Key takeaways:

- Glassnode researchers analyzed the latest market pullback and found strong arguments in favor of the continuation of the Bitcoin rally

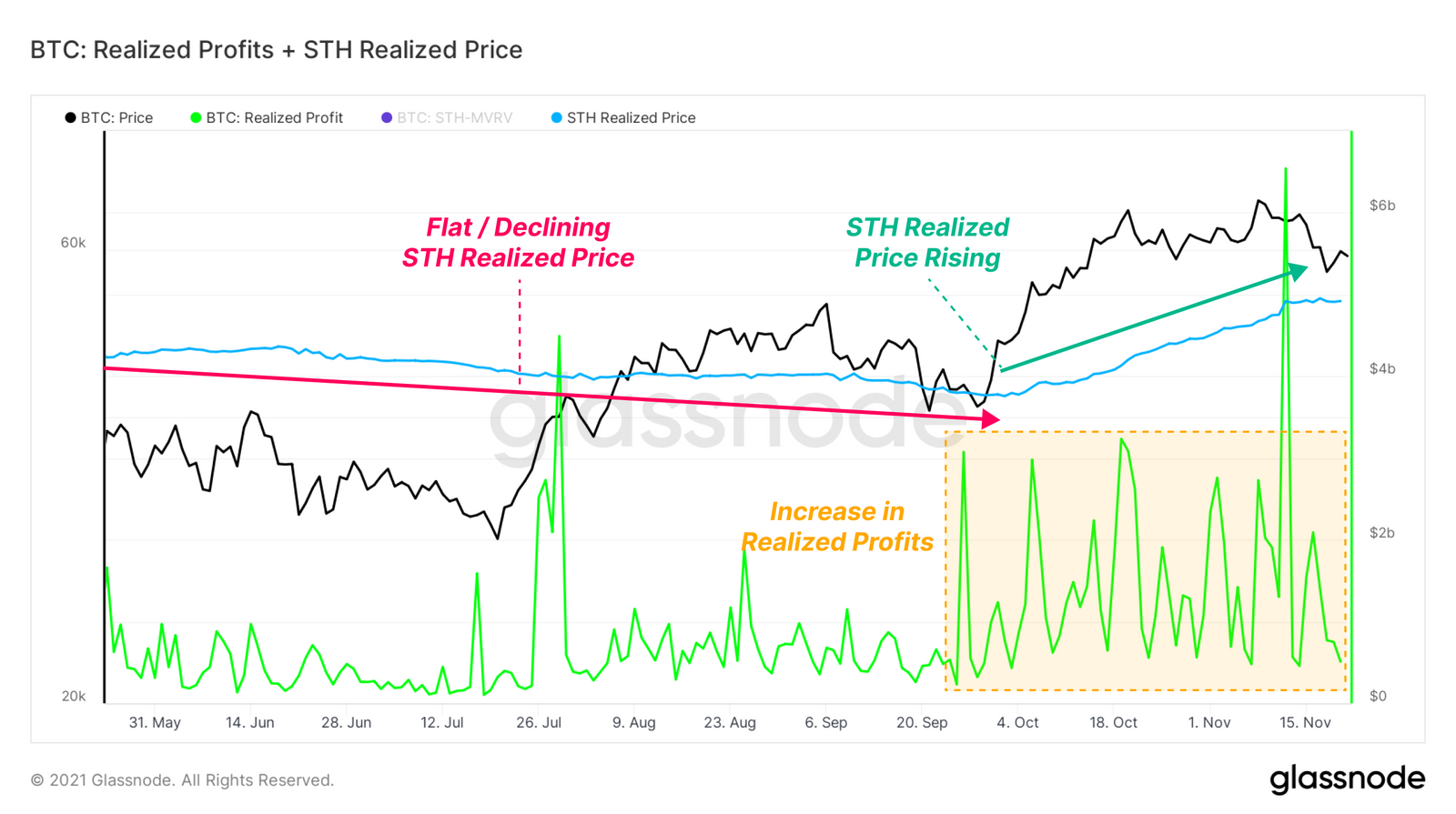

- A drastic increase in profit realization among short-term and long-term holders was the key element for the recent price drawdown

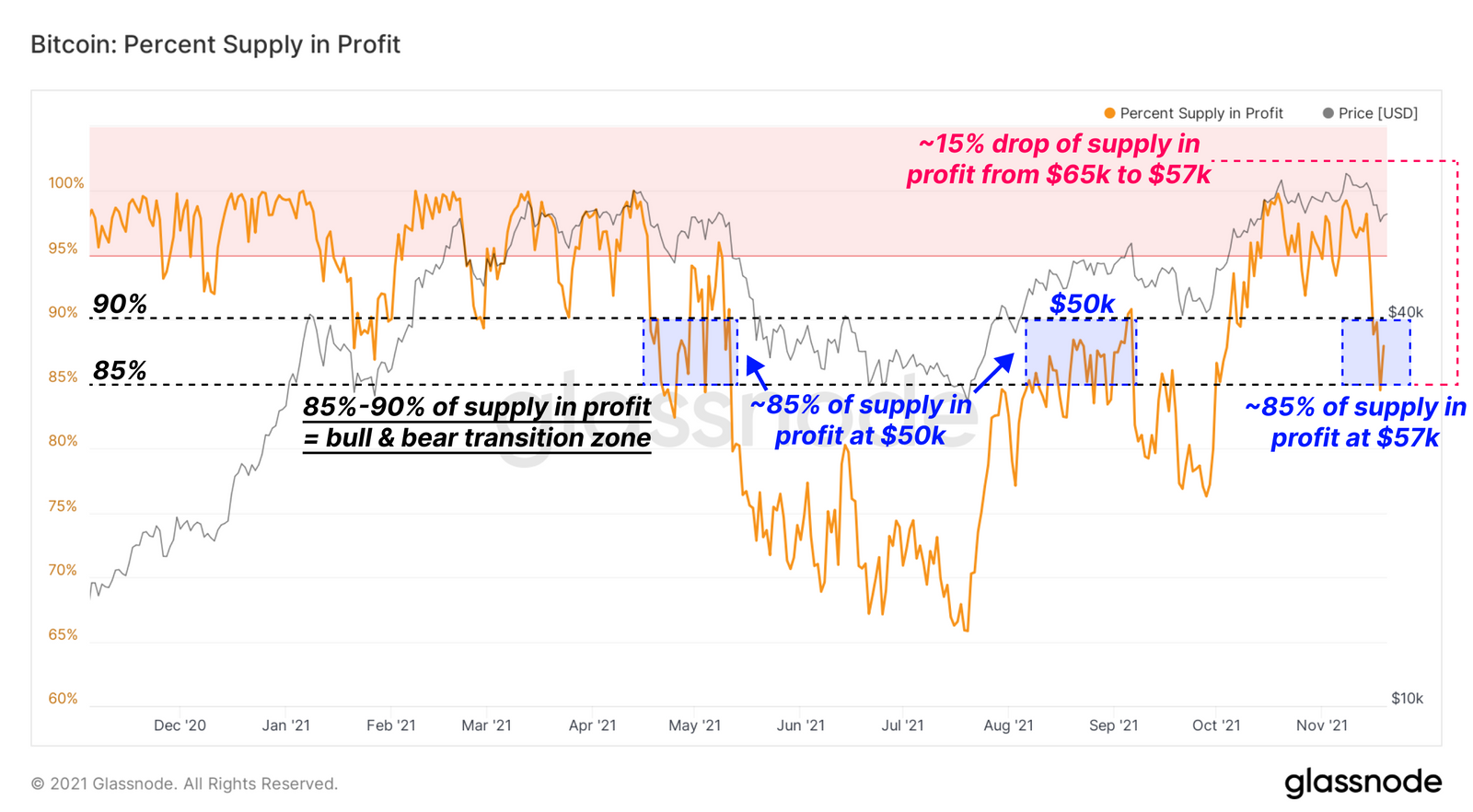

- More than 85% of BTC supply is currently in profit, while the share of short-term holders is at multi-year lows

Glassnode, a blockchain analytics firm, published a new installment of its weekly onchain report on Monday. The report sifted through the recent Bitcoin (BTC) market trends and analyzed how the latest pullback impacted the trading markets.

Long-term Bitcoin holders are at a multi-year high, the share of short-term holders is dropping

The new report analyzed the reasons behind the latest market pullback, which saw BTC’s price drop from its all-time high above $68,000 to the November low of $55,650. Glassnode researchers found unique market properties that have historically been associated with the end of long accumulation periods and a beginning of a new bull market.

However, the latest drawdown didn’t come after a prolonged bearish trend but on the heels of an intense bull market activity, which pulled BTC and the cumulative value of all digital assets in circulation above $3 trillion for the first time ever.

The main culprit for the recent BTC price downturn was the increased share of holders who decided to realize their profits at near all-time highs. Generally speaking, when the profit realization figure climbs higher, it becomes increasingly hard to sustain current price levels and even more challenging to reach new price peaks.

Also, short-term holders (STHs) are disproportionately affected by this market dynamic as they are more sensitive to price movements due to their high price entry point. In turn, they are more likely to take small profits or sell at a loss if the price swings into unprofitable territory.

According to Glassnode, the share of STHs dropped to a multi-year low as new BTC buyers quickly sold their holdings, leading up to the local (and historical) price top. The total BTC supply held by STHs dropped to multi-year lows, below 3 million coins.

The ratio between long-term holders (LTHs) and STHs can shift in favor of short-term investors in only three cases: when new digital currencies enter circulation via the mining process, when coins are removed from exchanges, and when LTHs decide to sell parts of their portfolio.

With 85% of BTC supply in profit at current market rates at the $57,000 price level, LTHs are presumably not incentivized to spend their holdings. Additionally, the number of BTC addresses with some amount of funds deposited has jumped to a new ATH above 38 million.

The amount of non-zero BTC addresses indicates the relatively even distribution of BTC among institutional and retail investors. This claim is supported by data from The Block, which shows that only 11% of BTC supply is held by large holders (defined as addresses that contain more than 0.1% of supply). For reference, large holders own more than 40% of the circulating Ethereum (ETH) supply and close to a third of Cardano (ADA) supply.

Glassnode researchers concluded the report by stating:

“Low STH supply is typical at the end of bear markets and in early bull markets, usually following long periods of accumulation. Seeing STH supply this low whilst price is near ATHs is a relatively unique case.”