Key takeaways:

- Gemini’s newly-published report on crypto surveyed nearly 30,000 adults from 20 countries across different regions

- 41% of respondents said they have made their first crypto purchase in 2021, while an additional 41% said they are interested in making their first investment in the next 12 months

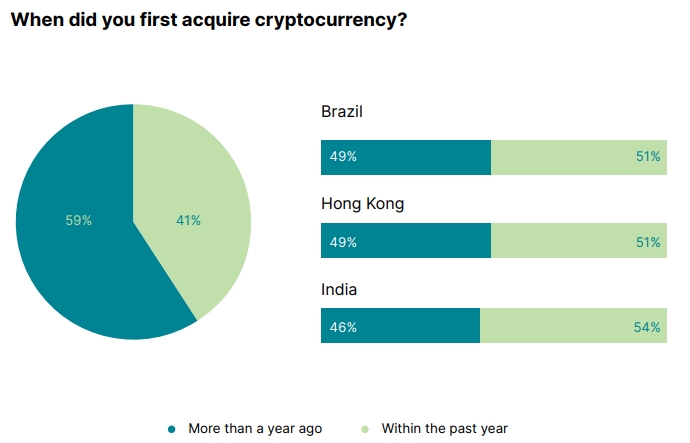

- Brazil, Hong Kong, and India have the highest share of new crypto owners

Inflation concerns were the driving force behind crypto adoption last year

Leading cryptocurrency exchange Gemini has recently published the 2022 Global state of crypto report, in which it documented the main reasons behind surging crypto adoption and highlighted countries that have the highest rate of digital assets ownership.

The Gemini team surveyed nearly 30,000 adults spanning 20 countries in North America, Middle East, Africa, Europe, Asia Pacific, and Latin America regions. The respondents shared their answers online between November 2021 and February 2022.

One of the most interesting findings of the newly-published report was certainly the rapid rate of global crypto adoption. Virtually all regions recorded a double-digit increase in crypto ownership last year, with 41% of surveyed adults saying they bought crypto for the first time in 2021. In a similar vein, the same share of respondents said they are interested in acquiring crypto and will likely do so in the next 12 months.

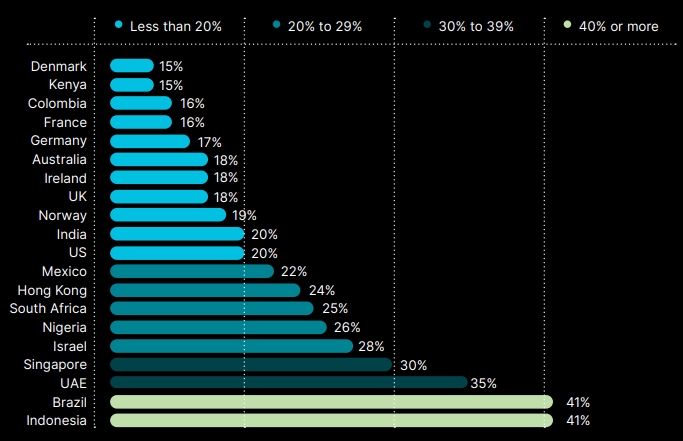

Brazil and Indonesia claimed the top two spots among countries with the highest rate of digital assets ownership. UAE and Singapore were the only other two countries that have an active ownership share of 30% or more.

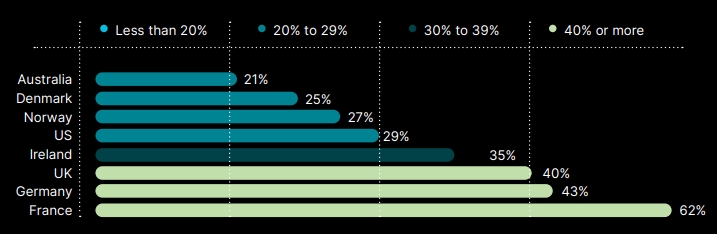

Despite the relatively low share of residents owning crypto in developed countries, it is worth noting that the high-income respondents in developing nations accounted for the largest share of crypto owners. For context, over 40% of high-income respondents in France, Germany, and the UK said they own crypto.

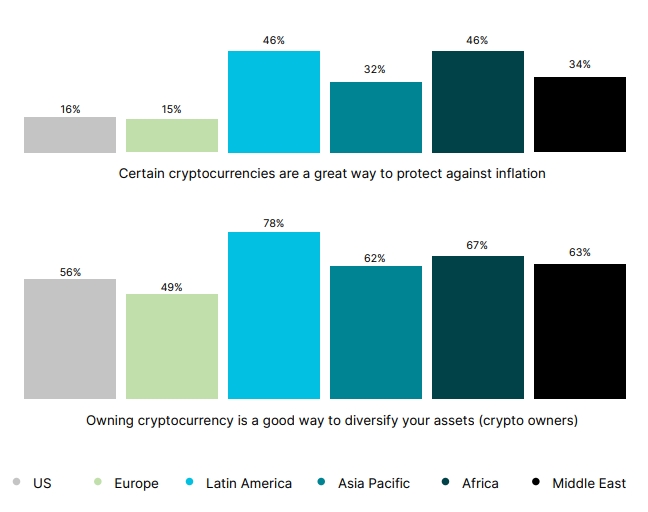

Cryptocurrency adoption in 2021 was in large part driven by inflation concerns and respondents’ search for portfolio diversification. 46% of respondents in Latin America and Africa said they have invested in crypto to protect their wealth against inflation. The data showed that the figure is lower in regions that have more stable local currencies. Case in point, only about 15% of respondents from the US and Europe said they have invested in crypto as an inflation hedge.

The Gemini researchers noted that the vast majority of crypto owners, close to 80% of all respondents, buy and hold digital currencies for their long-term potential.

The researchers also pointed out that 2021 was a pivotal year for crypto, both in terms of the total number of new owners as well as the total amount of investments made in the space. The research wrote:

“In 2021, cryptocurrency reached a tipping point, evolving from what many considered a niche investment into to a global, established asset class.”