Key takeaways:

- Circle, a payments technology company and the issuer of USDC, has announced it has entered a new merger deal with Concord, which raised the company’s valuation to $9 billion

- The previous deal with Concord, signed in July 2021, valued Circle at $4.5 billion

- USDC currently accounts for roughly two-thirds of Tether’s market cap, up from accounting for less than a quarter a year prior

Circle, the issuer of USD Coin, revisits its merger agreement with Concord

According to Thursday’s press release, Circle has terminated its existing business agreements with Concord, and has entered a new merger deal that is expected to be finalized by December of this year.

Circle is a global payments technology company and the issuer of USD Coin (USDC), the second-largest stablecoin in the industry. The company has made its intentions of becoming a publicly-traded company clear last year when it entered into a business arrangement with Concord, a special purpose acquisition company (SPAC) founded with the intention of facilitating Circle’s initial public offering (IPO).

While the arrangement made last July initially valued Circle at $4.5 billion, the new deal saw the value of Circle double to $9 billion.

The CEO and co-founder of Circle, Jeremy Allaire, commented on the prospects of Circle becoming a publicly-traded company:

“Circle has made massive strides toward transforming the global economic system through the power of digital currencies and the open internet. Being a public company will further strengthen trust and confidence in Circle and is a critical milestone as we continue our mission to build a more inclusive financial ecosystem.”

Once the newly inked merger deal is finalized, a newly formed company will acquire both Concord and Circle and is expected to trade on the New York Stock Exchange (NYSE) under the ticker symbol “CRCL.”

USDC is challenging Tether’s stablecoin dominance

Circle’s USDC has recently made great strides towards chipping away at Tether’s USDT dominant market share in the stablecoin sector. In January, USDC overtook USDT to become the largest stablecoin on Ethereum in terms of circulating supply.

Earlier this month, USDC surpassed the $50 billion market cap milestone on the tailwind of 10,000% growth in the previous two years. As of right now, USDC is natively supported on eight different blockchains, including Ethereum, Avalanche, Tron, and Solana. We could see the list lengthen in the coming months as the Circle team has been adamant about expanding USDC to as many chains as possible.

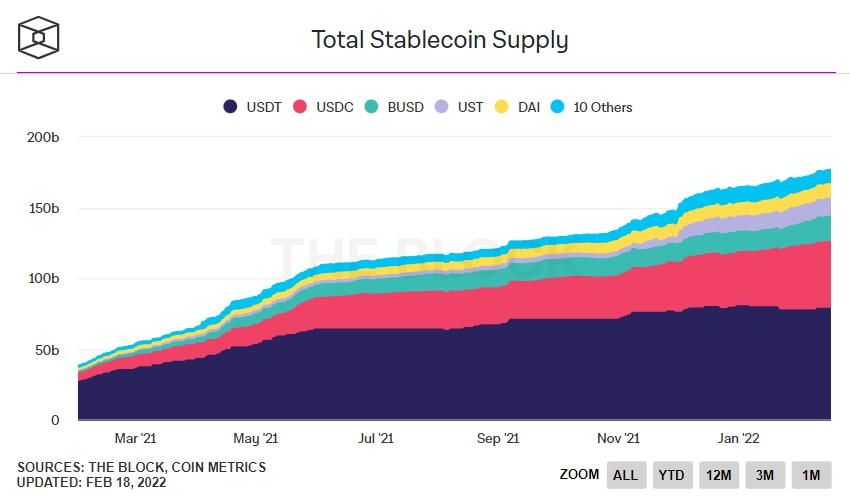

The stablecoin sector as a whole has undergone immense growth over the last year. According to data curated by The Block, the combined value of all stablecoins in circulation increased from $38 billion at the end of last January to over $177 billion today.

Given its recent market trajectory and the sector’s distinct growth trend, USDC could soon surpass USDT to become the most widely used stablecoin.