Cryptocurrency lending has become a popular practice among both cryptocurrency traders and investors. There’s many reasons why one would want to lend crypto. For example, a long-term holder might want to use their crypto holdings as collateral to access short-term capital without having to sell their coins. A trader focused on short—term market moves can use loans to add leverage to their trading positions.

In comparison to traditional loans, cryptocurrency loans typically have shorter terms. On Binance, for example, the duration of the loan can be between 7 days and 180 days. The reason why crypto asset loans are typically shorter is the high price volatility of cryptocurrencies, which introduces risks for both lenders and borrowers the longer the loan remains open.

As users who want to take advantage of crypto loans look for the best loan terms possible, they will inevitably encounter crypto lending “opportunities” that seem suspiciously favorable.

Be careful with crypto loans that sound too good to be true

One of the biggest red flags when it comes to crypto loans is “opportunities” to take out a crypto loan without having to supply collateral. There’s few real incentives for anyone to offer such a loan due to the high volatility of cryptocurrencies and the fact that once a cryptocurrency is transferred to another wallet, it’s impossible to retrieve it without having the necessary private key. In other words, a lender that provided a loan without requiring collateral upfront would have little recourse if the borrower simply decided not to pay the loan back.

As always, keep in mind that if something sounds too good to be true, it probably is. If someone is telling you they will lend you cryptocurrency without requiring collateral (or only requiring a tiny amount of collateral), they might be trying to lure you into a trap to steal your cryptocurrency, personal information or other valuable assets.

A notable exception to this are “flash loans”, which are offered by certain decentralized finance (DeFi) protocols like Aave. Flash loans are a legitimate product that makes it possible to take out a loan without collateral, but the borrowed funds must be returned to the protocol within the same block on the blockchain. However, flash loans are very different from typical loans due to their extremely short-term nature and also require advanced technical knowledge to execute profitably.

If we set aside the flash loans niche, legitimate crypto lending products like Binance’s Crypto Loans will require you to supply cryptocurrency as collateral before you can take out a loan. The product can be used to borrow more than 160 different cryptocurrencies, and supports over 50 different cryptocurrencies as collateral.

Legitimate crypto lending products typically require collateral

There are many reasons why cryptocurrency lenders require you to provide assets as collateral before you can take out a loan.

When it comes to crypto lending products, there’s usually no such thing as credit checks – anyone is free to take out a loan, so long as they can provide the necessary collateral. The collateral provides security to the lender in the scenario that the borrower is not able to repay their debt.

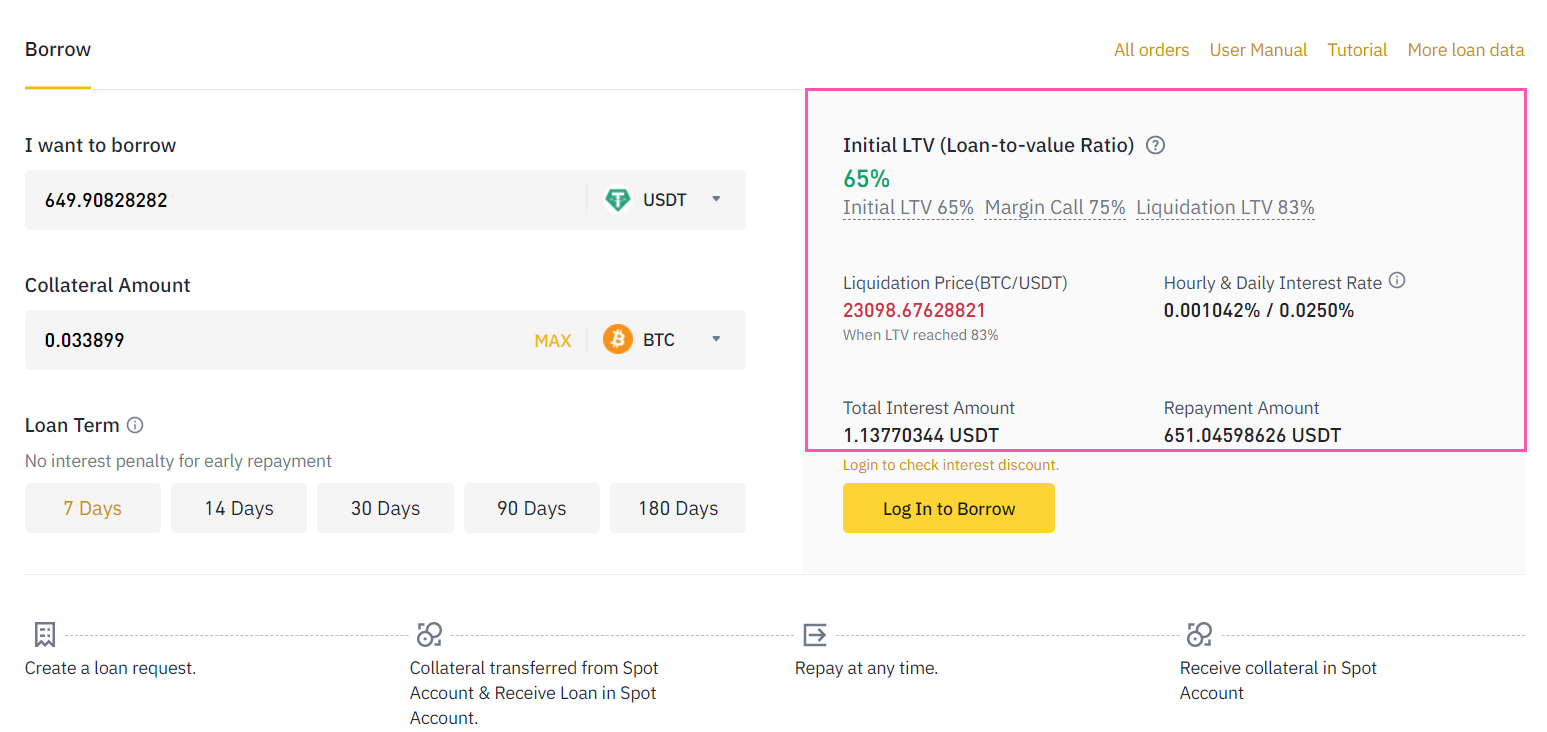

In addition, the collateral provided to borrow funds is used by the lender to calculate lending risks. The ratio between the value of the borrowed funds and the value of the collateral is known as the Loan-to-Value (LTV). A low LTV indicates that the loan is in good standing, as the supplied collateral is sufficient to offset the risks taken on by the lender. Conversely, if the LTV increases past a certain point, the borrower is asked to supply additional collateral to avoid their collateral being liquidated.

The Binance cryptocurrency exchange is an example of a platform that offers cryptocurrency lending products that require collateral. The initial LTV depends on the cryptocurrency that’s being provided as collateral. As a rule of thumb, a higher initial LTV will be allowed if you’re providing more established crypto assets like BTC, ETH or BNB as collateral. Altcoins with a smaller market capitalization are riskier, and will typically have a smaller initial LTV.

Let’s illustrate the concept of LTV with a simple example. Let’s say that we’re providing $1,000 worth of Bitcoin to take a loan in USDT. At the time of writing, these are the terms offered by Binance for such a loan:

- Initial LTV: 65%

- Margin Call: 75%

- Liquidation LTV: 83%

The Initial LTV of 65% means that we’ll be able to borrow $650 worth of USDT by providing $1,000 worth of BTC as collateral. If the price of Bitcoin falls after we take out the loan, the LTV will increase. If the LTV increases up to the Margin Call level (75%), we will be notified to supply additional collateral or repay the loan.

Meanwhile, the Liquidation LTV is at 83%—if our LTV reaches this point, the BTC we provided as collateral will be automatically sold, but we’ll still be able to keep the borrowed USDT.

The benefits of Binance’s Crypto Loans

Binance Loans is available to all users that have a Binance account, and have the necessary level of identity verification. The product provides a lot of flexibility to lenders, thanks to the wide range of crypto assets that are supported for borrowing and supplying collateral. In addition, borrowers can choose between five different loan terms:

- 7 days

- 14 days

- 30 days

- 90 days

- 180 days

Regardless of the loan term you select when taking out a loan, you can repay your loan in full at any time before the term expires. In such a scenario, you would only pay interest for the period that the funds were borrowed. The amount of interest you owe is updated on an hourly basis.

Depending on the cryptocurrency you’re providing as collateral, you could be eligible for a special reduction on your interest rate. This feature is available for certain cryptocurrencies like Cardano, Avalanche and Polkadot, which support staking. If you provide one of these coins as collateral, Binance will stake the coins and use the staking rewards to offset the amount of interest you have to pay. You can identify coins that are supported for this discount by the “Staking” indicator next to the coin name.

In March 2022, Binance also introduced a new promotion featuring reduced interest rates for cryptocurrency borrowers. For regular users, the daily interest rate is now as low as 0.0250%, and can be reduced even further if the asset used as collateral supports the staking feature we just discussed. Users that have a VIP account will receive additional discounts on their interest rates, with better discounts being offered for higher VIP levels.

Conclusion

Cryptocurrency lending can be a highly useful tool that opens up new investing and trading strategies. However, it’s important to be wary of suspicious lending opportunities, especially those that seem to be offering crypto loans without collateral requirements—more likely than not, there’s a catch and you will end up on the losing side.

Legitimate crypto lending products will require you to supply collateral, so that the lender can manage their risks. One of the best places to get a crypto loan is Binance, thanks to their huge selection of cryptocurrencies and highly competitive interest rates.