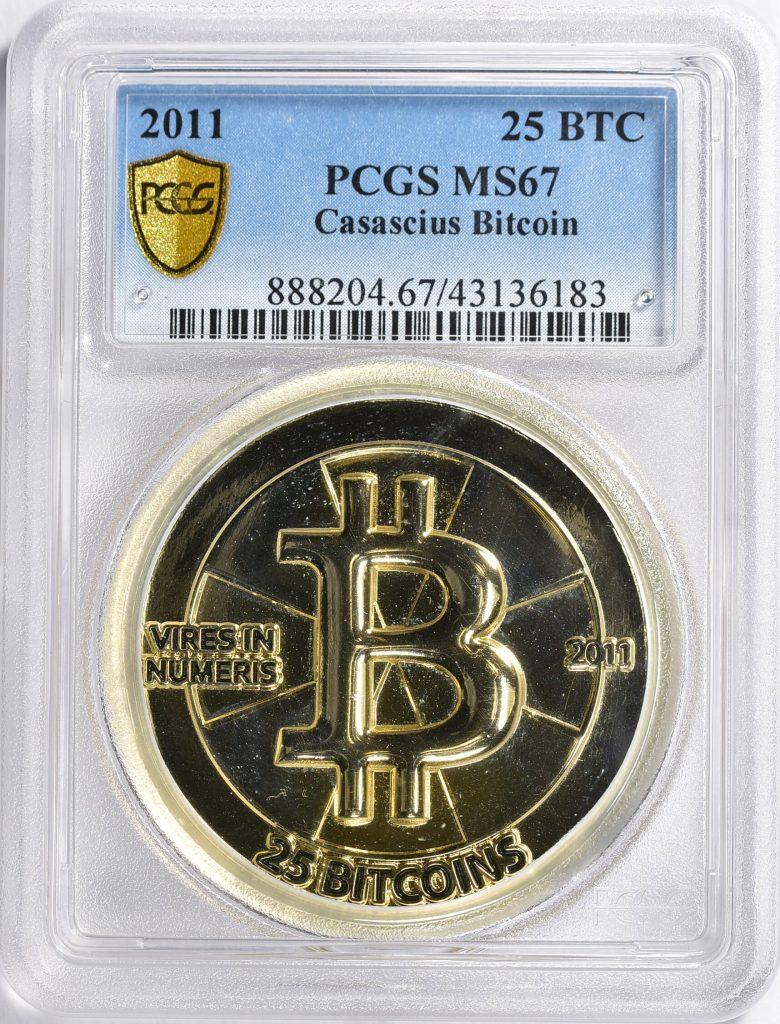

Although there were several examples of physical Bitcoin products, the most notable by far came from a company called Casascius, which was founded in 2011.

Casascius physical Bitcoins have a Bitcoin private key embedded on the coin, concealed by a hologram that transforms to a honeycomb pattern if tampered with. The exterior of the coin displays the first eight characters of the Bitcoin address associated with it.

During its time in the market, Casascius produced various versions of their physical Bitcoins in denominations of ₿0.1, ₿0.5, ₿1, ₿10, ₿25, ₿100, and ₿1,000. As you can imagine, the value of Bitcoin when Casascius was active was much lower than it is today – at current prices, a ₿1,000 Casascius coin holds $104 million worth of BTC.

Regrettably, Casascius was forced to stop operations after U.S. regulator FinCEN notified the company that they would need to get a money transmitter business license or shut down their operations.

Today, Casascius coins are the most sought after examples of physical Bitcoin. Thanks to their collectible appeal, Casascius coins can sell at a premium over the value of the actual BTC they contain.

Other examples of companies that have produced physical Bitcoins include Satori, Ravenbit, Titan Bitcoin and Alitin Mint.

Another notable project was Denarium, created by Finnish company Prasos. These coins contained an embedded paper wallet sealed with a tamper-resistant hologram. The company even maintained a public database of all Denarium Bitcoins produced before discontinuing the line.

Ravenbit also took a unique approach by offering DIY kits that allowed users to assemble their own physical Bitcoins, embedding their own private keys with holographic stickers.

Per our research, there is only one active company on the market which is still making new physical Bitcoin products. The company is called Ballet, and sells physical Bitcoin products with denominations ranging from 0.001 to 0.1 BTC. Compared to most other examples of physical Bitcoin, Ballet’s physical Bitcoin products are shaped like a card, and not like a coin.

Physical Bitcoins can have some aesthetic appeal and it can certainly feel nice to invest in something that is tangible. However, there are very good reasons why physical Bitcoins are largely seen as a novelty and haven’t seen much adoption.

For one, owning a physical Bitcoin is actually less secure than simply storing your cryptocurrency in a hardware wallet. If a thief were to steal your physical Bitcoin, they would easily be able to access the BTC it contains. Meanwhile, hardware wallets are protected with a PIN code which will give you enough time to respond even if your hardware wallet gets stolen.

If you buy a physical Bitcoin, you must also trust that the manufacturer doesn’t have access to the private keys imprinted on the coins. This concern doesn’t arise with hardware crypto wallets, because they generate private keys completely offline.

Devices from manufacturers like Ledger or Trezor are considered among the safest ways to store Bitcoin. As long as users back up their seed phrases securely, even a stolen hardware wallet cannot compromise their funds.

Physical Bitcoins as decoration

If someone were to ask you what Bitcoin looks like, the first thing that comes to mind is probably a golden coin with a large ₿ symbol in the middle and writing engraved alongside its edge. This is typically how people represent Bitcoin visually, and you have most likely seen such depictions of Bitcoin countless times on news websites and cryptocurrency sites.

Such decorative physical Bitcoins can easily be purchased online, and typically aren’t too expensive. However, it’s important to stress that they are just decorations and don’t actually contain any BTC value.

Physical Bitcoin ETFs

Sometimes, the term “physical Bitcoin” is used when referring to physical Bitcoin ETFs. These are exchange-traded funds that are directly backed by BTC held by the issuer.

While the use of the word “physical” can be misleading, it distinguishes spot Bitcoin ETFs — which hold actual BTC — from futures ETFs, which track Bitcoin prices through derivatives. In the U.S., spot Bitcoin ETFs were approved in January 2024 after years of applications by major asset managers.

FAQs

There’s quite a few questions that users typically have about physical Bitcoin. Let’s answer some that are asked most frequently.

What is the value of a physical Bitcoin?

The value of a physical Bitcoin is largely driven by the amount of BTC that it contains. Over the years, companies have made physical Bitcoins representing a huge range of BTC amounts, from 0.001 BTC all the way up to 1,000 BTC.

In addition, certain physical Bitcoin might have additional value as collectibles, so they can potentially sell for more than the value of the BTC they contain. The most famous kind of physical Bitcoins are Casascius Bitcoins.

Are Bitcoins actual coins?

No, Bitcoins themselves are not physical coins. Bitcoin exists entirely as digital data on the blockchain. Physical Bitcoin coins are simply representations that may or may not contain access to BTC through private keys.

Can you physically buy Bitcoin?

Bitcoin is a fully digital currency. However, if you want to hold Bitcoin in a physical form, the closest you can get is to purchase a “physical Bitcoin”. These are physical representations of Bitcoin that have the information to access a pre-determined quantity of BTC inscribed on them.

If you want to buy Bitcoin in person, you can use a Bitcoin ATM, which allows you to purchase Bitcoin with cash. We generally advise users against using Bitcoin ATMs, as they tend to charge very high fees.

How to check a physical Bitcoin?

Physical Bitcoins usually incorporate a tamper-proof system that clearly reveals if someone has previously attempted to reveal the confidential information needed to access the Bitcoin wallet associated with the coin. If you want to buy a physical Bitcoin, ensure that you’re purchasing it from a manufacturer or seller with a very good reputation.

The bottom line

Although physical Bitcoins are an interesting chapter in the story of Bitcoin, they are not much more than a gimmick. They are not very convenient to use and have security risks that you don’t need to worry about with other methods of storing Bitcoin.

If you want the best combination of security and convenience, consider using a hardware wallet along with a metal backup for your seed phrase.