Key takeaways:

- Grayscale surpasses the world’s largest spot gold ETF in terms of assets under management

- Investors are becoming increasingly more comfortable with choosing digital assets over gold for inflation hedging purposes

- Despite the rising inflation rates, the price of gold is down over the last year

Grayscale, a leading digital currency investing firm, has announced it hit more than $60 billion in assets under management (AUM), which means that the cryptocurrency investment giant has surpassed now the world’s biggest and most liquid gold ETF, SPDR Gold Shares (GLD).

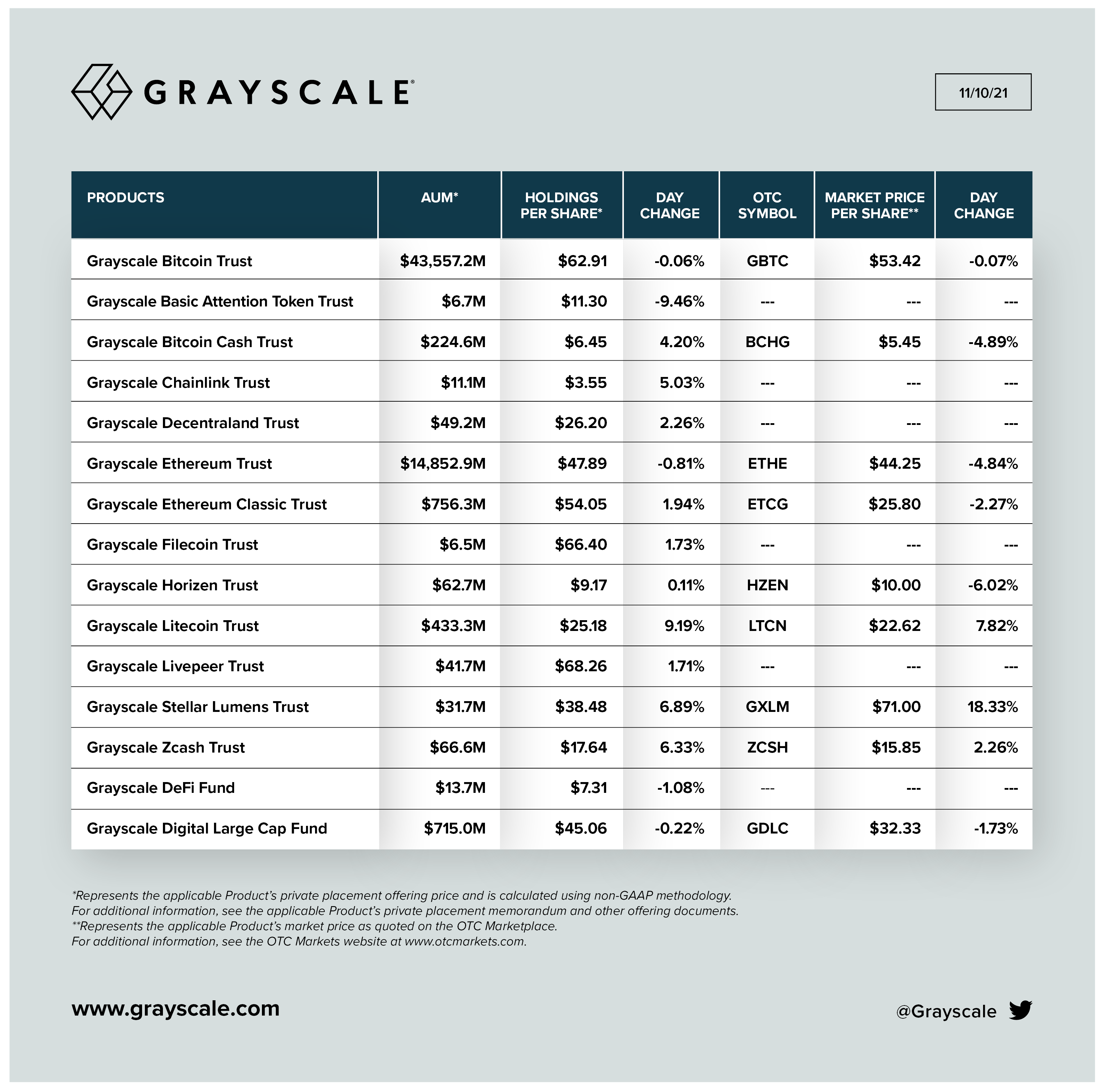

Grayscale controls $60.8 billion worth of digital assets

According to a recent update, Grayscale controls more than $60 billion worth of digital assets across its 15 cryptocurrency funds. Grayscale Bitcoin Trust (GBTC) accounts for the biggest share with 646,000 BTC worth $42.1 billion at current market rates, followed by Ethereum and Litecoin Trusts.

The total value of Grayscale-controlled assets is now roughly $4 billion larger than that of SPDR Gold Shares exchange-traded fund (ETF), whose AUM is currently $57.1 billion.

The impressive bull run that saw the cryptocurrency market cap surpass $3 trillion for the first time ever, and increasing interest from retail and corporate investors alike, are the main reasons for the ‘flippening’ of the world’s largest crypto and gold funds.

Grayscale’s product offering currently includes 15 cryptocurrency trusts, based on some of the more popular digital assets, including BTC, ETH, LINK, LTC, and XLM, just to name a few. The asset management firm recently announced that it is considering expanding its financial products suite with Terra and Avalanche.

Investors are choosing crypto, not gold, as an inflation hedge

Over the past year, it has become apparent that belief in digital assets as lucrative inflation hedge candidates has been gaining traction in traditional financial circles and is no more an opinion held just by blockchain enthusiasts.

For instance, Goldman Sachs’ Global Markets managing director Bernhard Rzymelka recently shared his market outlook on Ethereum and revealed that he believes that the price of the second largest crypto will surge to $8,000 on the tailwind of investors looking for a viable hedge against inflation. Likewise, a group of JPMorgan strategists recently identified inflation concerns as the main reason for the latest BTC rally.

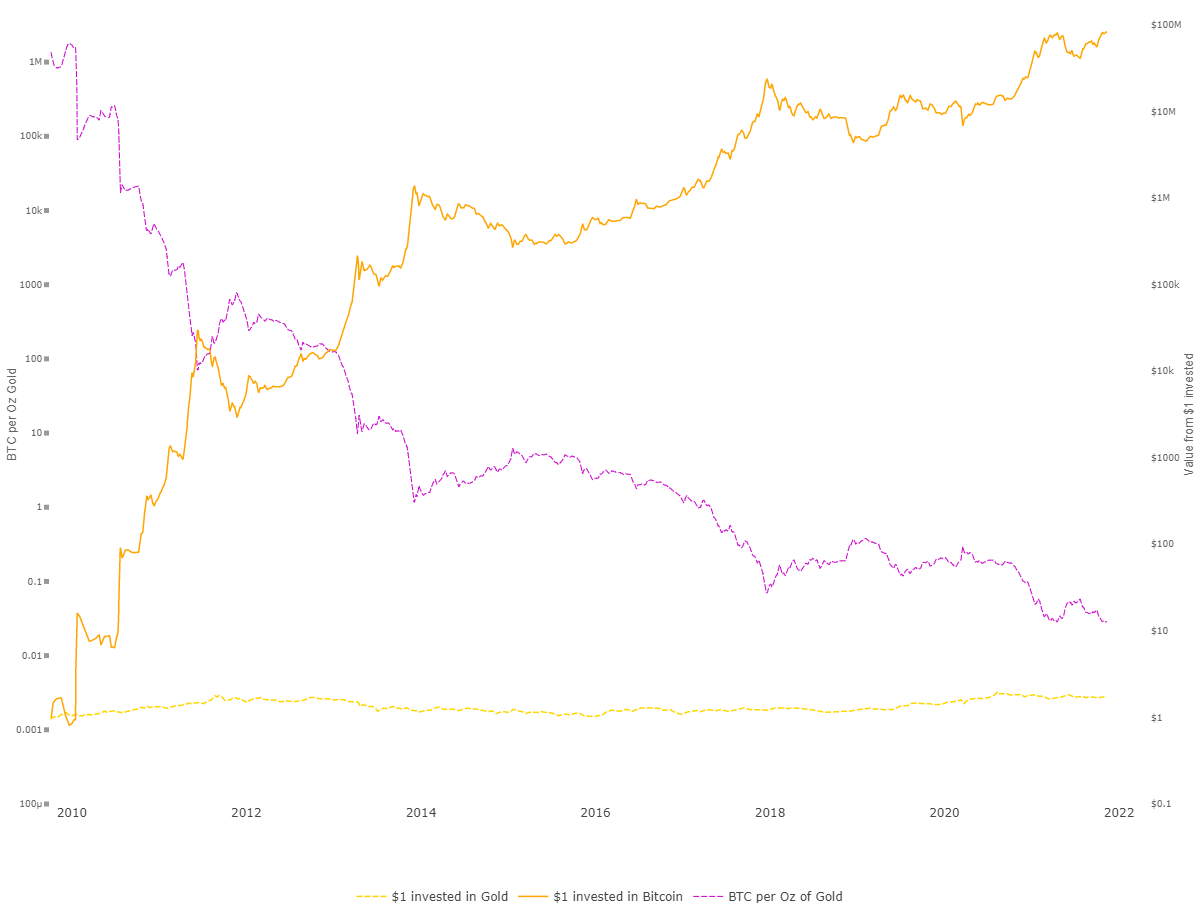

Back in August, we’ve covered a report by Ecoinometrics researchers that concluded that it might be a good idea to sell gold to buy Bitcoin. Judging by the current market activity, they couldn’t have been more correct.

On August 10, the price of GLD closed at $161 per share, while Bitcoin was exchanging hands at an average price of $45,500. Fast forward to today – the price of BTC has increased by over 40% in the last 3 months, while shares of the world’s largest gold ETF increased by a modest 7%.

You might say that the big short-term BTC price increase is, in actuality, a testament to gold as a less-volatile investment that is going to win the race in the long term, especially if inflation rates increase. The data doesn’t seem to support this claim. Gold has been underperforming despite the growing inflation and is currently down by 1.48% in the past 12 month period (data collected on Nov 11).

Over the last five years, the value of gold has improved by roughly 50%, which is a very healthy gain, at least on paper. However, when you account for the massive increase in money supply, which has grown by 20% since 2019 in the US alone, the 50% figure doesn’t seem as impressive anymore. Particularly for a safe haven asset that should perform at its best in times of exponential monetary expansion and diminishing value of fiat.

For reference, Bitcoin has gained 8,900% in the last five years.