Key takeaways:

- The impact of Ethereum burning is becoming ever more apparent; ETH circulating supply decreased by over 300 ETH on October 27

- The deflationary pressure was introduced along with the launch of EIP-1599, which went live as a part of the London hard fork in early August.

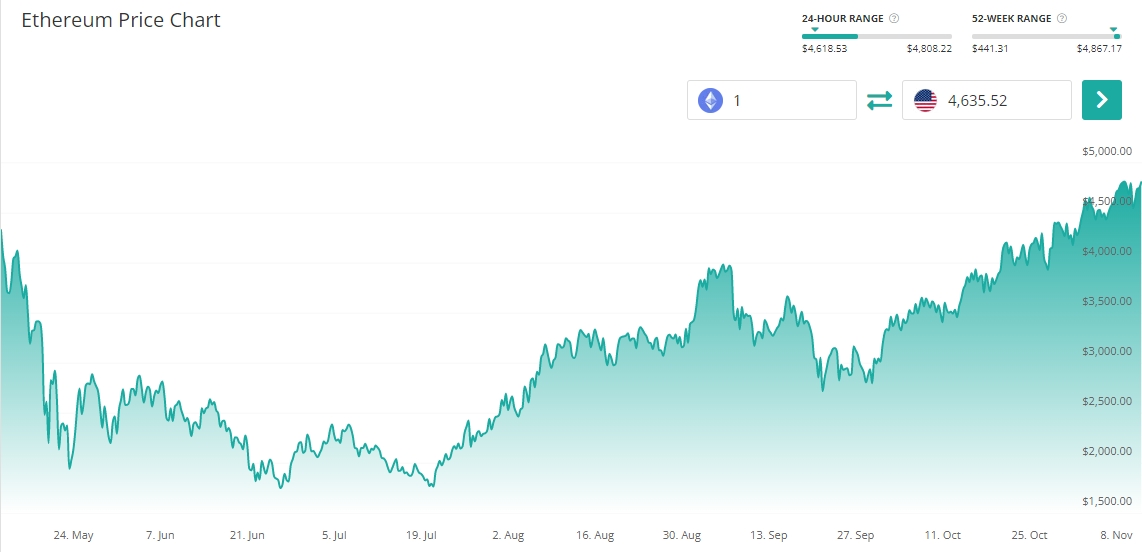

- The price of ETH has increased by roughly 70% since the London upgrade was rolled out

Ethereum’s circulating supply decreases for the first time ever

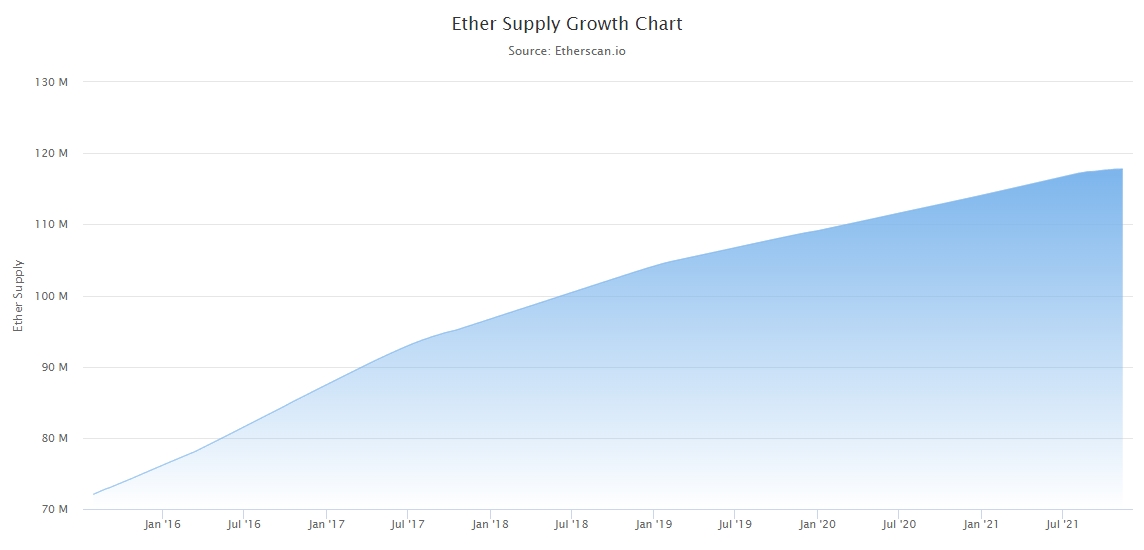

For the first time since being launched in 2015, the total amount of Ethereum tokens in circulation has decreased by 307.96 ETH on October 27. The monetary deflationary pressure was introduced to the Ethereum network with the launch of the London hard fork in early August, which included a set of five Ethereum improvement proposals (EIPs).

The EIP-1599 was at the center of the new protocol upgrade. It improved the estimation system of transaction costs for the users and, most notably, changed the way transaction fees are handled – fees that were previously paid to miners are now removed from circulation and burned.

About a month before the hard fork launched, ConsenSys CEO Joseph Lubin predicted a massive increase in demand and value of ETH. When Lubin made these claims, the price of Ethereum had fallen to a then-four month low below $1,800. Now, roughly ten weeks after the London upgrade went live, the effects of Ethereum burning couldn’t have been more apparent.

It didn’t take long for Lubin’s predictions to become a reality. Exponential demand for Ether tokens on top of decreasing supply has pushed the price of ETH to its all-time high earlier in November. At its peak on November 10, ETH was exchanging hands at $4,867 per token, far beyond July’s lows. With a circulating supply of over 118 million tokens, Ethereum’s current market cap stands at $548 billion, accounting for almost a fifth of the total market value of all digital assets in circulation.

On top of the extraordinary bullish market sentiment that is permeating the crypto market as of late, Ethereum benefited from several positive news coming its way over the past few weeks. For instance, CME Group, the world’s largest financial derivatives exchange, announced it will expand its crypto product portfolio with the launch of Micro Ether futures (MET). Additionally, investment banking giant Goldman Sachs recently predicted the price of ETH will surge to $8,000 by the end of the year on the tailwind of institutional investors looking for a lucrative inflation hedge candidate.

The launch of Ethereum 2.0, the biggest network upgrade to date, is slated for early 2022. The ‘2.0’ update will replace the outdated and highly energy-consuming proof-of-work (PoW) with the efficient proof-of-stake (PoS) consensus mechanism and likely solidify the Ethereum platform as the de facto leader for decentralized applications and non-fungible tokens (NFTs) for years to come.