Key Highlights:

- The Ethereum foundation has launched Medalla, one last testnet before Eth2

- After transitioning to Eth2, Ethereum miners will turn into validators… if they can

- The price of the coin has been showing encouraging action over the summer, what’s next?

In the afterlife of Eth2, also known as Serenity, we will be witnessing such epic features as Sharding, PoS and as Vitalik Buterin has put it, “an opportunity to participate in the network at all scales”. This means that a regular user will be able to validate. No professional mining and staking farm needed, no tons of electricity spent, just enough money in your account. The minimum threshold is 32 Ether.

Let’s examine the Medalla testnet, future Ethereum validators and the current price action in detail.

Why Medalla is important

The road leading to Serenity, the new state of Ethereum, isn’t so bumpy as it’s long. In order to reach this state, the developers will need to roll out phases 0, 1 and 2 throughout the years to come.

Medalla has definitely pushed us closer to phase 0, that’s why everybody was so pumped not only about the switch but also the price of the asset.

When developers make sure the final multi-client public testnet is safe and sound to run, they will switch to the Beacon Chain, an important part of the whole Eth2.

This chain will manage the PoS consensus, including validators and shards. And shards, in turn, are a key feature of the new protocol since not only do they store their state, but also improve the overall transaction throughput.

So in phase 0, we will already have the Beacon Chain implemented. Using manifold testnets, the Ethereum devteam has already tried its features and functionality, but with Medalla, the whole world can participate in the test.

Let’s have a peek at the roadmap that was leading us to the Eth2 state and those latest testnets.

The road to Medalla

The Ethereum devteam has been working on the switch to the Serenity state for quite some time now. In Vitalik Buterin’s words, such a switch appeared on the agenda from the very beginning.

But everything started from the Frontier phase (2014-2015), the earliest implementation of Ethereum that culminated in the finished product going live in 2015.

The next one was Homestead (2016-2017), the phase to stabilize the network, and then Metropolis, the phase (2017-2020) preparing us for Serenity, followed.

This very last phase was all about security updates, a larger automation degree and of course testnets to run the Beacon Chain functionality. Let’s catch a glimpse of those testnets.

The Beacon Chain in miniature saw the light for the first time on the Sapphire testnet in April 2020. The nodes used small deposits of 3.2 Ether.

The Topaz network appeared in May with nodes using 32 Ether. Later, in June, the Onyx testnet gathered around 20,000 validators, and Altona was running steadily in July, and then, Medalla popped up.

So, what’s your role in this new play?

Miners or validators?

As you know, with the Proof-of-Work algorithm, miners spend a lot of energy to solve difficult puzzles.

With Proof-of-Stake, there will be no place for miners, but there will be validators who put bets on potential blocks and get rewarded in accordance with the staked money.

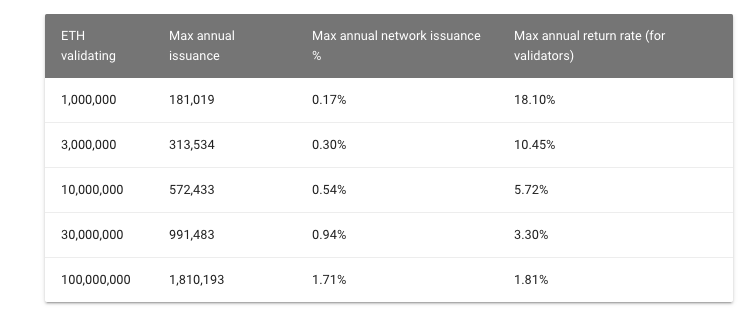

How much money will the validators make? It all depends on the total amount of Ether at stake.

The more Ethereum in the ecosystem is at stake (see column 1), the less annual return the miners will get (column 4), and vice versa. However, the total amount of the minted coins (columns 2, 3) will increase in proportion with the amount of Ether at stake.

As a future validator, however, you should be aware of the fact that you might be given a ticket, too, for inadvertent and malicious actions.

The Ethereum price matters

Essentially, the launch of Medalla signified an important shift, which already had an impact on the price of the asset.

It’s not financial advance, however, take a closer look at the way Ether has been acting over the past few months.

Several things factor in the bullish trend, including DeFi growth, the altcoin season flourishing and of course the ETH 2.0 momentum.

So keep your eye on Vitalik’s coin because it might be interesting to watch in the next few weeks.