Key takeaways:

- Silvergate, one of the largest crypto banks, has postponed its financial report, which has many fearing that bankruptcy could follow

- Coinbase, Paxos, Galaxy Digital, and CBOE are just a few of the companies that terminated their relationship with the bank

- Silvergate stock lost over -58% after the news broke, while Bitcoin and the broader crypto market plunged into the red zone

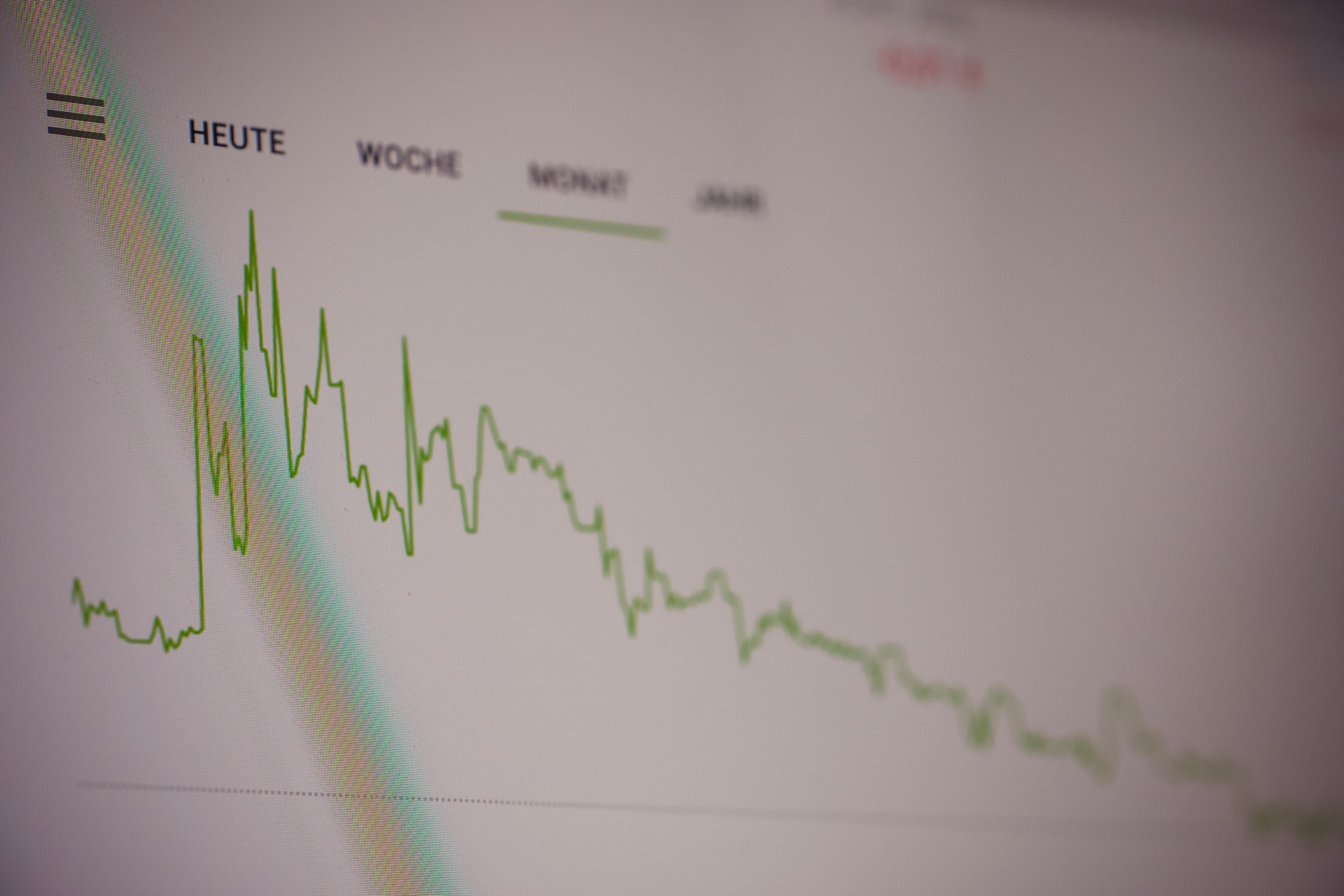

Silvergate stock price fell -58% in the last 48 hours

Cryptocurrency bank Silvergate announced on March 1st that it would postpone its annual 10-K financial report, which sparked widespread concern over the bank’s solvency among crypto firms. To make matters worse, some analysts believe Silvergate could be heading for bankruptcy.

Following the postponement of the financial report, the stock price of Silvergate stock plunged by -58%, from $13.37 on March 1st to $5.61 at the time of writing.

The news has had a ripple effect on cryptocurrency markets as well, with Bitcoin and Ethereum losing over -4% each in the last 24 hours.

A number of cryptocurrency firms have been quick to break their ties with Silvergate and to reassure their investors that they have no exposure to the bank. According to a popular crypto personality “tier10k” – who has broken several major crypto stories in the past (such as the infamous shutdown of the BitZlato cryptocurrency exchange about a month ago) – Coinbase, Circle, Paxos, Galaxy Digital, and CBOE are just some of the companies that terminated their relationship with Silvergate.

According to “tier10k” the reason for their decision is as follows:

“They [Silvergate] failed to file their annual report citing regulatory investigations, maybe being possibly not super solvent and also doubts about the companies future.”

In addition to the above-mentioned companies, Tether, the company behind the world’s largest stablecoin, and MicroStrategy, the largest public holder of Bitcoin, both assured users that they have no, or very limited exposure to the bank. MicroStrategy said that they have an outstanding loan with Silvergate, but that none of its 130,000 BTC is custodied by them.

According to a partner at CEHV, Adam Cochran, the collapse of Silvergate “is going to be rought for crypto.”

“I don’t think retail investors realize how much market maker money moved around quickly via SEN, and how many crypto exchanges were/are banking with them,” he added.