Key takeaways:

- Bitcoin and Ethereum have today plunged to their respective multi-week lows after having accrued double-digit losses in the past seven days

- Apart from Monero, virtually all top 50 largest market cap coins have been trading in the red zone over the last week

- Layer 1 DeFi platforms Terra, Solana, and Cardano have suffered the largest losses

The markets have been in a state of a gradual pullback over the last seven days. During that period, the value of most major digital currencies has diminished by double digits, including Bitcoin (-10.7%) and Ethereum (-11.8%). Consequently, the total value of all digital currencies in circulation shrank from $2.21T on April 4 to $1.98T on April 11.

Bitcoin finds new support at $41,000

In the past couple of weeks, Bitcoin’s price movement was emblematic of the broader market trend permeating the industry. After reaching its highest YTD price point of just shy of $48,000 at the end of March, the world’s largest crypto has been caught in a sell-off mode, which has pushed its value to the $41,000 level.

Last week, the popular crypto analytic and private fund manager behind the Twitter handle Gaah highlighted the importance of Bitcoin retaining the $44,400 level. He argued that a descent below that crucial price point could spell a further drop to the $37,000 zone and bears claiming the upper hand.

While it is impossible to predict with certainty how Bitcoin will perform over the coming days, an algorithmically generated Bitcoin price prediction from CoinCodex shows a drop below the psychological $40,000 level could be a real possibility.

Major altcoins are down over 20% in the last 7 days

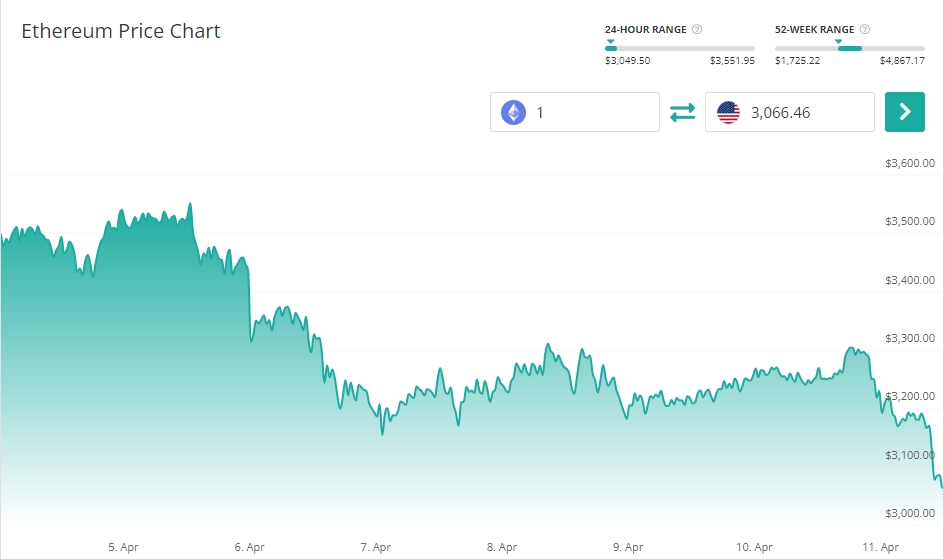

Several altcoins trading in the crypto top 10 have experienced even more severe pullbacks than Bitcoin. Case in point, Ethereum has lost over 11% in the last seven days and dropped to the $3,000 level, its April low.

However, Ethereum was far from being the worst-performing top 10 coin of the past week. That unfortunate title goes to Terra, which lost 22.8%. Other Layer 1 smart contract platforms, including Solana, Cardano, and Avalanche, didn’t fare much better and also lost more than 20% since last week.

Excluding stablecoins, Monero (+3.3%) was the only digital asset among the 50 largest market cap projects to not lose value over the previous seven days.

In the coming days, it will be interesting to observe whether Bitcoin and Ethereum manage to consolidate above the $40,000 and $3,000 psychological levels, respectively. If not, we could see bears extending their dominance in the short term.