The month of October is here – a make it or break it month for Bitcoin price. The leading cryptocurrency by market cap has reached a pivotal resistance level. Breaking above it, could mean a phase of full-blown Bitcoin FOMO and cryptocurrency mania.

PrimeXBT analysts have provided a research-based retrospective explaining how the current market environment and coming changes in those conditions could spur widespread investor speculation.

Here is a closer look at the Bitcoin mania that could soon unfold.

Bitcoin, And How Investors Behave During Bubbles

Bitcoin and other cryptocurrencies exist solely in the virtual world, which has made them challenging for many to come to terms with. The fact they’re a new type of technology that isn’t backed by governments is a strange concept to others. Until the asset becomes truly mainstream as a currency, cryptocurrencies will remain a speculative asset class – for now.

The stock market, housing, and just about anything else at all can form a bubble that eventually bursts, causing a return to mean and a period of rebuilding. Speculative assets do the same, but tend to go far beyond the semi-realistic valuations of other traditional assets.

These sharp changes in price happen abruptly. For example, Bitcoin grew 375% from $4,000 to $20,000 in only three months. Within a year, Bitcoin had retraced back to $3,000. Such moves aren’t always healthy for the asset, market, or investors, but that’s just the way market participants behave during such bubbles.

Supply Shock Narrative Worldwide To Cause BTC FOMO

Adding fuel to the fire of what’s to come, the supply of BTC on exchanges is at historic lows. The 21 million hard-capped supply of BTC is already tiny by comparison to the trillions of US dollars that were produced in 2020 and 2021 alone.

The supply shock narrative could soon become the narrative of all things across the rest of the quarter. US Secretary of Treasury Janet Yellen warned US citizens about the coming holiday season, cautioning people to expect serious supply issues and to not be alarmed. All markets work in a state of supply versus demand, and if supply is limited, and demand is high, prices on all consumer goods could soon skyrocket.

Conditions created by the pandemic continue to create a strain on society that isn’t going away anytime soon. When the hysteria over not being able to buy, or even afford, the goods that Americans once took for granted, a flight of US dollars into literally anything else could happen.

Smarter investors will put that money into crypto versus luxury items and other goods. The complete lack of available BTC one exchanges while the world goes into a mass buying frenzy, could fuel what is ultimately the last let up in Bitcoin’s bull cycle, and fulfill its destiny of reaching $100,000 or more.

PrimeXBT Bitcoin Price Retrospective: What Do Technicals Suggest?

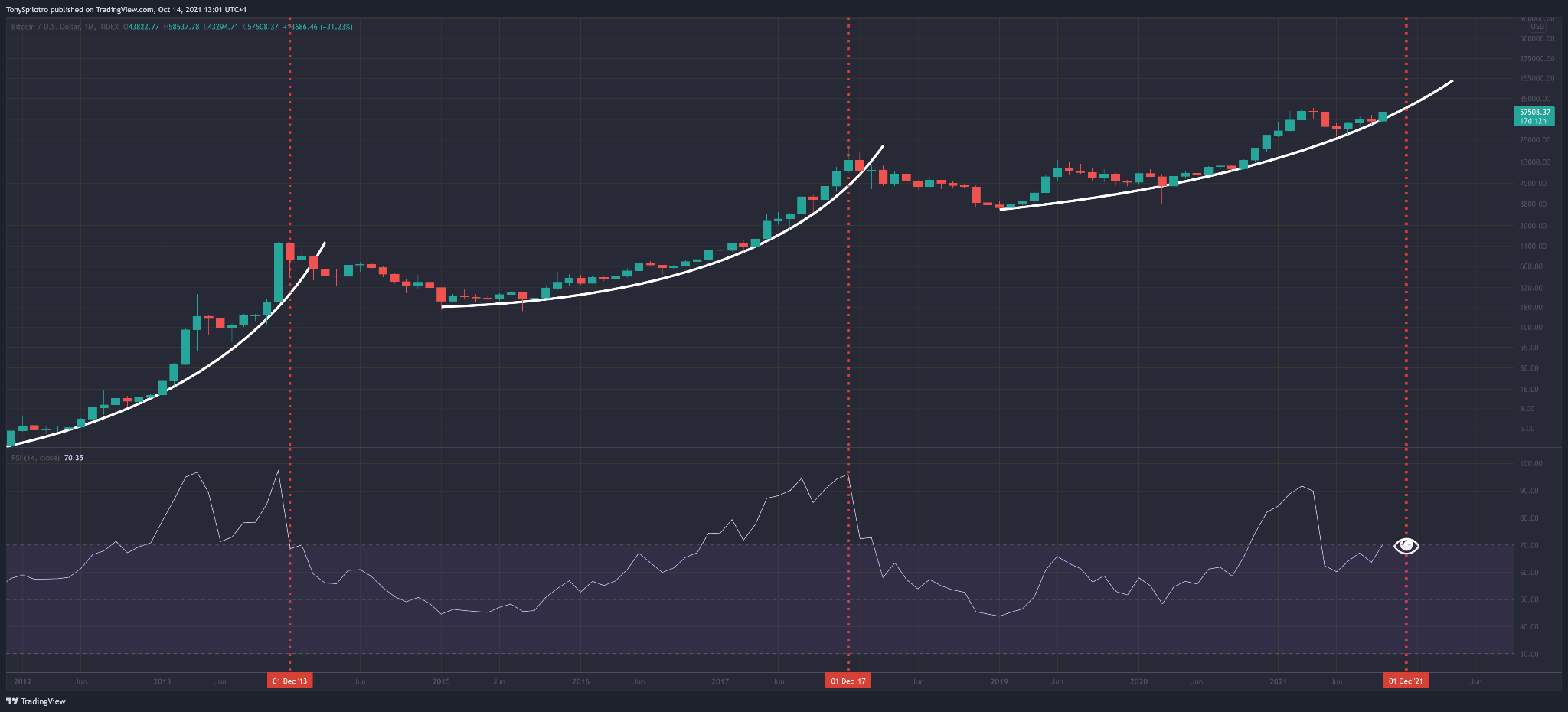

Looking back at price action, courtesy of PrimeXBT’s research retrospective and free built-in charting tools, each Bitcoin cycle thus far has culminated between late November and mid-December.

Each cycle also ended with the monthly RSI above a reading of 70, which typically would indicate overbought levels. During the peak of a bull market, however, assets can stay overbought for an extended period.

Note that in the chart above, the current cycle more closely mimics Bitcoin’s earliest cycle, where mania arrived after a previous high was taken out. The monthly RSI bounced precisely at the 70 level, resulting in a bearish divergence that was ultimately proven valid, leading to Bitcoin’s longest bear market on record.

After such a beating, Bitcoin’s next cycle stayed elevated above 70 for nearly a full year. With Bitcoin a bit more bullish during the most recent cycle, a reading of 70 came early, but so did a correction. Bitcoin price is back at a reading of 70 on the monthly RSI, just as a new parabolic curve seemingly builds another base.

Benefit Best From Bitcoin Mania With PrimeXBT

PrimeXBT traders have the most control over the outcome, whatever it ends up being. Leveraged long positions can make the final phase of the bull run more profitable than otherwise possible, while a well-timed short position near the top could prove to be an even bigger trade.

In the right hands, the award-winning and advanced trading tools can make the most out of the opportunity that possibly lies ahead. Users can buy BTC, trade synthetic contracts on crypto, forex, stock indices, oil, gold, and more, all from a single, secure account protected by bank-grade security.

Personalized services are offered to novices and professionals alike through a dedicated account manager and 24/7 live customer support. A help center and company blog also include valuable market insights, with useful charts like the one provided above.