Key takeaways:

- The President’s Working Group (PWG) has released a report assessing stablecoin risks and called on Congress to legislate the booming stablecoin sector

- The PWG has outlined key areas that require additional rules and proposed potential regulatory solutions

- Stablecoins issuers recognize the need for increased regulatory oversight and welcome extra regulatory clarity

After a prolonged wait, the US Treasury Department has finally released its report on risks associated with stablecoins on November 1. The report, which was put together by the President’s Working Group on Financial Markets (PWG), includes several proposals that would introduce stringent measures on stablecoins issuers and enforce additional rules on stablecoin reserves.

Regulators want to put limits on stablecoin issuance and introduce rules for reserves

Stablecoins are digital currencies that are pegged to the value of a certain fiat currency, or to the basket of digital assets from which they derive their value. In essence, stablecoins maintain constant prices regardless of market circumstances. The most prevalent use case for stablecoins is the ability for cryptocurrency investors to easily onboard and withdraw funds from cryptocurrency exchanges and to transfer funds between wallets and services without losing value due to the volatility that other digital assets experience.

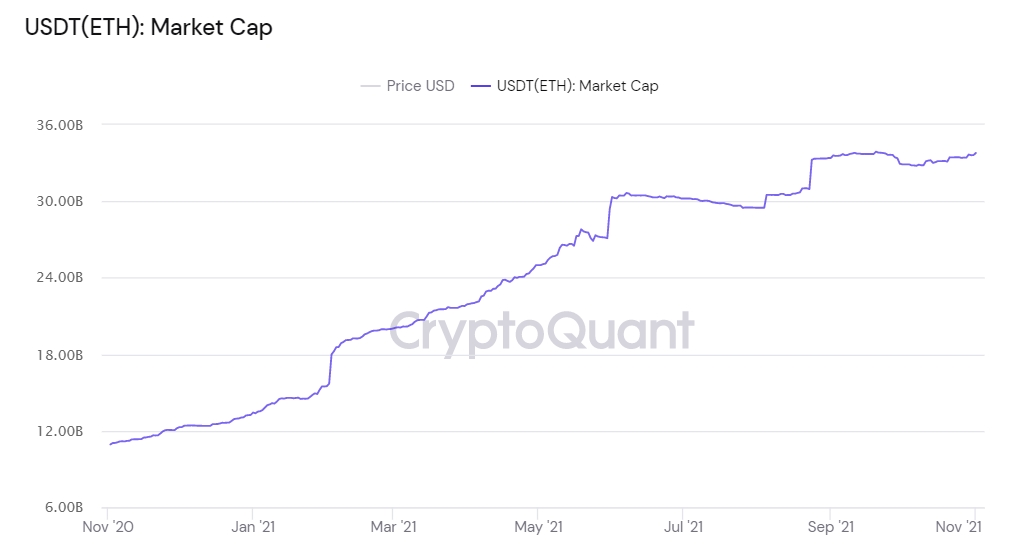

With the surge in their popularity, regulators have become increasingly adamant about how the sector should be regulated. Most notably, Treasury Secretary Janet Yellen has called for a new “regulatory framework” that would legislate the sector back in July.

The PWG has identified several key issues that should in their opinion be addressed by new laws. The PWG has put an emphasis on the transparency of stablecoin reserves and expressed concern over the process of issuance of new stable digital currencies.

According to the PWG’s report, the current “stablecoin arrangements raise significant concerns from an investor protection and market integrity perspective.” The team working on the newly released analysis of the stablecoin sector offered its potential solutions to safeguard users:

“To address risks to stablecoin users and guard against stablecoin runs, legislation should require stablecoin issuers to be insured depository institutions, which are subject to appropriate supervision and regulation, at the depository institution and the holding company level. The legislation would prohibit other entities from issuing payment stablecoins.”

The burden of regulation would fall on the shoulders of various regulators, including the Securities and Exchange Commission (SEC), the Federal Reserve, and the Commodity Futures Trading Commission (CFTC).

The report outlined the need for Congress to act swiftly to enact new laws and regulations that would limit who can issue stablecoins and introduce rules on how to handle stablecoin reserves. According to The Block, stablecoin issuers recognize that stablecoins “are going to be widely regulated,” given the recent surge in their popularity. Additionally, regulators “desire more regulatory clarity” going forward.