Key Takeaways:

- Increased demand for Bitcoin creates a supply shock, which could push the price of BTC over $50,000 in the short-term

- Following the successful launch of the London upgrade, Ethereum continues to build on its upward momentum that started last month

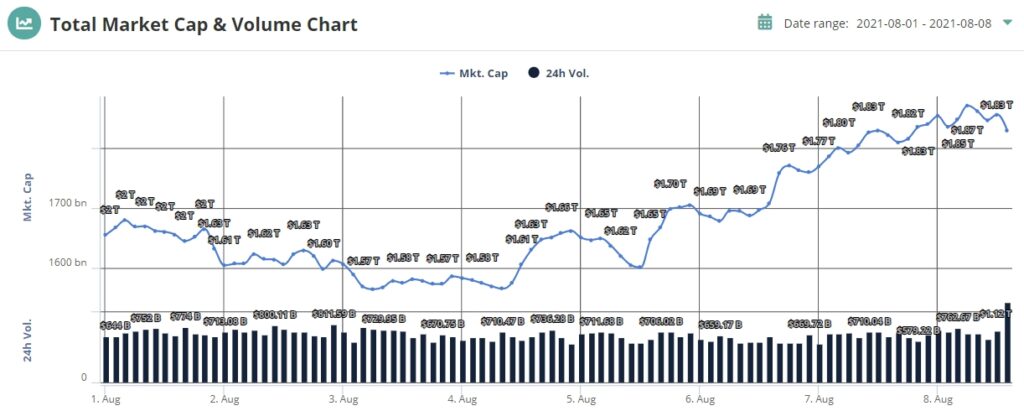

- The total market capitalization grew to $1.87 trillion and reached the highest point since May 19 crash when more than $300 billion were lost in a single day

After a prolonged retraction from April’s all-time highs, the cryptocurrency sector seemed to have cooled off and lost its momentum. This week, however, the bulls were running amok as the market saw huge gains by Bitcoin and Ethereum. Read along for a quick recap of this week’s market action.

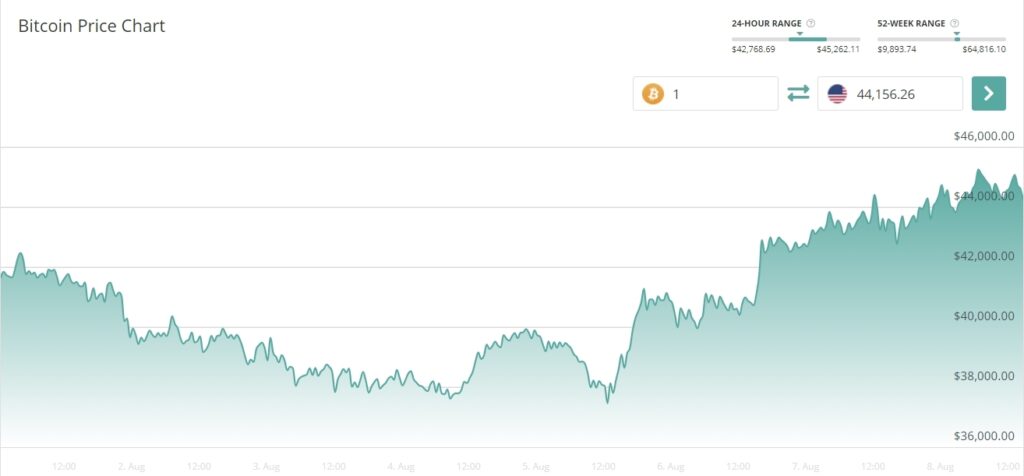

Bitcoin climbs over $45,000, the number of new BTC buyers continues to grow

Since Aug 5, the price of BTC has rallied from $37,462 to $45,275 in the next three days as it recorded a 21% increase. According to Lex Moskovski, CIO of Moskovski Capital, the data from Glassnode seems to suggest that the number of new entities buying BTC “continues to hit ATH”, which in turn creates a BTC supply shortage at current price levels.

Prominent Bitcoin on-chain analyst Willy Woo also thinks the supply shock led to a rapid price increase we’ve seen over the past few days and is convinced the current demand for BTC could push the price over $50,000 to address the “demand/supply imbalance in the market”.

Ethereum’s London Hard Fork goes live, the market responds positively

In anticipation of Ethereum’s London Hard Fork, the price of the second-largest digital currency rallied by more than 50% from its July low of $1,728. Since then, the price has nearly doubled, and ETH came very close to breaching the $3,200 price point this week. In the last 7 days, ETH gained 17.4% and set a cycle high of $3,187.

The latest ETH upgrade introduces a previously non-existent market dynamic to Ethereum token economics. With the introduction of EIP-1599 that went live with the London upgrade on August 5, ETH tokens will be burned with every transaction made on the Ethereum network. This creates deflationary pressure and consequently shrinks the supply of ETH.

With the upcoming Ethereum 2.0 protocol upgrade coming by the end of the year and many ETH already staked in anticipation of the ‘2.0’ upgrade, ETH was bound to see a massive price increase as predicted by ConsenSys CEO Joseph Lubin last month.

The total crypto market cap grows by more than $200 billion

In the last 7 days, on the tailwind of recent price surges, the total cryptocurrency market capitalization has increased by 13% and grew by $215 billion to reach $1.87 trillion. This is the highest price point the combined market cap has reached since the crash on May 19 earlier in the year, when more than $300 billion were wiped out in a single trading day.