Key takeaways:

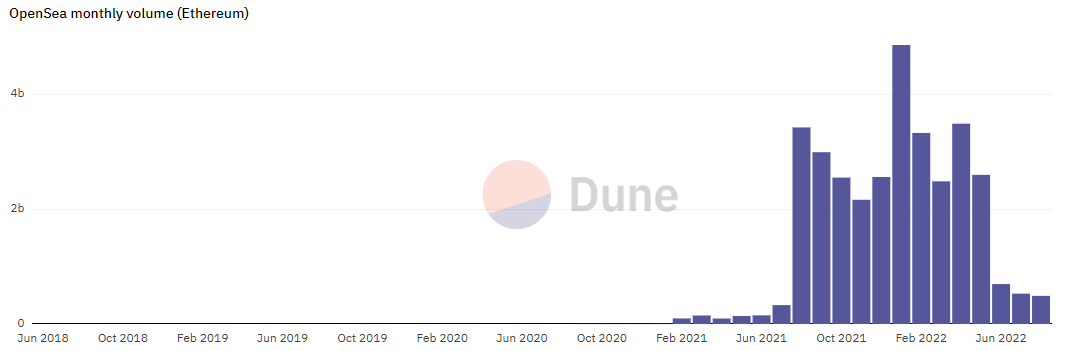

- OpenSea marketplace saw a 90% reduction in Ethereum-based NFT sales since January

- The leading NFT market facilitated $4.86 billion in trading volume in January and just $490 million in August

- The company laid off 20% of its workforce in July in anticipation of a prolonged bear market

NFT trading volume took a big hit amid the bear market

The past couple of months have been difficult for the cryptocurrency market – we’ve witnessed Bitcoin shed more than 70% since November’s all-time high, and the total value of all digital assets in circulation drop from $3 trillion to beneath $1 trillion.

The negative market sentiment permeating the sector has left a huge mark on non-fungible tokens (NFTs) as well. While the sector exploded in 2021 and reached record activity in January 2022, the current situation looks grim.

OpenSea, the world’s largest NFT marketplace, has experienced a roughly 90% drop in NFT trading volume between January and August, according to data from Dune Analytics. Whereas OpenSea facilitated over $4.86 billion in trading volume of Ethereum-based NFTs in January (its best month on record), it failed to reach $490 million in August.

It is worth noting that the decrease seems to come mainly from the falling prices of Ethereum and NFTs, and not as much from the lower number of NFTs traded. For context, 2.28 million NFTs exchanged hands in January and 1.43 million in August.

The fall in activity on Ethereum is mirrored when looking at data for Polygon and Solana. The number of Polygon NFTs sold has experienced a particularly sharp decline of more than 96%.

The falling NFT trading volume has led to OpenSea laying off roughly a fifth of its workforce in July. CEO Devin Finzer said that the decision to reduce the team’s size was a “difficult” one, but a necessary one to take to prepare the business for “the possibility of a prolonged bear market.” At the time, Finzer added that the company had enough capital to sustain a five-year-long crypto winter.