Key takeaways:

- Bitcoin and other digital assets lost as much as 20% during Friday’s flash crash, the second-worst 24 hour period for crypto markets since May 19

- Fed’s upcoming interest rates hike intended to combat 30-year high inflation levels has put downward pressure on risk assets, including digital currencies and tech stocks

- The mid-December period has historically been pivotal for Bitcoin’s performance in subsequent months

After a month-long period of downward momentum and trading in a relatively tight range, Bitcoin and the broader crypto market were hit by a severe flash crash on Friday, which torpedoed prices of most crypto assets and, in several cases, sent them to 2-month lows.

What is driving the bearish market trend?

According to a prominent US investor Louis Navellier, the recent market pullback can be primarily attributed to the Federal Reserve’s assumed policy change regarding inflation rates. The world’s most influential central bank will likely elect to reign in the runaway inflation (currently at 30-year highs) by raising interest rates. The US central bankers are not alone in their approach, as Brazil, Canada, and India are considering implementing similar measures.

Bloomberg recently reported that the Consumer Price Index (CPI) rose by 0.7% in November, signifying a massive 6.7% year-over-year increase in the prices of consumer goods and services.

The Fed deems that the low-interest rates and loose economic policy concerning inflation, implemented as critical tools in combating the economic fallout of the Covid-19 pandemic, have achieved their desired effect of lowering the unemployment rate (which fell to a year-low of 4.2% in November) and that not adjusting the monetary policy would end up hurting the economy in the long term.

Bitcoin and crypto assets, in general, have benefited immensely from the expansionary monetary policy central banks across the world have employed to diminish the impact of the pandemic. For reference, Bitcoin’s price tag increased from roughly $4,000 in March 2020 to the all-time high of approximately $69,000 in November 2021 – a whopping 1,600% increase over 20 months.

Speaking to Forbes, the CEO of Florida-based investment firm Zega Financial Jay Pestrichelli, identified similar economic factors at play as Navellier:

“The lower growth paired with potential supply chain issues from the new omicron variant may actually cause the Fed to raise rates more aggressively than previously thought—all in an effort to fight rising inflation.”

The stock markets and crypto markets alike have responded to the potential tightening of the cheap money faucet with distinct negativity. The inherent volatility of crypto markets came to light on Friday when the total market capitalization of all digital currencies in circulation shrank by approximately $500 billion in the span of hours. The stock market also suffered heavy losses, with the most notable losers being technology companies as Tesla declined by 6.4% and Zoom Video by 4.1%.

Mid-December has historically been a pivotal period for Bitcoin

Navellier maintains that the recent advertisement shopping spree by the likes of cryptocurrency exchanges Crypto.com and FTX point to the crypto market top and the mania stage of a textbook bubble. Going forwards, Navallier believes a massive correction is coming in 2022, with the price of Bitcoin falling to $10,000.

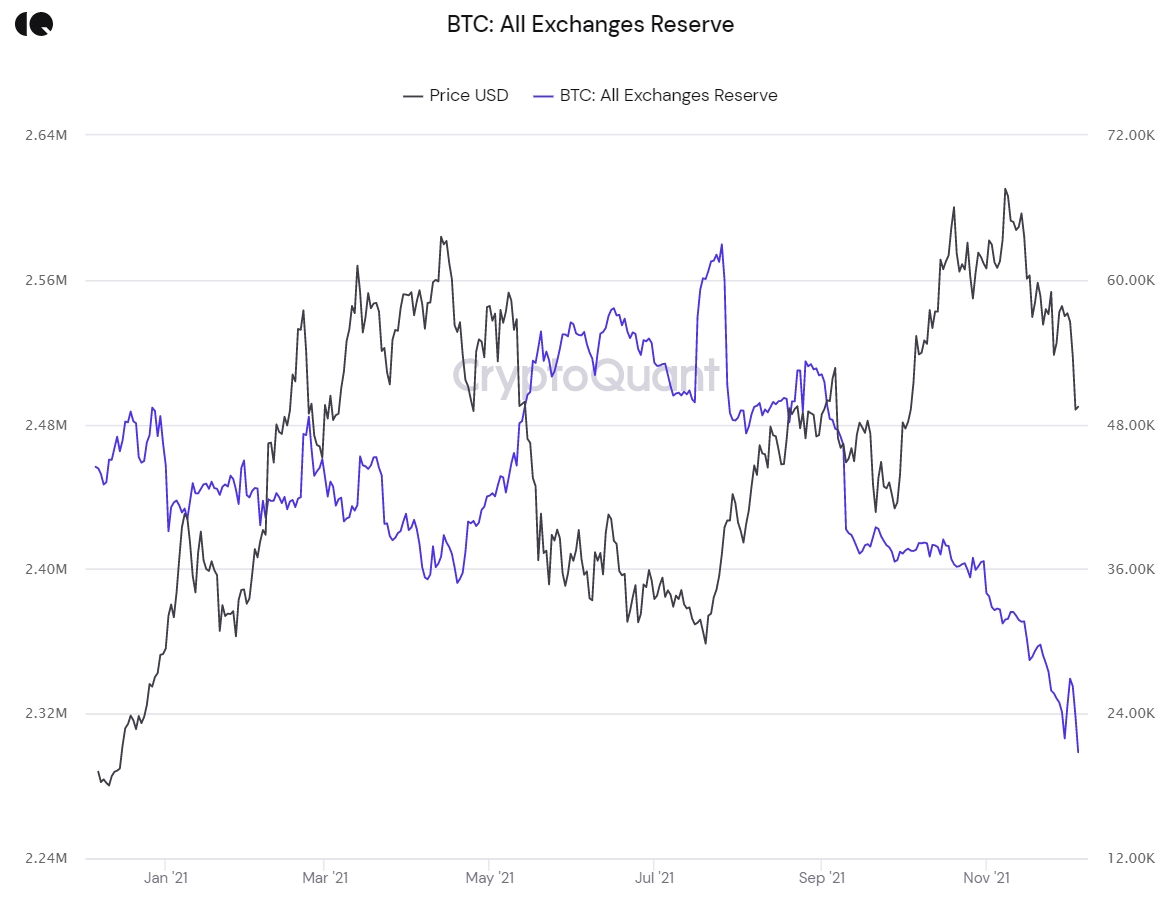

It seems that such a bleak outlook might be premature. For example, the amount of BTC on exchanges keeps dropping, which is generally regarded as bullish as crypto assets are taken off exchanges to be stored in cold storage and removed from short-term trading cycles.

Philip Swift, a crypto analyst and the creator of a learning hub lookintobitcoin.com, has recently shared the multi-year overview of the last five mid-December market periods.

Although past market data shouldn’t be considered a prediction for future trends, given the vastly different broader economic factors at play between different years, it is interesting to observe how mid-December has historically set the stage for BTC markets in subsequent months.

The next few days will likely determine the fate of crypto markets for the next few months. Given the recent developments, it is now all but certain that Bitcoin won’t reach optimistic predictions, made by several analysts, of a $100,000 price tag by year’s end.