When you’re considering crypto contract trading, you can be overwhelmed by the numerous options available in 2024. Binance Futures stands out with its high liquidity and up to 125x leverage on selected trading pairs. Meanwhile, platforms like PrimeXBT and Bybit offer feature-packed interfaces and robust security measures.

We’ve selected 10 of the best crypto contract trading platforms based on key factors such as liquidity, selection of trading products, number of listed cryptocurrencies, and more.

Before we feature our picks for the best crypto contract trading platforms, let’s quickly refresh our knowledge of what crypto contract trading is all about.

List of the best crypto contract trading platforms in 2024:

- Binance Futures: The best crypto contract trading platform overall

- PrimeXBT: A leading crypto CFD platform

- KuCoin: Versatile platform with over 800 supported cryptocurrencies

- Bybit: A feature-packed crypto exchange with a strong crypto contract offering

- BitMEX: A pioneering crypto contracts exchange

- OKX: A rock-solid alternative to Binance

- Deribit: The best platform for crypto options contracts

- BingX: Crypto contract trading platform with rewards for new users

- Phemex: Crypto contracts trading platform with an impressive selection of features

- Huobi: Top-notch security and reputation

What is contract trading in crypto?

The term “contract trading” in a crypto context refers to the trading of derivatives, as opposed to spot trading. A derivative is a type of financial instrument that derives (hence the name) its value from an underlying asset.

There are different types of derivatives – in the cryptocurrency market, the most popular derivatives are futures contracts and options contracts. When you are trading Bitcoin futures contracts, for example, you are not actually buying and selling Bitcoin, but you are buying and selling a contract that derives its value from the price of Bitcoin.

Compared to spot trading, contract trading gives traders more flexibility and allows them to easily access leverage or go either long or short on a specific cryptocurrency. However, contract trading is more complex than spot trading and isn’t recommended for inexperienced traders.

Also, due to leverage, you should keep a close eye on and calculate crypto position size so that you don’t exceed your trading budget with any single trade.

The best crypto contract trading platforms in 2024

Without further ado, here is our selection of the best crypto contract trading platforms available on the market right now.

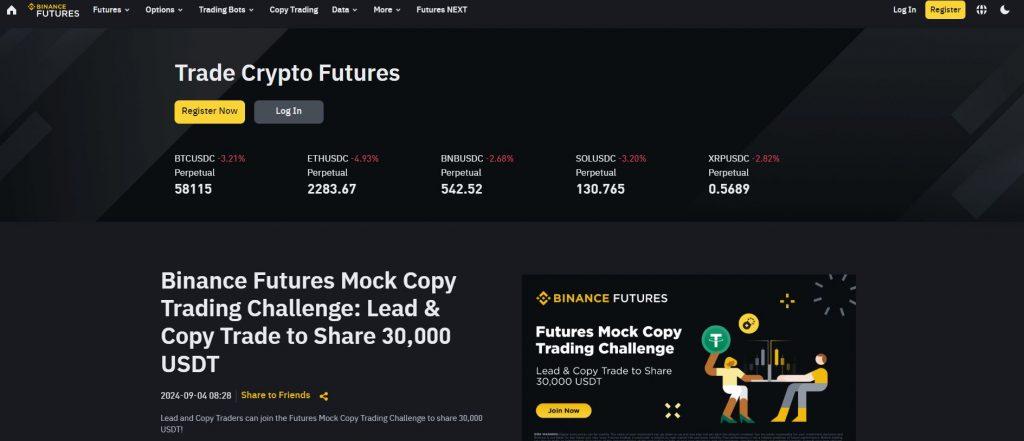

1. Binance Futures: The best crypto contract trading platform overall

When it comes to futures trading platforms in the crypto market, Binance Futures is probably the first thing that comes to mind. It’s the largest crypto exchange in the world, and the most liquid crypto contract trading platform on the market.

You can access over 350 perpetual futures contracts, making it one of the largest platforms for derivatives trading.

High leverage options are available. You can utilize up to 125x leverage on selected trading pairs. This flexibility is great for experienced traders, though newbies should be very careful.

Binance Futures features a competitive fee structure that starts from 0.05% for taker orders and even lower for maker orders. Also, users can reduce their fees even more by paying them with the BNB token.

The platform also offers options trading, which can unlock even more opportunities and strategies for the most advanced traders.

It boasts significant liquidity, with daily trading volumes exceeding $35 billion. This guarantees efficient trade execution and minimal slippage.

When you add advanced trading tools, including various order types and charting features, Binance Futures is a top choice for crypto contract trading.

Key features:

- Offers high liquidity for crypto contracts

- Users access over 350 perpetual futures contracts

- Up to 125x leverage on select pairs

- Competitive fees, reduced further with BNB token

- Advanced trading tools with various order types and charting features

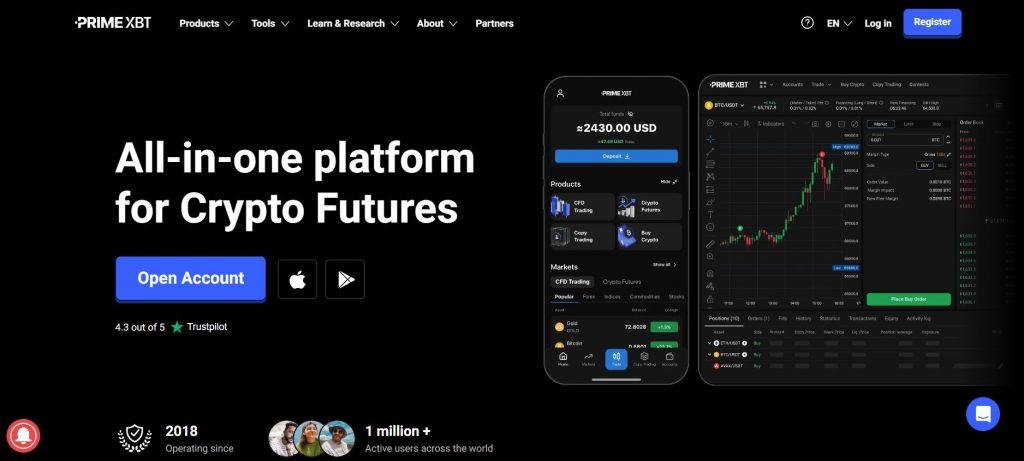

2. PrimeXBT: A leading crypto CFD platform

PrimeXBT offers an extensive multi-asset trading platform that offers a variety of trading products, including crypto futures, crypto CFDs, forex, indices, and commodities.

The platform offers leverage of up to 200x on its cryptocurrency futures.

When you use PrimeXBT, you’ll have access to a wide range of cryptocurrencies and advanced trading tools, including charts and market analysis.

The platform stands out from some other entries on our list for its user-friendly interface that simplifies the crypto futures trading process, which is something newcomers will appreciate. You can execute trades efficiently thanks to high transaction speeds.

Fees are another strong point of PrimeXBT. Taker fees start at 0.02%, while makers pay 0.01% on trading orders. Meanwhile, spreads for CFDs start at 0.1%, which is very competitive compared to many other similar platforms.

Finally, it’s worth noting that PrimeXBT offers a rich selection of educational materials aimed at helping new users on their derivatives trading journey.

Overall, PrimeXBT is a great platform for trading of various financial instruments, and that includes crypto contract trading.

Key features:

- Multi-asset platform offering crypto futures, CFDs, forex, indices, and commodities

- Leverage up to 200x for cryptocurrency futures

- Advanced trading tools with market analysis and charting features

- User-friendly interface suitable for beginners

- Low fees: 0.02% taker, 0.01% maker, competitive CFD spreads

3. KuCoin: Versatile platform with over 800 supported cryptocurrencies

KuCoin is an interesting pick due to its expansive futures markets and versatile trading options.

This platform offers a wide range of trading pairs and contract types, as well as leverage positions up to 125x.

Key features include futures grid trading, which enables automated strategies to capitalize on market fluctuations. With support for over 800 cryptocurrencies (an extremely high number), KuCoin gives traders access to a diverse array of digital assets for both spot and futures trading.

KuCoin’s all-inclusive trading tools and flexible leverage options make it a compelling choice for both novice and experienced futures traders. Its extensive futures markets and advanced features like automated trading capabilities empower users to navigate the dynamic crypto market effectively.

Key features:

- Over 800 supported cryptocurrencies for spot and futures trading

- Futures grid trading for automated strategies

- Leverage up to 125x for futures trading

- Extensive trading tools and features for all types of traders

- Automated trading capabilities for navigating the market

4. Bybit: A feature-packed crypto exchange with a strong crypto contract offering

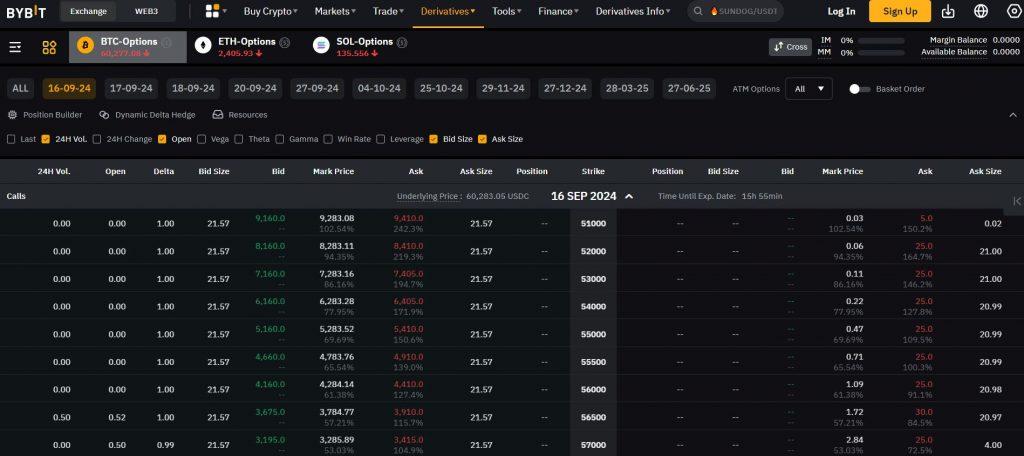

Bybit is a global cryptocurrency exchange that was founded in 2018 and has over 2 million registered users by now. The exchange started off with a focus on crypto futures contracts, but they have since upgraded their suite of products and now also offer options trading, as well as spot trading.

Still, futures contract trading remains the focus of Bybit’s offering, and the exchange provides futures settled in the USDC and USDT stablecoins, as well as futures settled in the underlying cryptocurrency. Bybit has taken a page out of Binance’s book and provides futures contracts for well over 100 cryptocurrencies, which makes the platform suitable for all types of cryptocurrency traders.

An interesting feature of Bybit is copy trading, which allows users to copy the trades made by more experienced traders automatically. Of course, users can adjust the maximum amount of capital they’re willing to commit to a single trade.

Bybit offers competitive leverage options of up to 200x on select contracts. Also, their daily trading volume exceeds $1 billion, which shows high liquidity and popularity in the crypto derivatives market.

Key features:

- Focus on crypto futures contracts and options trading

- Copy trading feature allows automatic replication of experienced traders

- Leverage up to 200x on select contracts

- High liquidity with daily trading volume exceeding $1 billion

- Support for futures settled in USDT, USDC, and underlying crypto

5. BitMEX: A pioneering crypto contracts exchange

BitMEX is a pioneering cryptocurrency exchange that made significant advancements in the cryptocurrency derivatives sector and popularized crypto contract trading with high leverage.

Although BitMEX has seen a notable decrease in market share in recent times, it remains a solid crypto contract trading platform that primarily caters to experienced traders.

They offer advanced risk management tools and leverage options of up to 100x on perpetual contracts.

Primarily focusing on Bitcoin, BitMEX offers features that allow for significant speculation on price movements without requiring asset ownership. This platform’s robust trading engine can handle large volumes, making it a popular choice among experienced traders seeking liquidity.

BitMEX has a fairly complex fee structure. You can find the details on BitMEX website, but the short version is – it encourages high-volume trading. With enough trading volume, your fees will typically be lower than many competitors in the derivatives space.

They have also introduced its BMEX token, which operates similarly to other exchange tokens. BMEX token holders can access discounts on both taker and maker fees, with larger holders potentially qualifying for rebates on maker fees.

Key features:

- Pioneering crypto contract trading platform

- Up to 100x leverage on perpetual contracts

- Advanced risk management tools

- Encourages high-volume trading with fee discounts

- BMEX token offers fee discounts and rebates for large holders

6. OKX: A rock-solid alternative to Binance

You want the Binance experience but without using Binance? Try OKX.

Much like Binance, OKX boasts an extensive selection of cryptocurrencies, listing more than 350 different coins at the time of writing.

As far as crypto contracts go, OKX provides perpetual swaps, futures, and options. In addition, the exchange also provides extra features such as copy trading and simplified crypto options.

With OKX, you have access to a wide range of diverse crypto contracts, with maximum leverage up to 125x.

What makes OKX extra appealing are its competitive fees. Maker fees start off at 0.08%, while taker fees begin at 0.1%. These trading fees can be further reduced based on the user’s trading volume and holdings of OKB tokens.

A unique aspect of OKX is its trading bot marketplace, enabling users to “follow” trading bots created by others. The creators of these bots receive a share of the profits generated by their bots. Of course, users also have the option to publish their own trading bots on this marketplace. In a way, it’s like copy trading, but instead of traders, you follow traders’ bots.

With its diverse offerings, cool features and competitive fees, OKX is a rich and versatile platform for trading crypto contracts.

Key features:

- Over 350 cryptocurrencies and multiple contract types (perpetual swaps, futures, options)

- Leverage up to 125x on selected contracts

- Competitive fees: 0.08% maker, 0.1% taker, reduced with OKB token holdings

- Trading bot marketplace for following or creating bots

- Copy trading available for beginners

7. Deribit: The best platform for crypto options contracts

Deribit is a top choice for options contracts, particularly in the Bitcoin options market. It leads the cryptocurrency options market, holding over 85% of the open interest in Bitcoin options at the time of writing.

Despite the fact that Deribit mainly offers options contracts for Bitcoin and Ethereum (though you can also trade MATIC, SOL, and XRP), it remains the top destination for cryptocurrency options trading.

Beyond catering to institutional-grade crypto derivatives traders, Deribit also has some beginner-friendly features. The exchange offers a free options trading course and a tool called Options Discovery, which aids traders who are new to options in understanding the mechanics of options through practical examples.

Deribit also has a testnet version of its trading platform, enabling traders to experiment with different strategies without exposing themselves to real financial risk.

Fees are starting at 0.03% for both maker and taker orders, capped at 12.5% of the option’s value. Leverage options are flexible, up to 100x for futures and 10x for options.

Whether you’re looking to hedge or speculate, Deribit’s advanced tools and deep liquidity make it an ideal choice for crypto trading.

Key features:

- Leading platform for Bitcoin and Ethereum options contracts

- Over 85% of open interest in Bitcoin options market

- Free options trading course and Options Discovery tool for beginners

- Testnet available for strategy testing without real financial risk

- Leverage up to 100x for futures, 10x for options

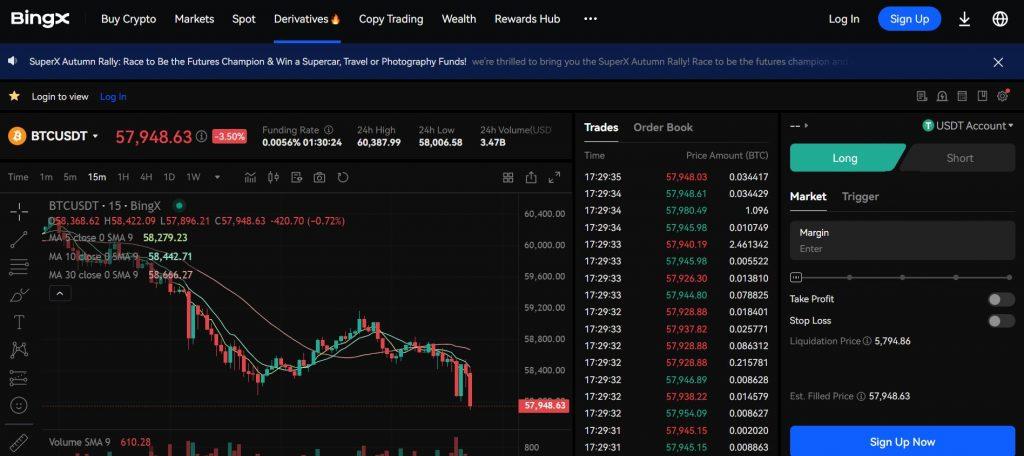

8. BingX: Crypto contract trading platform with rewards for new users

BingX is a cryptocurrency exchange with both perpetual and standard futures contracts. The futures contracts listed on BingX are settled in the USDT stablecoin.

Similarly to Binance, Bybit, and OKX, BingX also lists a huge selection of cryptocurrencies, allowing traders to access futures for most relevant altcoins.

A key highlight is the platform’s user-friendly copy trading system, which allows you to replicate the strategies of successful traders with ease.

Their fees start at 0.04% for contracts.

You can also enjoy a variety of order types, including market, limit, and stop orders.

BingX provides a rewards program for new users, and the bonuses can be quite high if you generate a lot of trading volume. The exchange also hosts the SuperX trading competition, which gives the best traders a chance to earn rewards in addition to their trading profits.

Key features:

- Wide selection of cryptocurrencies for futures trading

- User-friendly copy trading system

- Low fees starting at 0.04% for contracts

- Rewards program for new users and SuperX trading competition

- Variety of order types, including market, limit, and stop orders

9. Phemex: Crypto contracts trading platform with an impressive selection of features

Phemex is a Singapore-based cryptocurrency exchange founded in 2019. It’s carved out a niche for itself in the crypto contract trading space with its emphasis on speed and reliability.

It can manage up to 100,000 transactions per second.

Phemex supports a diverse range of cryptocurrencies and trading pairs, catering to various trader preferences and strategies. It offers competitive leverage options of up to 100x for specific futures contracts, allowing you to maximize your exposure to market movements.

The platform’s fee structure is flexible, with a maker fee of 0.01% and a taker fee of 0.06%..

They also have a full TradingView integration for traders relying heavily on technical analysis.

When trading contracts on Phemex, traders can access “hedge mode,” which allows them to hold a long position and a short position on the same contract simultaneously. The platform also provides copy trading, which can be a useful tool for less experienced users.

Phemex also features a simulated trading mode, which makes it possible for users to easily test out new trading strategies without taking on any risk. Overall, Phemex is one of the more beginner-friendly crypto contracts trading platforms on the market.

Key features:

- Leverage up to 100x for specific futures contracts

- Flexible fees: 0.01% maker, 0.06% taker

- Full TradingView integration for technical analysis

- Simulated trading mode for strategy testing without risk

- Hedge mode for holding long and short positions simultaneously

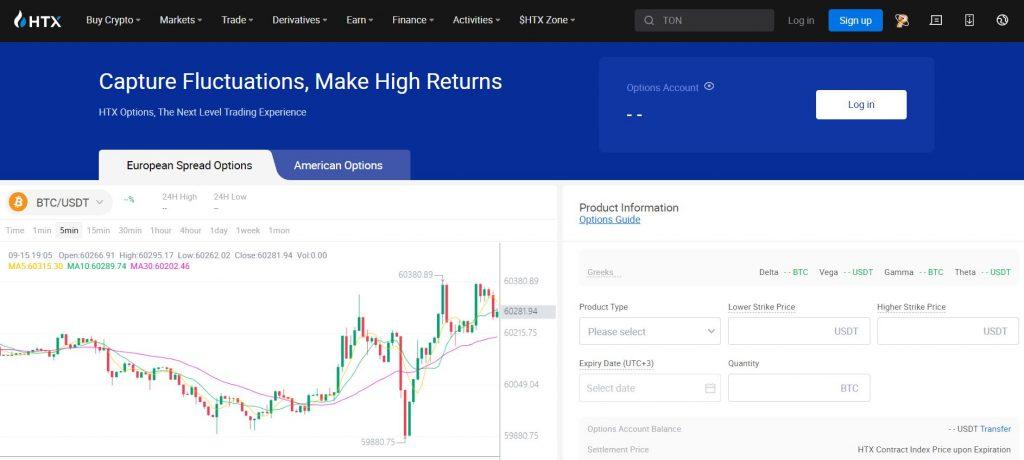

10. Huobi: Top-notch security and reputation

Huobi is a reputable, premier crypto contract trading platform in 2024. It offers traders a thorough range of futures contracts and advanced trading tools.

You’ll find leverage options of up to 125x on various contracts, providing you with significant exposure to market movements. The platform supports over 200 cryptocurrencies.

Huobi is recognized for its powerful security measures, including multi-signature wallets and two-factor authentication, so your funds are safe.

The user-friendly interface is designed to cater to both novice and experienced traders, enhancing the overall trading experience.

Competitive fees are another highlight of Huobi. The exchange implements a fee structure that starts with maker fees of 0.02% and taker fees of 0.05%.

With Huobi, you can leverage advanced trading tools and security features to optimize your trading strategies and navigate the dynamic crypto market effectively.

Key features:

- Supports over 200 cryptocurrencies for contract trading

- Leverage up to 125x for select contracts

- Strong security: multi-signature wallets and two-factor authentication

- User-friendly interface for both novice and experienced traders

- Competitive fees: 0.02% maker, 0.05% taker

The bottom line

And that’s all folks. Each crypto contract trading platform on our list deserves to be here. It doesn’t mean they’re all the same, it just means they all have something that makes them appealing.

Top platforms like Binance Futures, PrimeXBT, and Bybit offer high-speed transactions and competitive fees.

Consider your trading needs: OKX for extensive derivatives, Huobi for strong security, and Bybit for user-friendly features. Analyze platform specifics and make a well-considered choice tailored to your trading strategy.

If you’re looking for more high-quality platforms for trading cryptocurrency, make sure to check out our selection of the best crypto exchanges available on the market today.

Key Takeaways

- Top-notch platforms: Binance, OKX, Bybit, and Deribit are among the top crypto contract trading platforms, offering various derivatives and robust security measures.

- Leverage options: High leverage options are available on most platforms, often up to 100x or 125x, allowing traders to amplify their positions and potential returns.

- Security features: Common security features include two-factor authentication, SSL encryption, multi-signature wallets, and cold storage to protect user assets.

- Low fees: Competitive fee structures are offered by platforms like Binance, OKX, and Phemex, with low maker and taker fees starting from 0.01% to 0.08%.

- User experience: Many platforms offer user-friendly interfaces and advanced trading tools, making them suitable for traders of all skill levels.