You’re wondering if XRP can reach a whopping $500 price point — a notion that seems unlikely at first glance (and second and third, to be fair). To achieve this, the market capitalization of XRP would need to skyrocket to over $26 trillion. That would dwarf the GDP of major economies.

This would require a monumental shift in the cross-border payments market, with widespread adoption and favorable regulatory outcomes. While this scenario might seem far-fetched, there are factors that could drive significant growth.

Let’s explore what it would take for XRP to reach such heights and what industry experts have to say about its potential trajectory.

Key takeaways

- Market Cap Requirement: A $500 price point requires a market cap exceeding $26 trillion, making it highly improbable.

- Growth Necessity: XRP needs an unprecedented increase of over 100,000% from its current price to reach $500.

- Adoption and Demand: Capturing a larger share of the cross-border payments market and increased adoption by financial institutions are crucial for significant price increases.

- Realistic Targets: More plausible price targets are between $10 and $50, contingent on favorable market conditions and regulatory clarity.

XRP market capitalization analysis

The prospect of XRP reaching a $500 price point hinges heavily on its market capitalization. To put this in perspective, achieving such a price would require a market cap of approximately $26 trillion, which far surpasses the total market cap of all cryptocurrencies combined and is significantly higher than the GDP of major economies like the United States.

Currently, XRP’s market cap stands around $31 billion, indicating that the asset would need to increase more than 700 times to achieve the proposed $500 price point. We don’t like to make bold predictions here, but… this just isn’t happening any time soon.

A more realistic analysis suggests that even capturing a significant share of the growing global remittance market would yield a much lower price. For instance, capturing 25% of this market would only yield about $50 billion in revenue, translating to a potential price of $250.

This shows how impractical it is to expect a $500 price point for XRP under current market dynamics and regulatory environments.

Thus, a price analysis reveals that the notion of XRP reaching $500 is highly speculative and unlikely without substantial shifts in market conditions and regulatory clarity.

Ripple project overview

Ripple’s project encompasses a multifaceted approach to revolutionizing cross-border payments. It leverages its XRP token to provide liquidity and efficiency.

You can see this reflected in RippleNet, their platform that uses XRP as an intermediary to enable fast international transactions. This strategy aims to provide liquidity services to businesses and financial institutions. Ripple is positioned as a potential disruptor to traditional systems like SWIFT.

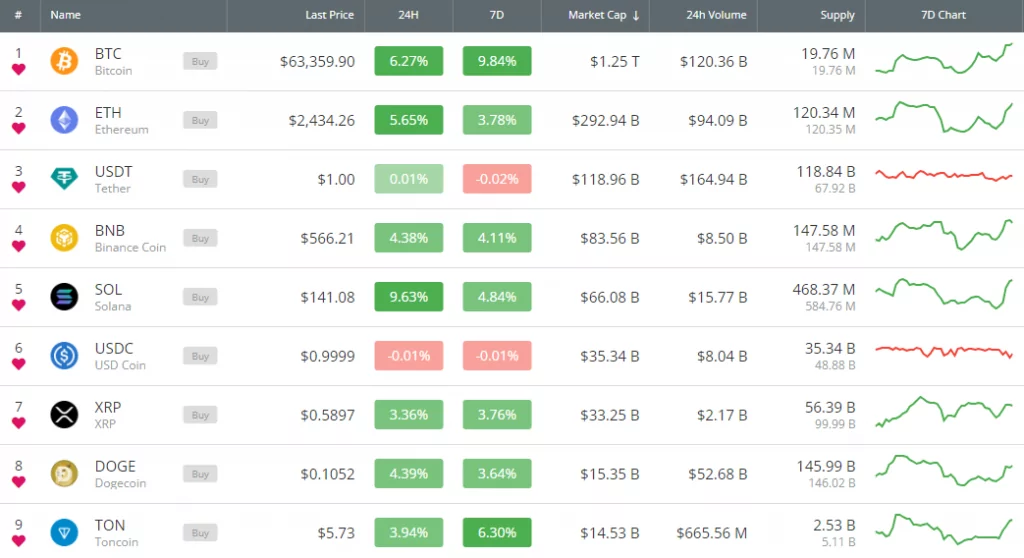

Founded in 2012 by Chris Larsen and Jed McCaleb, Ripple’s XRP has grown to become the 7th largest cryptocurrency by market capitalization.

With a maximum supply of 100 billion tokens and a circulating supply of approximately 56 billion XRP, it’s evident that their strategic partnerships with major financial institutions like American Express and Bank of America are working well for them.

A key part of their success is the Ripple Protocol Consensus Algorithm (RPCA), which enhances decentralization and security, allowing Ripple to process 1,500 transactions per second with a block processing time of just 0.06 seconds.

This technical capability, combined with strategic partnerships, highlights the Ripple project’s potential to transform cross-border payment efficiency for financial institutions.

Historical price analysis of XRP

When examining the historical price movements of XRP, you’ll notice a pattern of significant volatility, marked by dramatic fluctuations since its launch on February 1, 2013. Initially, XRP gained little market attention but eventually reached an all-time high of $3.84 in January 2018 during a bull market.

This peak was followed by a steep decline to around $0.20 in November 2020, partly due to the SEC lawsuit against Ripple Labs, which significantly impacted its market performance.

Analyzing the historical data, you can see that XRP experienced a surge to approximately $1.96 in 2021 but faced instability due to fluctuating market conditions and continued legal challenges.

More recent data shows that as of September 13, 2024, XRP closed at roughly $0.56. This shows a fairly cautious market sentiment despite an 80% growth in 2023. By the end of the year, our XRP price prediction shows that the token will rise to $0.69 by the end of the year, which would be a relatively modest but still very respectable 18% price increase.

These price movements underscore the volatility of XRP. This historical context provides a foundation for understanding XRP’s potential price trajectories.

XRP current fundamentals

XRP’s current market position is built on a foundation of robust fundamentals that show its utility in the global financial ecosystem. You’ll find that XRP’s speed, liquidity provisions, and regulatory clarity play significant roles in its market dynamics.

Considering its current market cap of approximately $31 billion, XRP is the 7th largest cryptocurrency. The circulating supply of about 56 billion tokens out of a maximum of 100 billion indicates a substantial but controlled supply.

Key points to note about XRP’s fundamentals include:

- Transaction Efficiency: XRP can process 1,500 transactions per second, with a block processing time of just 0.06 seconds, making it significantly faster than many other cryptocurrencies.

- Liquidity Solutions: Ripple’s On-Demand Liquidity service eliminates the need for pre-funded accounts, enhancing the efficiency of cross-border transactions and liquidity for financial institutions.

- Market Structure: The top 10 addresses hold only 20.5% of the total supply, indicating a relatively decentralized structure.

- Regulatory Clarity: A pivotal ruling in the SEC lawsuit clarified that XRP isn’t classified as a security for public sales. This has had a positive impact on its market perception and trading volume.

These fundamentals suggest that while ambitious targets like $500 are impractical, more realistic predictions, such as $10 to $50 by 2040 or 2050, could be feasible under favorable market conditions.

Bullish market scenario analysis

Market momentum and favorable regulatory environments are necessary factors in the bullish market scenario for XRP. To reach a price target of $500, you’d need to see significant shifts in demand and adoption that propel XRP’s market capitalization to approximately $26 trillion, surpassing the combined market cap of major corporations like Microsoft and Apple.

In a bull market, capturing a substantial share of the growing global remittance market could enhance XRP’s value. If XRP were to capture 25% of the cross-border remittance sector, it could yield around $50 billion in revenue for Ripple, potentially translating to a price of $250 under favorable conditions.

However, achieving a $500 or even a $250 price point remains highly unlikely without substantial changes in market dynamics and regulatory clarity.

Still, that doesn’t mean XRP’s price can’t go up. Ripple’s strategic partnerships with over 200 financial institutions, including Bank of America and Santander, increase the likelihood of increased adoption and transaction volumes necessary for a price surge.

Positive regulatory outcomes, such as the recent ruling deeming XRP not a security for public sales, could also bolster investor confidence and lead to a substantial price increase if market sentiment remains bullish.

Bearish market scenario analysis

In a bearish market scenario, the path to a $500 price point for XRP appears insurmountable. The sheer scale of market capitalization required – approximately $26 trillion – far exceeds the total market cap of all cryptocurrencies combined as of October 2023.

To put this into perspective, consider the following:

- Astronomical market cap: Achieving $500 per XRP would necessitate a market capitalization that surpasses the US GDP, an unprecedented and unrealistic target.

- Unfeasible price surge: XRP would need to increase by over 100,000% from its current price of around $0.49, a growth trajectory that’s highly improbable given existing market conditions.

- Regulatory hurdles: Even a partial victory in the SEC lawsuit may not be enough to drive XRP’s price significantly higher due to ongoing regulatory uncertainties and market sentiment.

Historical performance: XRP’s historical price peaks, such as its all-time high of $3.84 in 2018, have yet to be replicated, further challenging the likelihood of reaching $500.

Factors influencing XRP price

Regulatory and market dynamics have a significant impact on the price of XRP. As an investor, you need to be aware of these factors.

The SEC lawsuit against Ripple, for instance, has had immediate implications for XRP’s legal status and market confidence.

Market sentiment also plays a huge role. The price movements of XRP are often correlated with the performance of major cryptocurrencies like Bitcoin and Ethereum. Positive developments in these markets can have a ripple effect (no pun intended) on XRP’s value.

Also, increased adoption by financial institutions can raise demand for XRP, which would impact its price positively. For XRP to reach higher price targets, it needs to capture a larger share of the cross-border payments market, which would necessitate a substantial increase in market cap.

Roadmap to $500 Price Point

XRP’s roadmap to a $500 price point hinges on a series of highly improbable events and market conditions. The most significant barrier is the astronomical market cap required, estimated at $26 trillion, which far exceeds the current US GDP.

For XRP to reach this level, it would need to capture a substantial share of the cross-border payments market, which is projected to reach $250 trillion by 2027.

Consider the following key factors that could theoretically support such a high price target:

| Factor | Description |

| Market Share | Achieving 10% market share of cross-border payments, translating to $800 billion in revenue. |

| Market Sentiment | Crypto as a whole would need to take off significantly from where it’s at currently, and XRP would need to be at the forefront of it. |

| Partnerships | Establishing liquidity and demand through partnerships with over 200 financial institutions. |

Given these conditions, even reaching a 10% market share would be a significant challenge. The historical price pattern suggests that XRP would need an unprecedented increase of over 100,000% from its current levels. This target is highly speculative at best and is likely not rooted in reality.

Frequently asked questions

How high can XRP go?

XRP could potentially reach a price range of $10 to $50 if favorable market conditions and regulatory clarity align, especially with broader adoption in the cross-border payments market. However, reaching a price as high as $500 is highly improbable without monumental shifts in market dynamics.

How high will XRP go in 2025?

By 2025, XRP might realistically reach $10, but it would require a lot of factors to align perfectly. Reacting $10 is contingent on increased adoption by financial institutions and very positive crypto market sentiment. This price range accounts for decent growth in cross-border payments and positive legal developments.

How high will XRP go in 2030?

By 2030, XRP could potentially reach $50, assuming significant market adoption, widespread use in cross-border payments, and ongoing regulatory clarity. This is a best-case scenario with strong institutional support and expanding use cases.

Will XRP reach $1,000?

Reaching $1,000 for XRP is extremely unlikely given the market capitalization required, which would need to surpass the total GDP of many major economies. Such a price would require unprecedented shifts in both financial markets and XRP adoption on a global scale. In short, XRP is very unlikely to reach $1,000 in our lifetime.

The bottom line

You’re examining if XRP can reach $500. Given its current market cap and the astronomical increase needed, reaching this price point seems highly improbable. A more realistic goal is between $10 and $50, contingent on favorable market conditions and increased engagement from financial institutions. Even then, it would likely take decades.

Achieving a $500 valuation would require significant adoption in cross-border payments and would lead to a market cap exceeding $26 trillion. Simply put, this is beyond the realistic scope of current market trends.

In a similar vein, investors hope XRP will reach $500, some Solana traders believe that SOL has what it takes to reach $1,000.