Key takeaways:

- Ki Young Ju, the CEO of on-chain and market analytics tools provider CryptoQuant, predicts that we will see an ETH ATH before a new BTC ATH

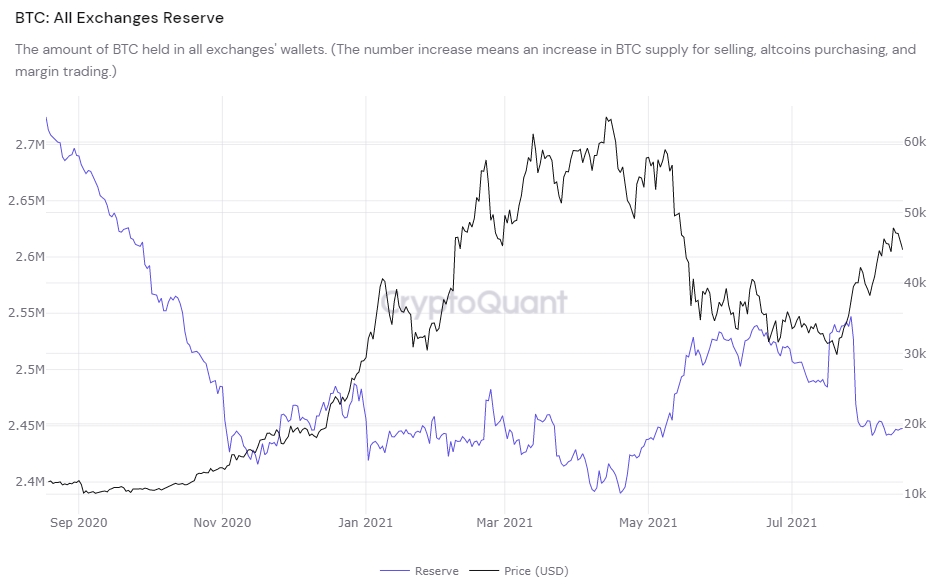

- Ki uses exchange flows and cryptocurrency reserve amounts as an indicator for his prediction

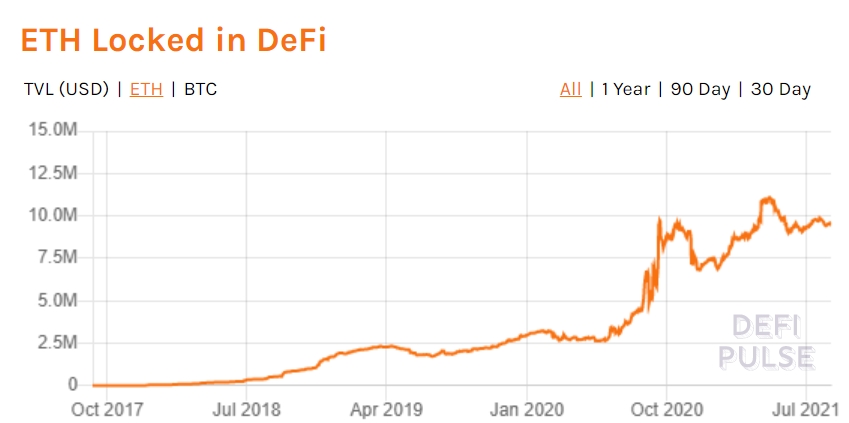

- Ethreum is underground a bigger supply shock than BTC, with London upgrade, Eth2 staking contract, and DeFi applications shrinking the circulating supply of available tokens

According to Ki Young Ju, CEO of on-chain and market analytics tools CryptoQuant, we are more likely to see Ethereum reach its all-time high before Bitcoin does. Ki points to the fact that ETH’s sell-side liquidity crisis is still intensifying, while BTC hit its lowest reserve levels on crypto changes back in May, to support his prediction.

Analyzing Bitcoin and Ethereum exchange flows

Bitcoin exchange reserves have experienced a sharp decline from over 2.71M BTC in September 2020, to 2.39M BTC at the lowest point in May 2021. After bottoming out the reserve grew in June and July, before a considerable drop heading into August.

On the other hand, Ethereum exchange reserves have seen a continuous linear drop that saw the ETH reserve amount drop from 26.2M ETH in Aug 2020, to 19.4M on Aug 17th, which signifies a 28% year-over-year decrease and at the same time a renewed two-year low.

According to CryptoQuant’s CEO, who has amassed a community of 230K Twitter followers and has over the years become a renowned figure in the cryptocurrency space, the Ethereum supply shock is more severe as can be deduced from the images of exchange flows above.

Eth2 staking contract, London upgrade and DeFi-related use-cases have shrunk the amount of available ETH

The demand for the second-largest cryptocurrency has started increasing long before the London Hard Fork has live on August 5th. A month earlier, CEO of ConsenSys Joseph Lubin identified key factors about the Ethereum network that pointed to an imminent increase in prices. In the market rally following the London update, the total market cap grew by more than $200 billion.

EIP-1599 went live as a part of the London upgrade and introduced Ether burning and thus brought additional deflationary pressure on EHT. Furthermore, with the Ethereum 2.0 upgrade reportedly coming sometime by the end of this year, the number of ETH tokens staked in the ‘2.0’ contract is immense. According to analytics provider Nansen, Eth2 staking contract holds 6.73 million ETH, which are worth more than $20 billion at current prices.

Additionally, there is 9.6 million ETH locked in Aave, Maker, Compound and other popular DeFi protocols, which provide an added layer of pressure on the Ethereum supply. At the moment, Ethereum is retesting the $3,000 support level that was breached on August 7.