Key takeaways:

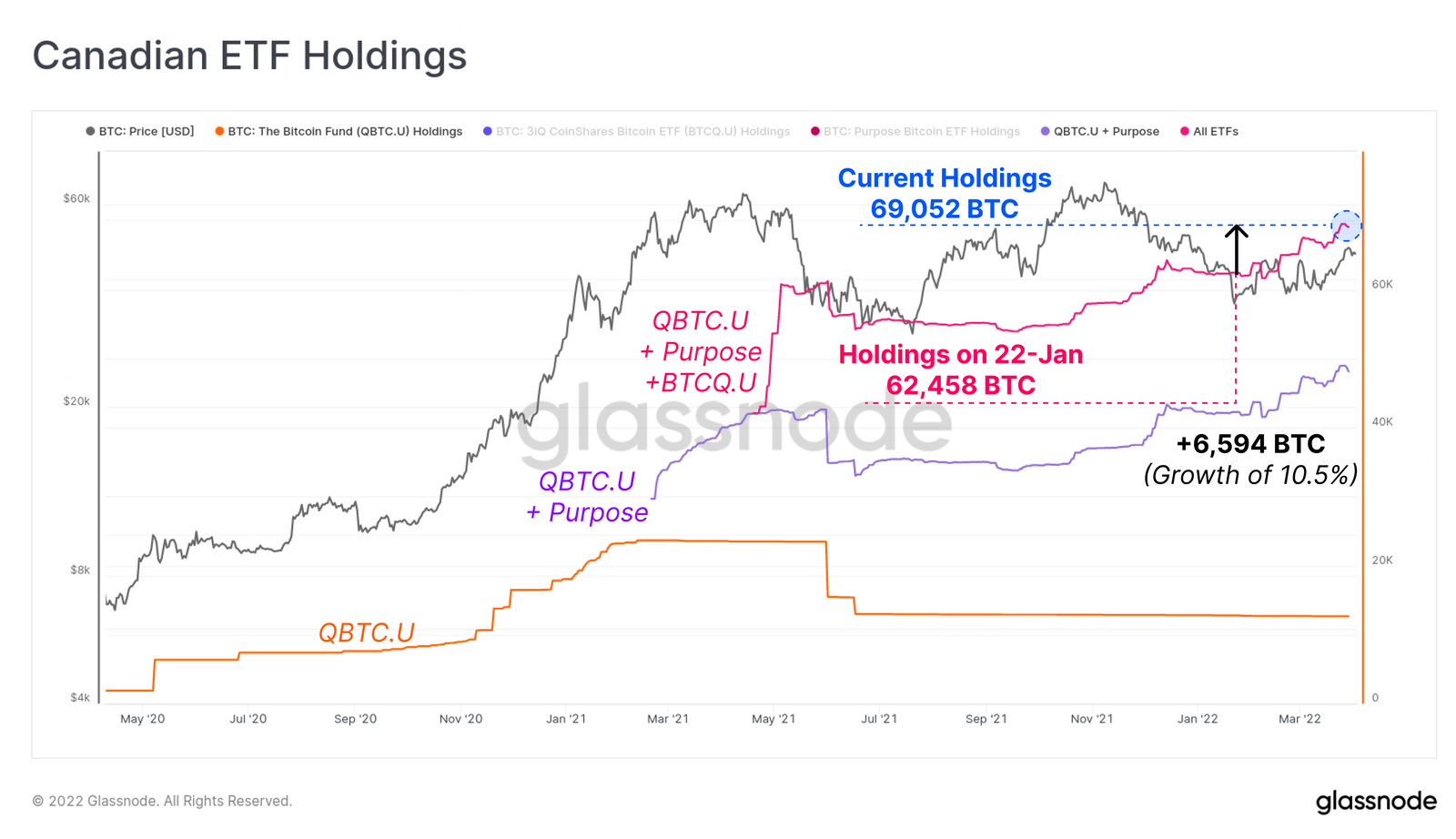

- Bitcoin holdings of Canadian crypto ETFs increased by over 10% since January, according to Glassnode

- The Purpose Bitcoin ETF (BTCC), a physically settled BTC investment vehicle, saw the most growth

- Glassnode noted that market participants are viewing Bitcoin with renewed optimism

Investments in physical Bitcoin ETFs lead the way

According to blockchain analytics firm Glassnode, the holdings of Canadian Bitcoin exchange-traded funds (ETFs) have ballooned over recent months, highlighting the fact that institutional investors are seeking ways of gaining exposure to Bitcoin beyond direct market buys.

Since January, the total amount of BTC held by regulated Canadian ETFs has increased by 10.5%. In absolute terms, this means that the total amount of BTC managed by the leading funds has increased by 6,594 BTC, to 69,052 BTC, in just a couple of months.

The quickest growing ETF in the last three-month period was the Purpose Bitcoin ETF (BTCC), which launched in February 2021 as the first physically settled BTC exchange-traded fund. BTCC gives investors the ability to gain exposure to the world’s largest crypto without having to hold any themselves. Since the start of January, BTCC’s holdings increased by 18.7% to 35,000 BTC.

Market participants view Bitcoin with renewed optimism

Glassnode noted how impressive it is that investors are pouring their funds into ETFs despite rising macroeconomic uncertainty sparked by the conflict in Ukraine and rising commodity prices. The Glassnode analysts also noted that Bitcoin is leaving cryptocurrency exchanges at an accelerated rate as of late, which is usually considered a bullish sign. Glassnode wrote:

“In general, the market appears to be viewing Bitcoin and its role in the future economy with a somewhat renewed optimism. This is most clearly reflected in the net trend of outflows from exchanges, and into self or assisted-custody.”

After a slow start to the year, which saw the price of BTC bottom out at the $33,000 level in January, the world’s oldest crypto has since regained much of its lost ground, and reached its highest YTD price of just above $48,000 last week. At press time, BTC is changing hands in the $45,500 range, about 5% removed from its cycle high.