Key takeaways:

- The latest Glassnode weekly report examined past bear markets to determine whether a Bitcoin bottom is forming

- Several market indicators point to the fact that LTHs and crypto miners are months removed from capitulation

- Going by Glassnode’s findings, the price of Bitcoin could continue moving in the negative direction in the near-term

Glassnode examined previous bear cycles to pinpoint a Bitcoin bottom

In their latest weekly report – aptly named Pressure Builds on Diamond Hands – Glassnode researchers examined past Bitcoin downtrends to determine whether “widespread capitulation” is near and – with Bitcoin trading more than 70% removed from its all-time high – the bottom has been reached.

The behavior of long-term holders (LTHs) – defined by Glassnode as investors who hold onto their digital assets for at least 155 days – is one of the most important metrics when identifying bear bottoms, according to the report.

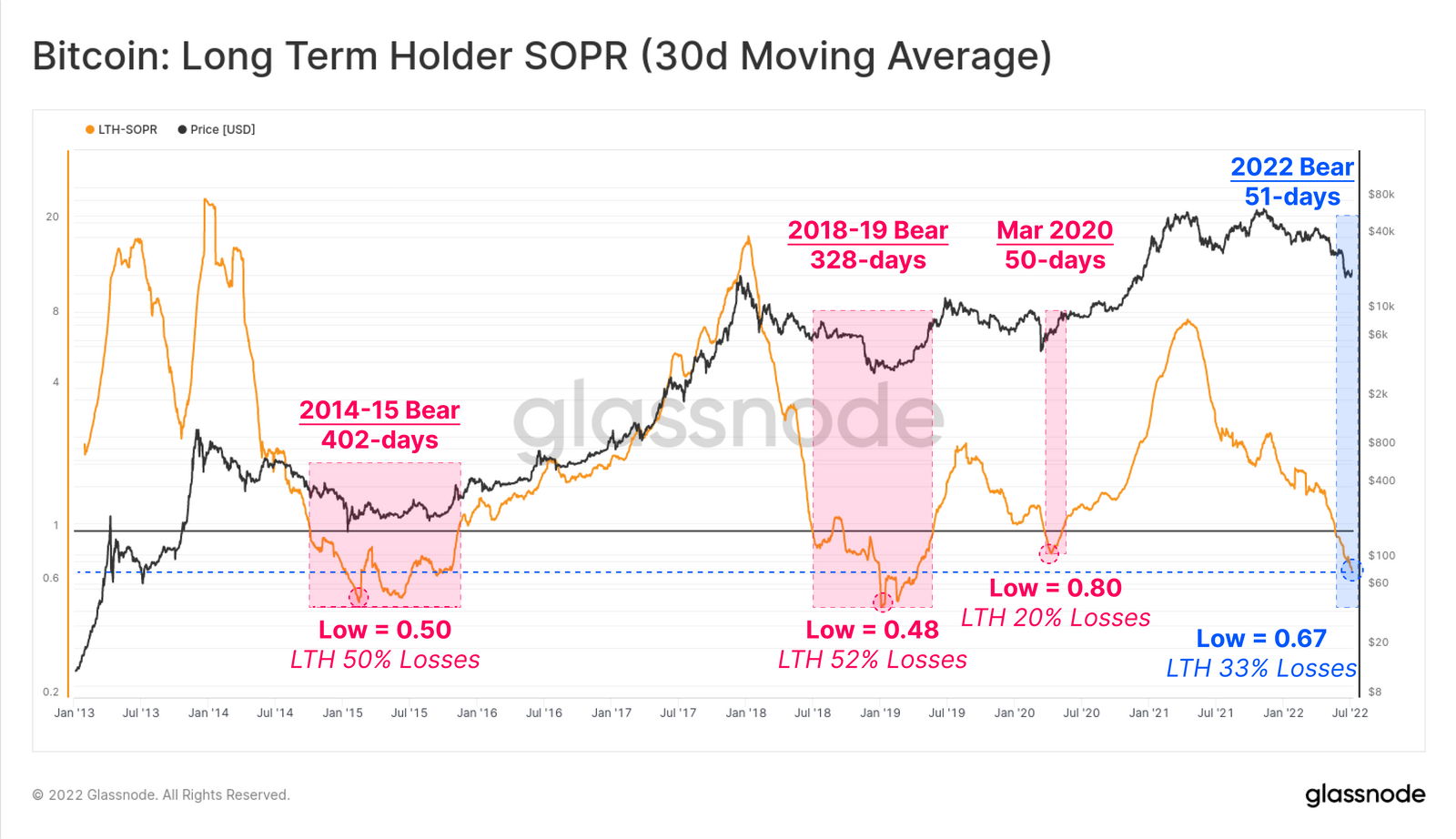

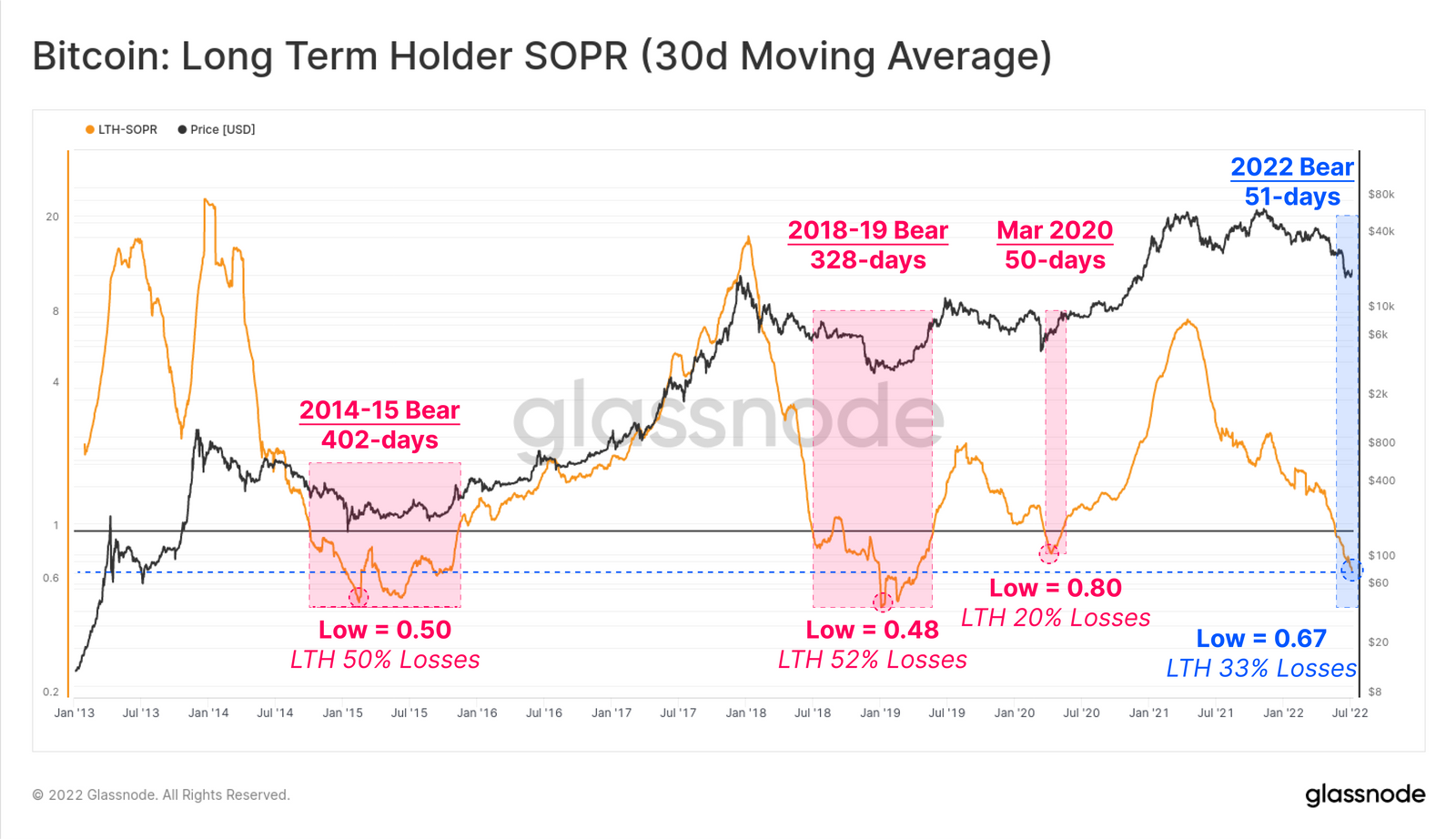

At current market rates of roughly $20,000 per Bitcoin, LTHs who are willing to spend their coins are locking in an average loss of 33%, according to the Long-Term Holder Spent Output Profit Ratio (LTH-SOPR) metric. For context, an LTH-SOPR ratio of 1.0 means the coins are spent at exactly their cost basis.

The current ratio of 0.67 is higher than in the short-lived March 2020 bear market, but still considerably lower than in the prolonged bear markets that started in 2014 and 2018, respectively.

“Similarly, LTHs are currently underwater on average, holding an aggregate unrealized loss of -14%,” continued the report.

The current LTHs to STHs ratio is still far above previous market bottoms

Another important factor to consider when trying to gauge market bottoms – at least when looking at historical data – is the ratio between LTHs and short-term holders (STHs). STHs are defined by Glassnode as investors who held to their digital assets for less than 155 days. The researchers noted:

“Bottom formation is often accompanied by LTHs shouldering an increasingly large proportion of the unrealized loss. In other words, for a bear market to reach an ultimate floor, the share of coins held at a loss should transfer primarily to those who are the least sensitive to price, and with the highest conviction.”

Currently, over 16% of the Bitcoin supply in loss is held by STHs, which indicates that these new holders will have to mature to LTHs before a “resilient bottom” can be established. Going by historical data, the share of supply in loss held by STHs fell below the 5% threshold during previous capitulation events.

In addition to LTHs selling their holdings en masse, miners losing conviction is another hallmark of late-stage bear markets. The report points out that miners are, in fact, facing severe pressure as of late. The aggregate miner income in USD – tracked by the Puell Multiple – is 49% below the 1-year average.

Glassnode predicts that if prices don’t experience a meaningful recovery in Q3 2022, we could see miners being forced to sell their BTC holdings in large amounts to cover operations costs. Glassnode wrote:

“The duration of miner capitulation in the 2018-2019 bear market was around 4-months, with the current cycle only having started in 1-month ago.”

Similar to the ratio of STHs, data pertaining to Bitcoin miners indicates that widespread capitulation could still be months away. Our algorithmically generated price prediction charts seem to agree with the negative market sentiment outlined in the report and forecast a considerable drop in the value of Bitcoin is in the cards in the coming months.