Theoretically, you can mine 1 Bitcoin in roughly 10 minutes. This is because the Bitcoin blockchain adds a new block (and releases the associated block reward) about every 10 minutes. Realistically, however, you need to make a significant investment in ASIC miners to mine 1 Bitcoin in a reasonable period of time.

Currently, the Bitcoin block reward is 3.25 BTC. If you set up a solo Bitcoin miner and got extremely lucky, you would be able to earn 3.25 BTC in about 10 minutes after you started mining. However, it’s important to understand that this scenario is highly unlikely unless you made a very large investment into Bitcoin mining hardware.

Since Bitcoin mining is extremely competitive and the Bitcoin protocol releases 100% of the block reward to a single miner, most miners would never earn any BTC if they didn’t join a mining pool.

If a miner that’s part of a given mining pool receives a block reward, the reward is split across all miners in that pool, proportional to the amount of hashrate they are contributing to the pool. For example, if you contributed 10% of the pool’s hashrate and another miner in your pool found a block, you would receive 10% of the 3.125 BTC reward (0.3125 BTC).

So, how long does it take to mine 1 Bitcoin realistically?

The Bitcoin blockchain is entirely public, which means we have access to all the information required to calculate roughly how long it would take to mine 1 Bitcoin in various scenarios.

By knowing a mining pool’s average hashrate in a given time period and how many Bitcoin blocks they mined during that period, we can arrive at a rough estimate of how much hashrate is required to mine 1 BTC in that period.

For example, let’s calculate how much hashrate we would need to mine 1 BTC in 1 day on average.

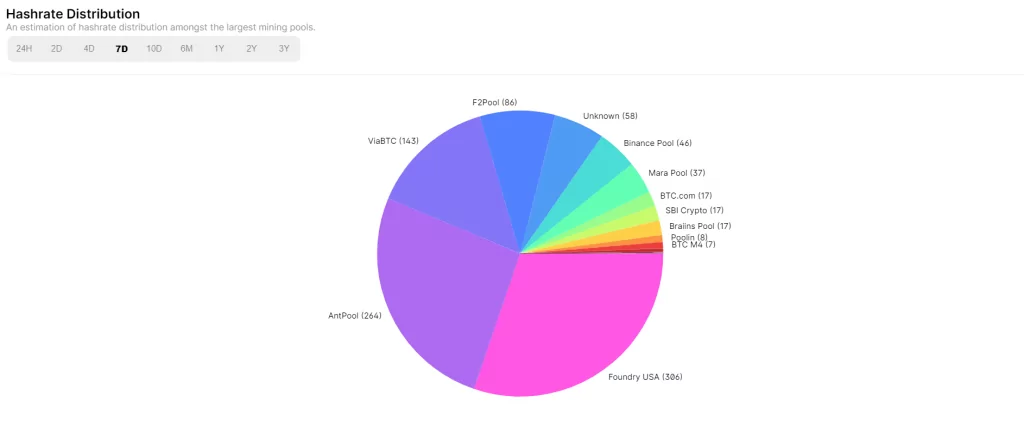

Foundry, which is currently the biggest Bitcoin mining pool in the world, mined 306 blocks in the last 7 days, which translates to 956 BTC in rewards. By dividing this figure with 7, we see that they earned 136.6 BTC per day on average in the last week.

Therefore, you would need 1 / 136.6 (equivalent to 0.7%) of Foundry’s hashrate if you wanted to mine 1 BTC per day on average. The average hashrate of the Foundry mining pool in the last 7 days was 187.9 EH/s, and 0.7% of that figure is 1.31 EH/s. This is how much hashrate you would need to be able to mine 1 BTC per day on average.

Reaching that level of hashrate requires a very large investment. As an example, let’s take the Bitmain Antminer S21 ASIC miner, which produces 200 TH/s and is listed at a price of $5,400 by the manufacturer (prices can vary depending on the merchant).

To achieve the 1.31 EH/s that is currently required to mine 1 BTC in a day on average, you would need 6,550 Antminer S21 miners, which would require an investment of $35 million.

Your computing power determines how long it takes to mine 1 Bitcoin

Now, let’s take a quick look at the following table to get a better idea of how fast you can mine Bitcoin assuming different investment amounts into ASIC miners:

| Amount of Bitmain Antminer S21 ASIC miners | Hashrate | Investment amount | Time to mine 1 Bitcoin |

| 5 | 1,000 TH/s | $27,000 | 1,310 days |

| 10 | 2,000 TH/s | $54,000 | 655 days |

| 50 | 10,000 TH/s | $270,000 | 131 days |

| 100 | 20,000 TH/s | $540,000 | 65 days |

| 500 | 100,000 TH/s | $2.7 million | 13 days |

| 1,000 | 200,000 TH/s | $5.4 million | 6.5 days |

| 5,000 | 1 EH/s | $27 million | 1.3 days |

| 10,000 | 2 EH/s | $54 million | 0.65 days |

These calculations are based on the difficulty of mining Bitcoin as of May 15, 2024 and the assumption that the miner being used is the Antminer S21, which produces 200 TH/s and is listed at a price of $5,400 by the manufacturer.

It’s also important to stress that the calculations above don’t account for other costs of mining Bitcoin, such as electricity, maintenance, cooling and the space where the miners are located. Accounting for these costs would drive the investment amounts required to mine 1 BTC in a given time period substantially higher.

The Bitcoin mining landscape has become even more competitive lately following the Bitcoin halving, which happened on April 19, 2024. The halving reduced the block reward from 6.25 BTC to 3.125 BTC.

Even though the Bitcoin mining difficult has dropped recently, it’s still roughly at the levels we saw in March. This means that mining a Bitcoin block still requires about the same amount of resources as it did in March, but yields half the rewards, which puts significant pressure on less efficient Bitcoin mining operations.

Why Bitcoin miners join mining pools

Without specialized Bitcoin mining hardware, it’s nearly impossible to mine 1 Bitcoin in any reasonable timeframe. For example, trying to mine Bitcoin with a standard gaming GPU won’t work due to the high level of competition in Bitcoin mining.

Solo mining (mining Bitcoin without joining a mining pool) is more akin to gambling in a lottery than a reliable income source, unless you operate a large-scale mining farm with hundreds or thousands of rigs. The most feasible way to earn through Bitcoin mining is by joining a mining pool, which still requires a significant investment in proper mining hardware to make sense financially.

The reason why it’s so difficult to make any profits with solo mining is because the Bitcoin protocol awards each block reward to only one miner. For example, if you controlled just 0.0001% of the total Bitcoin network’s hashrate, you would only have a 0.0001% chance of receiving a reward as each block is added to the Bitcoin blockchain.

Joining a mining pool provides a much more predictable stream of revenue. When any miner in your pool successfully mines a block, you would receive a portion of the Bitcoin reward, proportional to the amount of hashrate you contribute.

The bottom line

With Bitcoin being priced north of $60,000 at the time of writing this article, it’s no surprise that mining 1 Bitcoin is far from a trivial task.

The recent Bitcoin halving has heated up the competition in the Bitcoin mining industry even further, which means that mining only makes sense for miners that can achieve the highest levels of efficiency through low electricity costs, highly effective cooling solutions or other competitive advantages.

If you don’t want to make a significant investment of money and time into Bitcoin mining, it will likely result in a financial loss. Of course, if you want to engage in mining simply from a hobbyist perspective, the financial aspect is less important.

If you want to explore an alternative way of investing into Bitcoin mining, make sure to take a look at our list of the best Bitcoin mining companies to invest in for 2024.