When it comes to finances, the term “interest” refers to the amount of money that is paid by a borrower to a lender in order to use the money that has been lent. Interest is typically expressed as a percentage of the amount of money that has been borrowed, and it is typically paid on a regular basis (such as monthly or yearly).

When it comes to crypto assets, interest can be generated in a number of ways. For example, some crypto assets pay interest to holders on a regular basis, much like a traditional savings account. In other words, crypto dividends. As a result, flexibility is limited.

Other crypto assets may offer interest-bearing products, such as loans or credit products, that allow users to earn interest on their deposited funds. The practice is known as crypto lending and is considered highly risky.

Still, others may offer staking rewards to users who lock up their assets for a set period of time. Staking a coin requires trusting the coin, network, and team.

Last but not least, crypto trading can be automated. A number of companies automate the crypto trading process and invest for the benefit of their users. As part of their continuous reporting, automated crypto trading companies like Haru Invest release their recent performance numbers. They even allows you to calculate future earnings.

Regardless of the method, earning interest on crypto assets can be a great way to boost one’s returns.

Why earning interest on your crypto holdings can be a good idea?

Many people who invest in cryptocurrencies do so with the expectation of earning a return on their investment. One way to earn a return on your crypto holdings is to earn interest on them.

There are a few reasons why this can be a good idea. First, it can help you to grow your holdings without having to put any additional money into them. This can compound over time, leading to significant growth.

Second, it can provide you with a steady stream of income that can help offset any losses that you may incur.

Finally, it can help to diversify your portfolio and reduce your overall risk. For these reasons, earning interest on your crypto holdings can be a smart move.

What are the benefits of compound interest over time?

Compound interest is often described as the ‘eighth wonder of the world’, and for good reason. It is a powerful force that can work wonders for anyone who saves regularly, whether for retirement, a rainy day fund, or some other purpose.

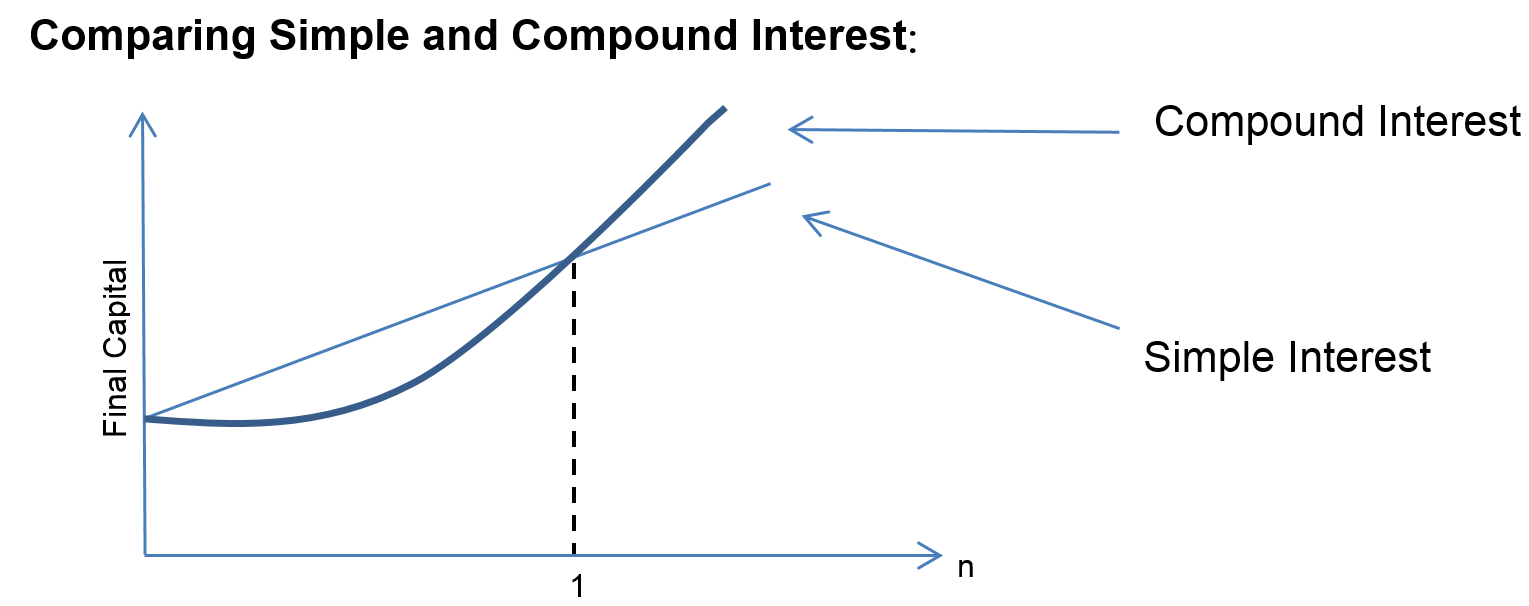

Unlike simple interest, which is calculated on the original principal only, compound interest is calculated on the principal plus any accrued interest. This means that the longer money is left to grow, the more rapidly it will grow.

For example, if someone deposits $100 into a savings account with an annual interest rate of 5%, they will have $105 at the end of the first year. In the second year, they will earn interest on the $105, rather than just on the original $100.

As a result, their balance will grow even faster, and compound interest will really start to work its magic as time goes on. Over time, even small amounts of money can grow to large sums through compound interest. This makes it an extremely powerful tool for anyone who wants to build long-term wealth.