Key takeaways:

- Goldman Sachs’ Global Markets managing director Bernhard Rzymelka shared his mid-term outlook on Ethereum

- Ryzmelka believes ETH’s price surge to $8,000 will be fueled by investors looking for a viable hedge against inflation

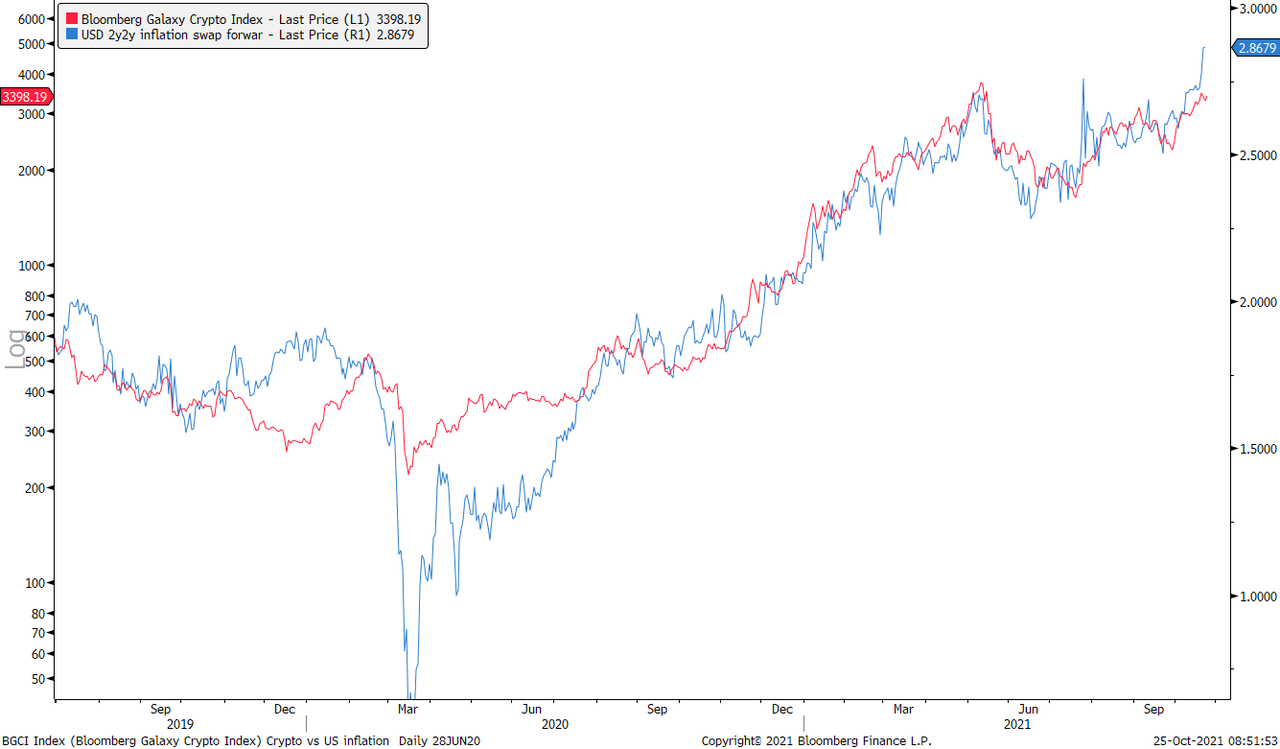

- The prices of digital assets have historically been heavily correlated with inflation rate figures

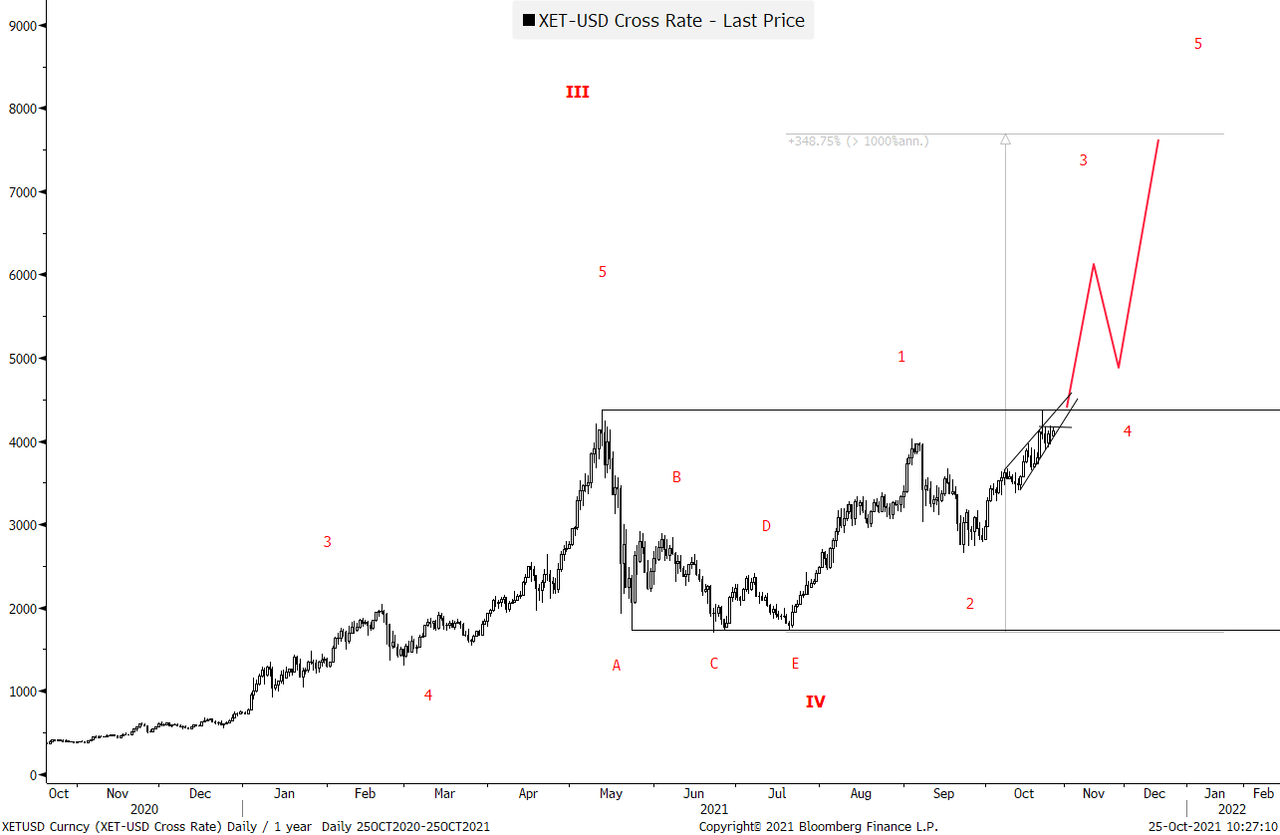

Goldman Sachs, the US-based investment banking giant sees Ethereum surging to $8,000 by the end of 2021. The bank’s Global Markets managing director Bernhard Rzymelka believes the potential 80% price increase will be driven by investors finding Ethereum a suitable candidate to use as a hedge against inflation.

ETH bullish prediction is based on the three-year-long market trend

According to Rzymelka’s note, prices of crypto assets have been heavily correlated with inflation breakevens since 2019, which has played a major role in the cryptocurrency market values reaching new highs.

Many in the crypto community believe that the prices of digital currencies will increase with rising inflation rates. The theory is not predicated on empty assumptions but is supported by the most recent market data.

As we can see from the chart above, the price of ETH has reached a local high at the same time that the inflation spiked to a multi-year high. Rzymelka explained the relationship between ETH price and rising inflation:

“The local backdrop looks supportive for Ethereum… the latest spike in inflation breakevens suggests upside risk if the leading relationship of recent episodes was to hold (grey circles below).”

An important thing to note is that the prediction of Ethereum reaching a historical high of $8,000 by the end of this year is based on the assumption that the economy will keep overheating and the inflation rate will not drop below 2.5% in foreseeable future.

The world’s second-largest crypto is currently trading close to its all-time high. Despite the historical performance, Ethereum’s price rally is likely going to keep up the pace next month thanks to the scheduled launch of micro Ether futures (MET). Starting with December 6, CME Group, the world’s largest financial derivatives exchange will allow traders to gain exposure to Ethereum via the new financial instrument, which will allow investors to trade futures contracts sized at one-tenth of one ETH.

Ethereum has gained 32% in the last month of trading and increased by more than five-fold since the start of the year. Judging by the current state of the market and going by ETH’s performance over the last couple of months, Goldman Sachs predicting an $8,000 price tag for Ethereum seems quite a reasonable take.

Prominent investors and crypto analysts share bullish outlook on digital assets

Goldman Sachs has held a positive stance towards cryptocurrencies for some time now. Earlier in the year, the bank’s analyst recognized cryptocurrencies as an emerging asset class with unique properties and stated that Ethereum might succeed in overtaking Bitcoin as the dominant crypto in the not-so-distant future.

Goldman Sachs is not the only marquee financial institution that has identified the interdependence between rising inflation rates and surging cryptocurrency prices. Last month, a group of JPMorgan strategists attributed the BTC price hike to inflation concerns and not the recently launched Bitcoin futures ETF.

Over the last couple of years, several prominent investors have made it publicly clear that they believe digital assets, in particular Bitcoin and Ethereum, are very likely to succeed in case of a prolonged period of high inflation rates.

For instance, the founder and CEO of Tudor Investment Corp. Paul Tudor Jones sees Bitcoin as a hedge against inflation and a viable store of value asset. Billionaire VC and PayPal Co-Founder Peter Thiel recently said he feels underinvested in Bitcoin and believes that the recently reached Bitcoin’s ATH points to the failure of central banks.

One of the most outspoken members in the crypto community and self-proclaimed BTC maximalist Tone Vays has long held the opinion that $100K Bitcoin by year’s end is not only possible but highly probable. Cryptocurrency market analyst Kevin Svenson not only agrees with Vays but believes that the $350K price point for Bitcoin during the current bull run is not out of the question.