With each passing year, cryptocurrency enthusiasts have access to more and more options to invest in digital assets. From spot market trades to a plethora of derivatives products and decentralized finance (DeFi) services, it can sometimes feel overwhelming picking among numerous trading options and strategies.

Dollar-cost averaging (DCA) is an old and proven method that allows both newcomers and veterans to start building their portfolio one scheduled buy at a time. In this article, we are going to explain the benefits of DCA and show how you can set it up on Binance.

What is dollar-cost averaging (DCA)?

Dollar-cost averaging is a simple investment technique that requires little to no investment knowledge and can be properly executed as long as its main principles are diligently followed. With DCA, investors make equally sized scheduled buys with a predetermined amount of funds no matter the market conditions.

For example, you can commit to investing $100 in Bitcoin every first Monday of the month. This negates the need for identifying optimal entry points, which is often the main obstacle holding people back from investing in crypto, or traditional markets for that matter. In addition, the inherent characteristics of DCA let investors prioritize long-term goals over short-term market fluctuations.

How does dollar-cost averaging work?

When using DCA, funds allocated for investment are spread over a longer period of time in order to pursue a potentially lower average price of assets bought than if they were bought at the same time. Let’s examine this premise in more detail in the following theoretical example.

Let’s say you are prepared to invest $1,200 in Bitcoin. If you decide to invest in one lump sum, the performance of the investment would be highly correlated with the market state at the time of the buy. On the other hand, DCA alleviates the short-term price swings and allows investors to “average out” their investment over time. For instance, you could decide to invest the full $1,200 amount in 12 equally sized monthly purchases over the span of an entire year.

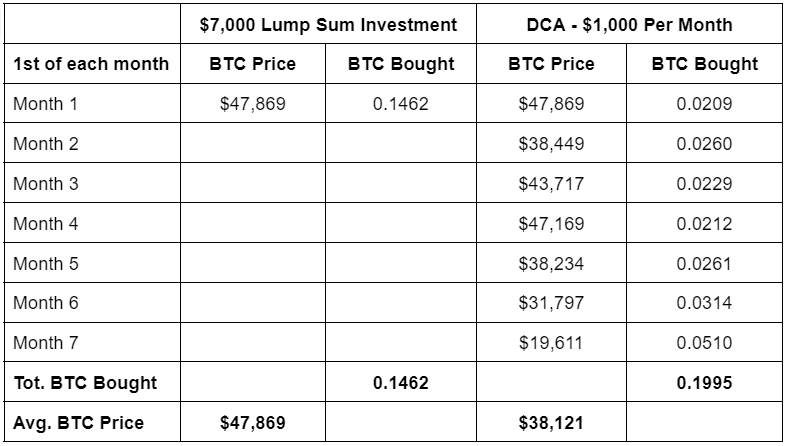

While investing in one lump sum can be more profitable than DCAing, if buying at an opportune time, it is also way riskier, stress-inducing, and susceptible to bad timing. To illustrate this point, let’s compare two scenarios – in the first one, an investor bought $7,000 worth of Bitcoin at the start of 2022. In the second scenario, an investor spent the same amount of money over the span of seven monthly buys of $1,000 apiece.

Due to the broader crypto market downturn, both investors showcased in the two hypothetical scenarios would have lost money. However, the difference in overall returns is quite stark. Going by the market rate of $22,125 per BTC (the rate at the time of writing), the lump sum investor would have lost 53.8% on its BTC investment, ending up with $3,234 worth of BTC out of the initial $7,000 investment.

The investor making $1,000 monthly purchases on the first day of each month, would have lost 41.8% on the crypto investment, ending up with $4,081 worth of BTC out of the initial $7,000 investment.

In relative terms, the second investor attained roughly 25% better BTC price entry point due to spreading out the investment over a longer time period.

Benefits of dollar-cost averaging

There are many advantages to dollar-cost averaging, which has allowed the investment strategy to pass the test of time and grow to become one of the most widely used techniques since being first introduced in Benjamin Graham’s book The Intelligent Investor in 1949.

1. Risk Reduction

The risk of loss is heavily reduced when averaging out the investment over a longer period of time. The added benefit of a strict investment regimen is that investors are more likely to take emotions out of investing, leaving them prepared to make rational decisions no matter which way the market moves.

2. Lower Entry Price

Lump sum buys can prove lucrative, particularly when buying during market downturns. However, knowing when the market will bottom or top out is basically impossible, even for the most experienced traders. In this sense, DCA provides a helpful outlet that compels investors to make their scheduled buys no matter the market conditions. In the long run, this often translates to a lower entry price, since faithfully following DCA means making buys during the harshest bear markets and the largest bull runs.

3. Prevents Bad Timing

The third point on this list follows logically from the previous two points mentioned above. Inventors, especially those who lack experience, are more likely to buy assets when the markets are in a bull cycle and assets trading near their price peaks. Stoked by FOMO (“Fears of missing out”), amateur investors often enter their positions when there is little upside potential. With DCA, these issues sort themselves out automatically, since buys are made on a predetermined basis, completely ignoring the short-term market trends.

4. Flexibility

Dollar-cost averaging can be used by a wide range of investors, irrespective of the money that is allocated for investment. Also, the strategy can follow a wide spectrum of schedules, from daily, weekly, monthly, and everything in between, accommodating different investor profiles with ease.

5. Structured Saving

DCA is a popular choice among those that wish to put some money to the side and let the market do its job. Investing in sound projects and assets can be more lucrative than depositing money in savings accounts, which at best generate one to two percentage points in returns each year.

DCA on Binance with the Recurring Buy feature

Binance, the world’s largest cryptocurrency exchange in terms of trading volume, allows investors to take advantage of the benefits provided by the dollar cost averaging strategy with a specialized investment product called Recurring Buy.

With Binance Recurring Buy, users can choose from a long list of supported fiat currencies to make weekly, bi-weekly, or monthly cryptocurrency purchases. The product allows Binance users to invest fixed amounts of fiat at regular intervals to mitigate the effects of market volatility.

The list of supported digital currencies includes the biggest coins, such as Bitcoin and Ethereum, as well as a broad range of DeFi tokens like Aave and Polygon, and native tokens of popular Layer 1 projects like Avalanche, BNB, Cardano, Polkadot, and Solana. In total, Binance supports almost 40 local currencies and more than 80 digital assets.

Step-by-step guide to Binance Recurring Buy

In this section, we are going to show how to grow your crypto portfolio with Recurring Buy and what settings you should be mindful of when putting together your own DCA plan.

Step 1 – Log in to your Binance account and navigate to Recurring Buy

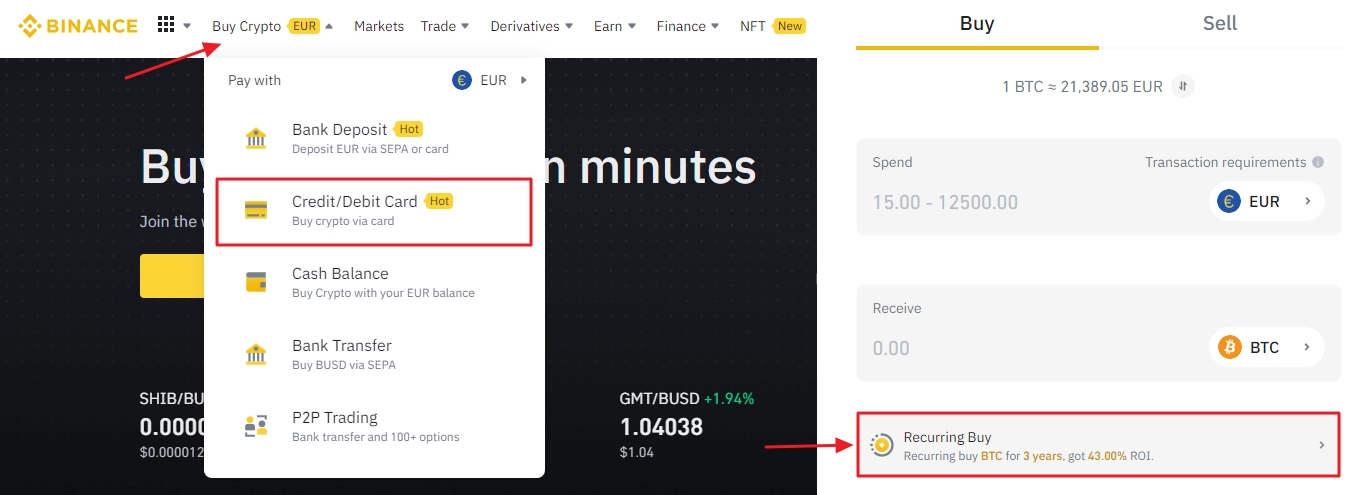

After logging into your Binance account, select the “Credit/Debit Card” option from the “BuyCrypto” drop-down menu. After that, click on “RecurringBuy” to set up your DCA plan.

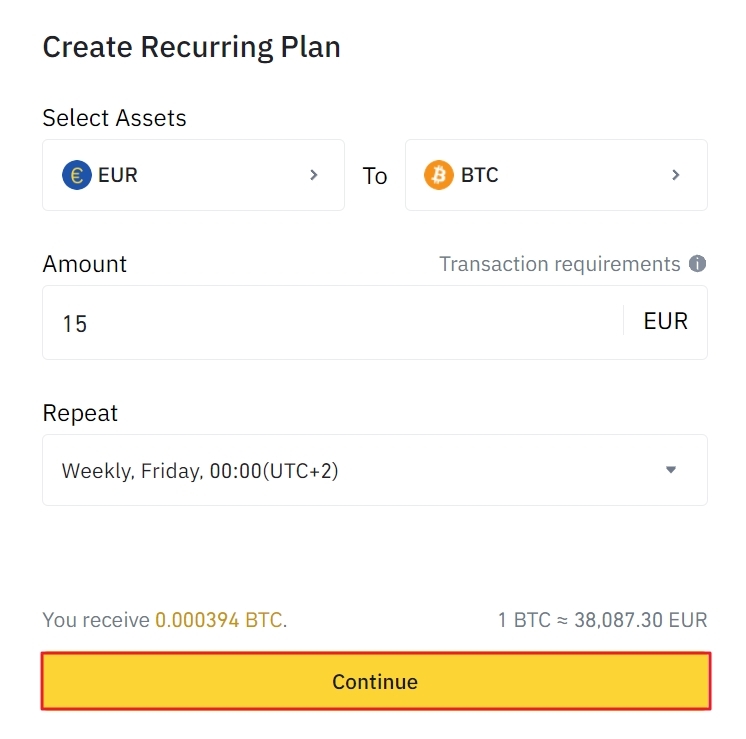

Step 2 – Select fiat and cryptocurrency, decide on investment frequency

In the Recurring Buy window, select the local currency you would like to use for purchasing crypto. Enter the amount of money reserved for interval payments and decide on their frequency. Proceed by clicking “Continue”.

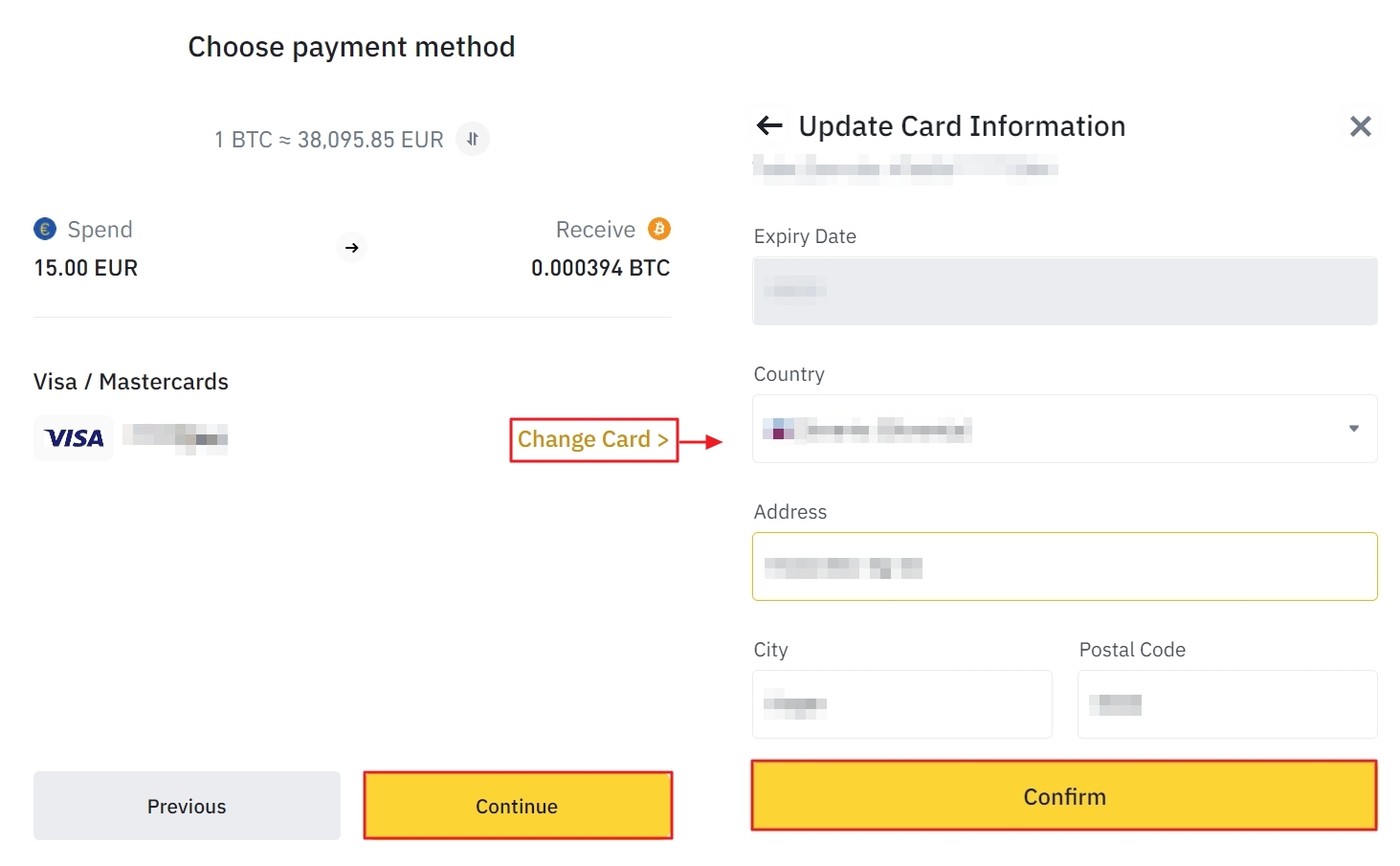

Step 3 – Choose your payment method

Select one of your existing payment methods or add new or change existing ones by clicking on the “Change Card” button. Once done, proceed by clicking “Continue”.

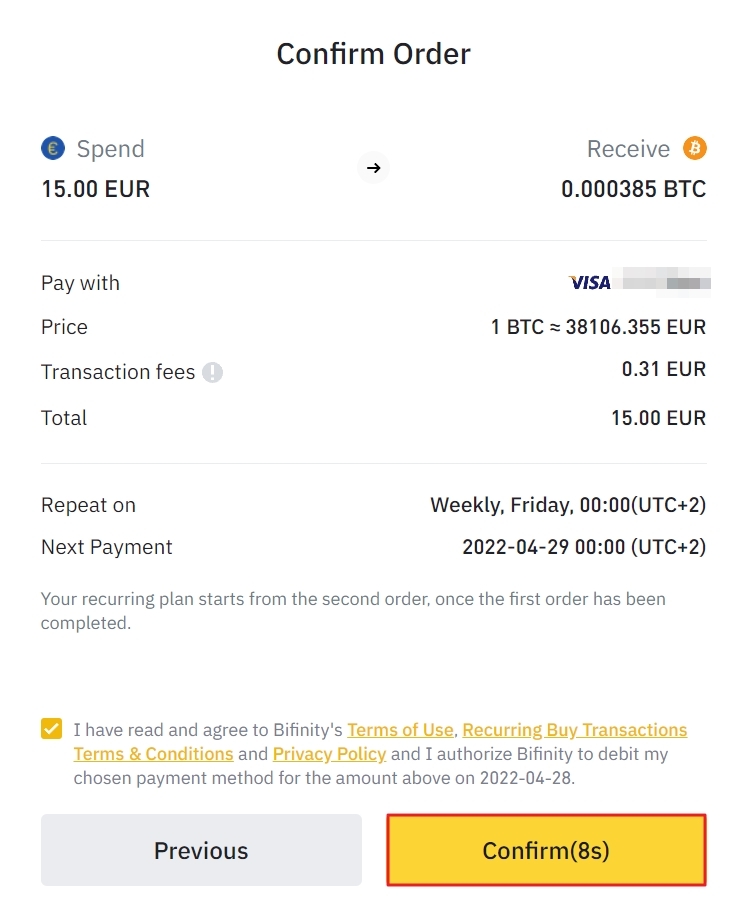

Step 4 – Confirm your Recurring Buy order

To complete the process and commence your DCA plan on Binance, click on the “Confirm” button in the Confirm Order dialogue showing the complete overview of your Recurring Buy plan.

Closing Thoughts

Binance Recurring Buy applies the principles of the dollar cost averaging strategy to cryptocurrency investments. It allows you to gradually grow your portfolio with a combination of scheduled crypto buys and potentially compounding market gains. While offering several benefits, the success of any DCA plan ultimately depends on the underlying asset that is being bought. Rember to DYOR before committing and never invest more than you are willing to lose.