Key takeaways:

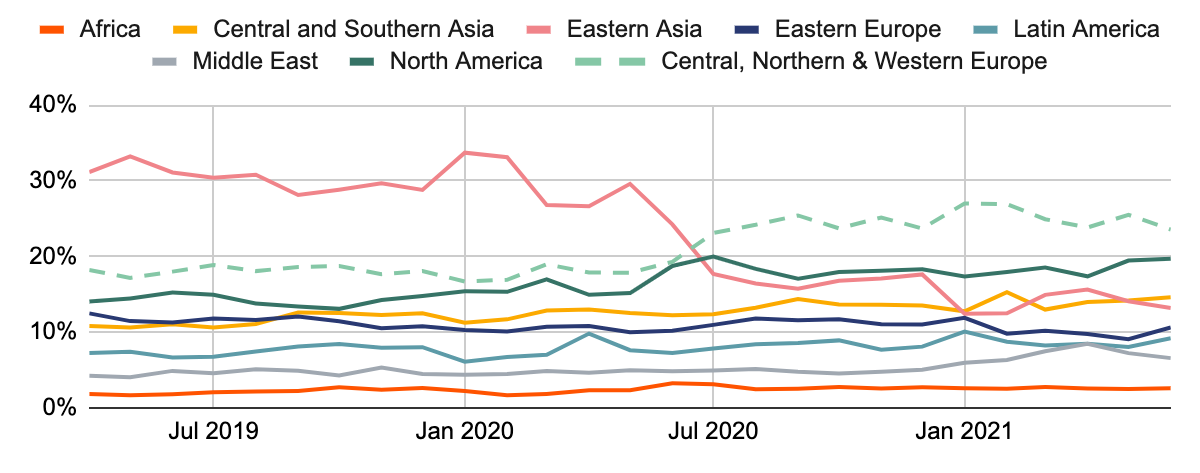

- The region of central, northern, and western Europe (CNWE) has grown to become the largest cryptocurrency economy, accounting for 25% of global crypto activity

- Per the Cainalysys report, decentralized finance services and institutional adoption have been the main drivers behind the uptick

- Institutional-sized transactions have overtaken retail investors and professionals in the past year

Europe has grown to become the largest cryptocurrency economy in the world, with a quarter of total global activity, according to the latest report from Chainalysis. The region of central, northern, and western Europe, or CNWE, has mostly benefited from a massive uptick in the use of decentralized finance (DeFi) protocols, and increased interest from institutional investors.

CNWE region accounts for 25% of global crypto activity

The report analyzed data spanning from July 2020 to June 2021. In this time frame, the CNWE region recorded an increased across all different cryptocurrency sectors, however, the DeFi sector has seen by far the most growth.

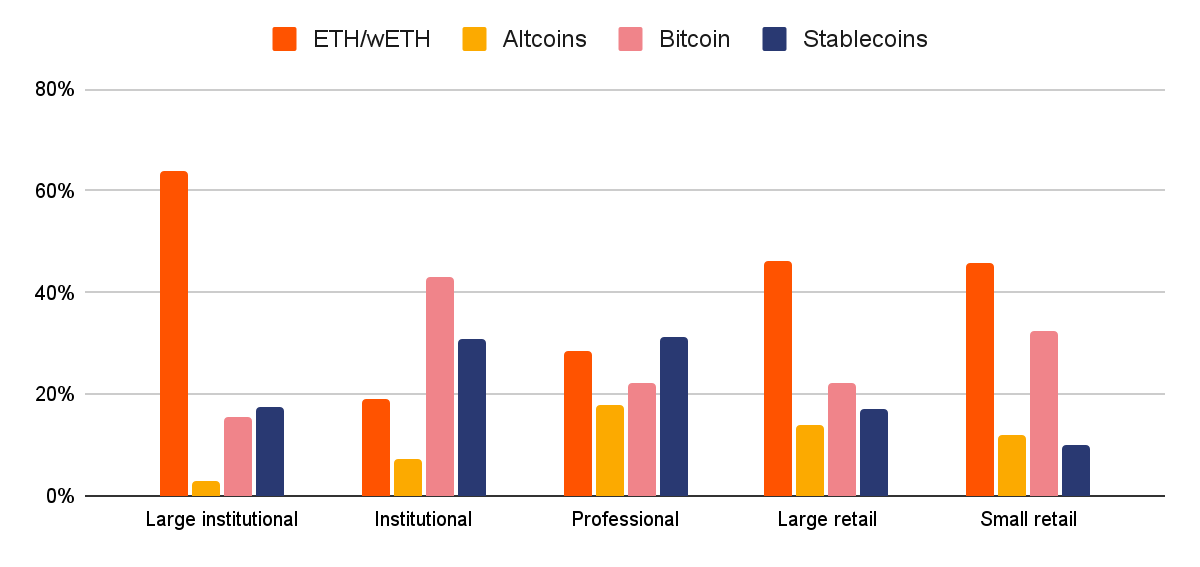

The DeFi boom is evident when looking at transaction activity by coin type. Ethereum and Wrapped Ethereum have seen the most activity across different categories, spanning from large institutions, to small retail investors. Perhaps the most interesting thing to note is the large discrepancy between Bitcoin and ETH among large institutional investments, as combined ETH/wETH transactions amounted to almost 4-times more than BTC transactions in the same time period.

In the past 12 months, CNWE managed to overtake the Eastern Asia region to become the leading digital assets economy. Eastern Asia lost its top spot mostly due to China’s crackdowns, which have thoroughly shaken up the blockchain industry and decimated the crypto activity in the region. The region is likely to sink even lower once the effects of China’s blanket crypto ban become apparent.

The CNWE region is followed by North America, and Central and Southern Asia. Apart from the downfall of Eastern Asia, there have been relatively few changes in the order of global regions and their share of crypto activity in the past two years.

While the relative share of crypto activity by regions remains relatively stable, global cryptocurrency adoption has seen a massive uptick, and is up more than 800% in the last year. The huge spike can mostly be attributed to the increasing number of peer-to-peer transactions in emerging economies.

Institutional investors are among the main drivers of increased crypto adoption

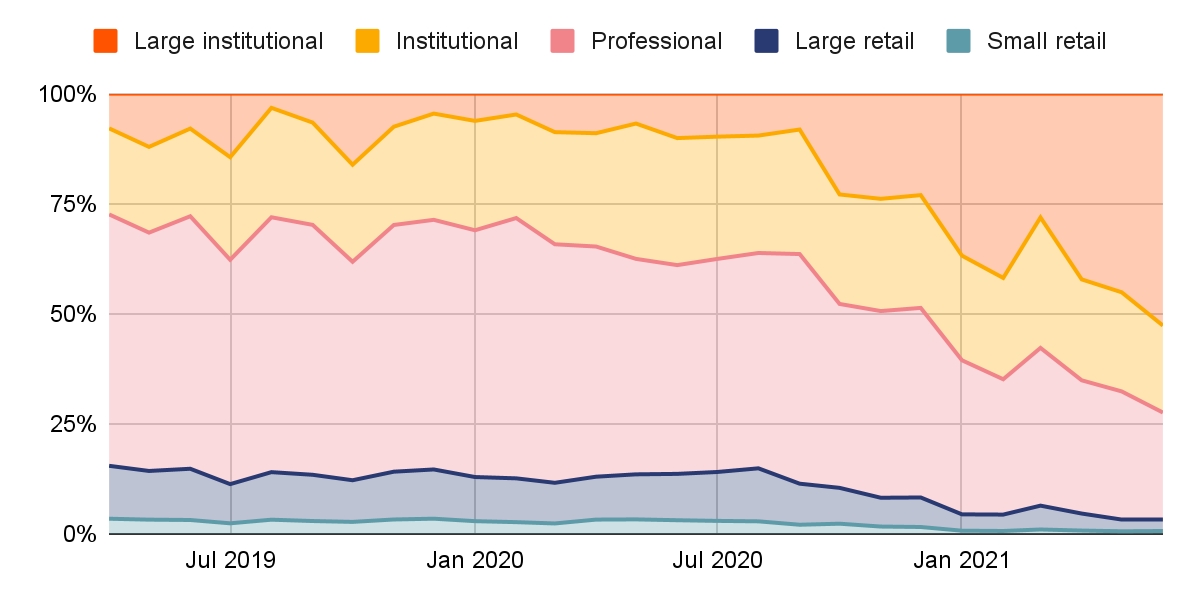

Since 2019, institutional-sized crypto transactions have overtaken the combined share of retail and professional investors, and now account for roughly 70% of all transactional volume. For reference, Chainalysis defines transfers worth above $10 million as large institutional transfers.

While the combined value of large institutional transactions amounted to just $1.4 billion in July ‘20, the amount grew to $46.3 billion by June of this year. Per the report, the majority of large transactions were sent to various DeFi protocols, with Ethereum being the most used token type. Uniswap and Instadapp were the most used DeFi services and received the largest amount of sent funds.

Institutional adoption keeps on gaining steam in recent months. For instance, institutional investors now hold more than 1.4 million BTC, which represents 6% of the total supply of the world’s largest crypto.